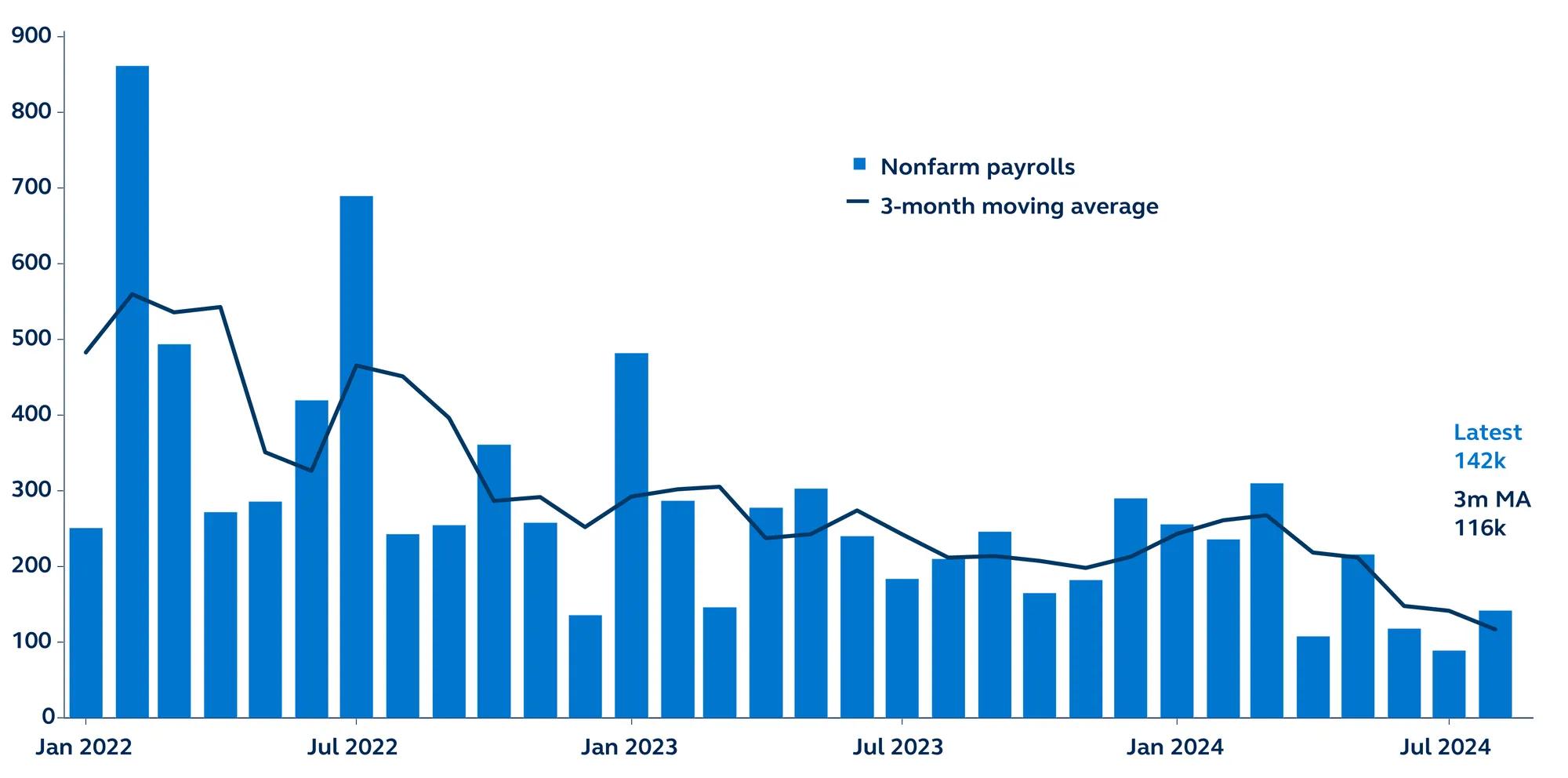

The August jobs report was a mixed bag and failed to resolve the recession debate that July’s jobs report had triggered. Non-farm payroll growth picked up in August to 142,000 but was below consensus expectations, while July’s already weak number was downwardly revised to just 89,000. However, offsetting this disappointment was a dip in the unemployment rate and a rise in hours worked. The Fed is set to lower policy rates this month—but today’s labor data has not clarified the question of a 25bps versus 50bps cut.

Non-farm payrolls

Thousands, January 2022–present