The August Consumer Price Index (CPI) report showed that headline inflation rose at the fastest monthly pace since June 2022. Given that it was driven by the recent surge in gasoline prices, the Federal Reserve (Fed) will likely look through the headline acceleration. However, the Fed will likely be more concerned by the nudge-up in monthly core inflation, particularly because the important “supercore” inflation measure has hit a 5-month high. Today’s inflation print is not hot enough to tilt next week’s Fed call towards a rate hike, but it also hasn’t provided complete clarity regarding the question of a November pause versus a hike.

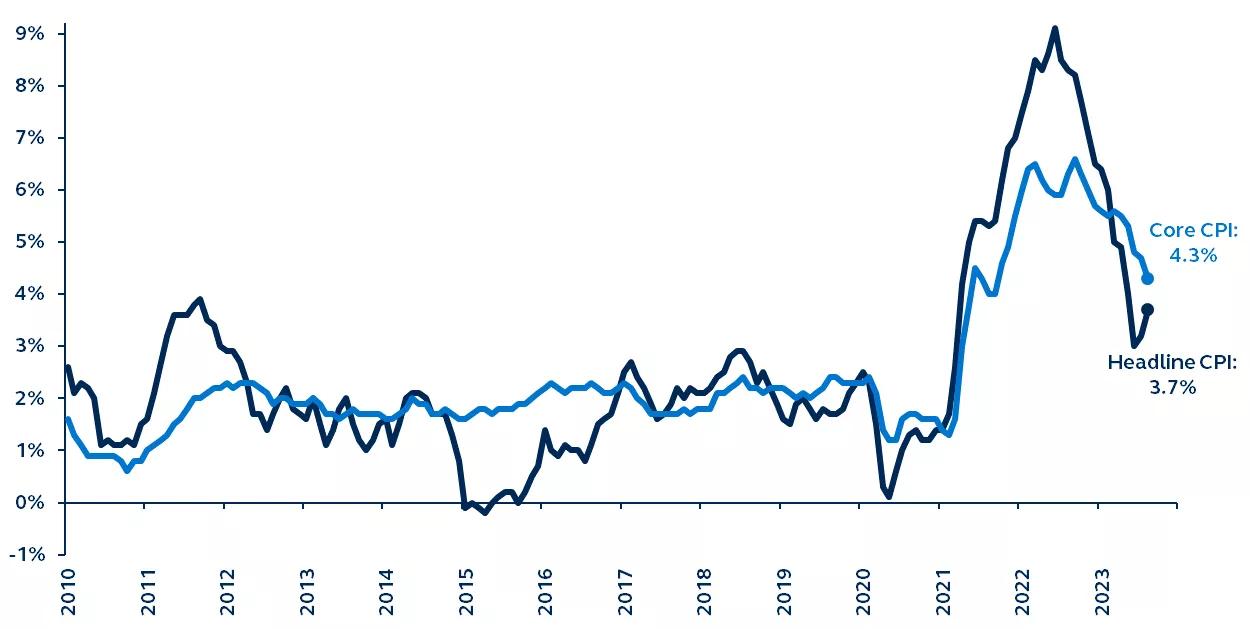

Consumer Price Index

Year-over-year % change, 2010–present

Source: Bureau of Labor Statistics, Principal Asset Management. Data as of September 13, 2023.

Report details:

- Headline inflation rose by 0.6% month-on-month in August, up from 0.2% last month, but in line with consensus expectations, driving the annual figure up from 3.2% to 3.7%. Gasoline contributed to more than half of the gain in headline inflation and, with little sign of oil price relief in the pipeline, is likely to continue pushing up inflation over the coming months.

- Core inflation rose by 0.3% month-on-month, up from 0.2% the previous two months and higher than the consensus expectation for a 0.2% increase. Nonetheless, annual core inflation dropped from 4.7% to 4.3%, the lowest number since September 2021.

- The Fed will likely look through the increase in headline inflation, given that the recent acceleration in oil prices is primarily a result of supply, rather than demand, pressures. It’s worth noting that, if sustained, higher energy prices can work their way into core inflation and inflation expectations over time.

- Within core CPI, core goods inflation fell 0.1% in August, a smaller decline than in the previous month, as new car prices rose more than expected. Overall, core goods disinflation should persist, but the recent rise in commodity prices and volatility in shipping costs pose a slight threat to the downward trend.

- Core services inflation accelerated slightly to 0.4% month-on-month. Within the category, shelter inflation, which consists mainly of rents and owners’ equivalent rents, continued to slow. While that is a positive development, the Fed will be concerned that core CPI rose despite the slowdown in shelter inflation. Indeed, transportation services were the largest contributor this month, and core services ex-housing inflation, often referred to as “supercore inflation,” and closely watched by Fed Chair Jerome Powell due to its link to the labor market, posted its biggest monthly gain since March 2023.

Today’s inflation report is a timely reminder that while inflation is clearly on a better trajectory than a year ago, the road will likely be very bumpy. The renewed rise in oil prices will put upward pressure on headline CPI in the near term, and it will be essential to keep a close eye on how inflation expectations respond. Our view remains that Fed rates have already peaked, but today’s inflation print and recent strong economic activity data certainly keep the risk of a November hike alive.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

3112519