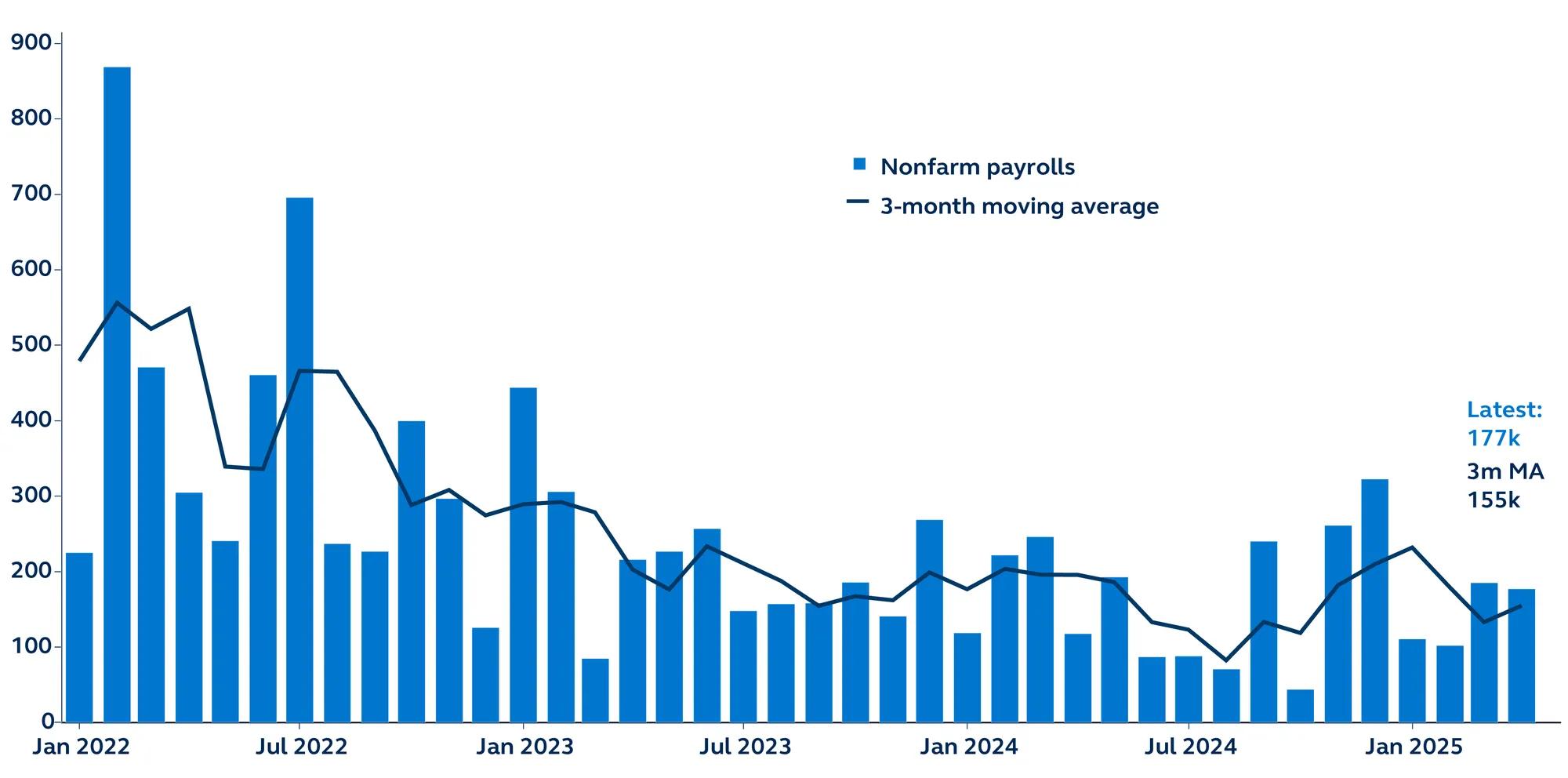

The April jobs report showed a solid 177,000-worker boost in payrolls, above consensus expectations, suggesting the impact of trade war-related uncertainty has yet to meaningfully impact hiring plans. While that negative shock is likely to eventually reverberate through the labor market in the months ahead, the data suggests an impressive degree of resilience currently at work in the economy.

Non-farm payrolls

Thousands, January 2022–present

Report details

- Total non-farm payrolls increased by 177,000 in April, well above expectations but somewhat slower than last month’s (downwardly revised) 185,000 gain. Nevertheless, consensus had called for 138,000 payrolls, so today’s upward surprise points to the ongoing solid momentum of the labor market in the face of the trade war shock.

- Overall job growth continues to be driven by a mix of cyclical and structural industries, including healthcare, transportation & warehousing, and leisure & hospitality, which added 51,000, 29,000, and 24,000 jobs, respectively. Despite the strong gains, these industries are likely to face the brunt of headwinds from the dual negative shocks currently impacting the economy, including DOGE-related job cut spillovers and the full impact of the trade war, which is likely to materialize in the months ahead.

- Offsetting the overall strength in job gains is a third consecutive monthly decline in federal government employment, losing 9,000 jobs in April, for a total of 26,000 lost jobs this year. However, this was largely counterbalanced by continued gains within state and local government hiring. The BLS counts workers on paid leave or ongoing severance or leave as employed, suggesting the fallout from federal government layoffs may not materialize for a few more months. Meanwhile, manufacturing jobs also declined by 1,000 workers, providing a slightly mixed picture of the effects of tariffs on the labor market.

- The unemployment rate held steady at 4.2%, despite the rise in the labor force participation rate, which ticked up to 62.6%, from 62.5% prior. This suggests the increase in labor supply continues to be be absorbed . Average weekly hours also stayed steady at 34.3, offsetting some concerns that firms may have cut hours amid elevated macro uncertainty.

- Average hourly earnings rose 0.2% in April, below expectations and down slightly from last month’s 0.3% pace. This kept the annual rate unchanged at 3.8%, which is likely to continue to slow as labor demand wanes in the months ahead.

- It is worth noting that, despite the incremental strength, the labor market remains in an uneasy equilibrium—low layoffs coupled with low hirings—suggesting that only a mild pick up in layoffs is needed to see the unemployment rate rise.

Policy outlook

The stronger-than-expected April payrolls report, especially amid a GDP data print earlier in the week that showed activity contracted, likely pushes back concerns of a recession another month. Overall job numbers remain very strong, suggesting there was an impressive degree of resilience in the economy before the tariff-induced shock.

That indicates economic weakness may not truly materialize in the numbers for several months, likely pushing the next Fed cut into Q3. After all, why would the Fed start cutting rates right now when the unemployment rate is near record lows, consumer spending is still fairly robust, and inflation is running above target? The economy will surely weaken in the coming months but, with this underlying momentum, the U.S. has a reasonable chance of averting recession if it can step back from the tariff brink in time.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

4464481