Markets struggled in the third quarter due to the synchronized global downturn. With the Federal Reserve making clear its intention to keep rates higher for longer, these challenges will likely continue to plague markets through the remainder of the year and into 2023.

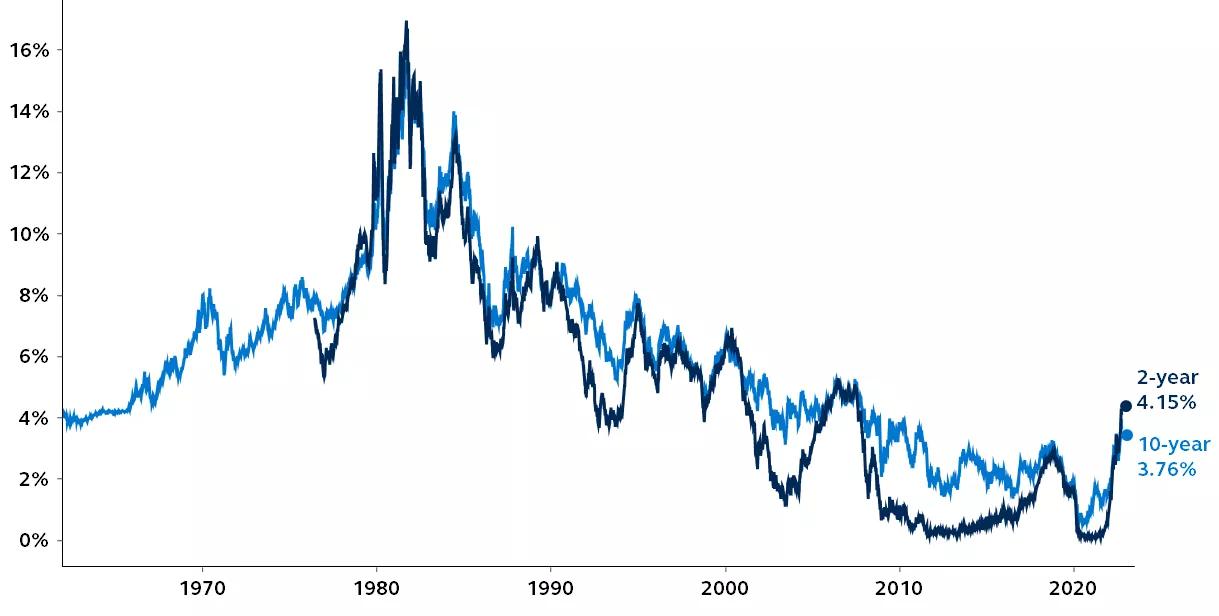

Historical interest rates

10-year and 2-year yields since 1960

Clearnomics, Standard & Poor's, Principal Global Investors. Data as of October 4, 2022.

Investors continued to face historic challenges in the third quarter, with all major indices entering bear market territory. Accelerating core inflation, rapidly rising rates, and a synchronized global economic downturn weighed on equities and fixed income. The S&P 500, Dow and Nasdaq fell 5.3%, 6.7% and 4.1%, respectively, while the 10-year Treasury yield climbed above 4% briefly. Although markets did rally from June to August, this quickly reversed when Fed Chair Powell suggested that the Fed would keep rates higher for longer as the central bank doubles down on its inflation fight.

These challenges will likely continue through the fourth quarter and into 2023, with markets struggling to digest the higher for longer narrative, and the accompanying possibility of a “hard landing” that could risk a recession. The Euro area is already contracting as it continues to deal with energy price spikes and shortages.

The macro environment, and thus today’s investing landscape, is almost completely dependent upon upcoming inflation readings. While the August data showed that energy prices in the U.S. improved significantly, core inflation, which excludes the often-volatile food and energy prices, reaccelerated—driving the Fed’s desire to move inflation back toward target levels and avoid a wage spiral.

Despite the year-to-date declines, global valuations are still not particularly appealing. Investors should continue to move to a more defensive mix by underweighting equities and fixed income, and focus further on real assets.

Wall Street Journal Custom Content is a unit of The Wall Street Journal advertising department. The Wall Street Journal news organization was not involved in the creation of this content.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world.

Principal Global Investors leads global asset management at Principal.®

2462414