Markets climbed in the second quarter, driven mainly by the tech rally and hopes of an imminent end to monetary tightening. However, notable risks to the rally lay ahead, including an increasingly hawkish Federal Reserve, which warrant caution from investors as the second half of the year gets underway.

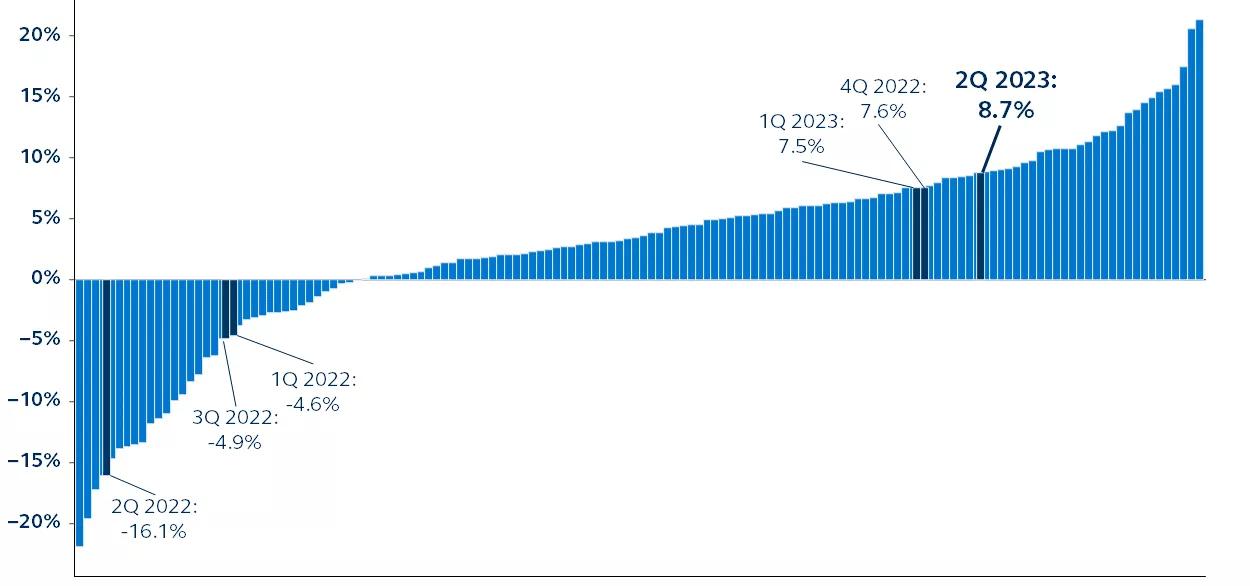

S&P 500 ranked quarterly performance

Price return, 1988–present

Source: Clearnomics, Standard & Poor’s, Principal Asset Management. Data as of June 30, 2023.

Markets continued to rally in the second quarter as inflation improved, the Fed slowed its pace of rate hikes, the banking sector stabilized, and technology-related sectors rallied. Through the first half of the year, the S&P 500 gained 16.9% with reinvested dividends, while the Nasdaq and Dow returned 32.3% and 4.9%, respectively. Interest rates were also steady after their sharp jump last year, with the 10-year treasury yield hovering around 3.8%.

Three major factors have driven this rally:

- Technology stocks made significant gains, driven largely by the enthusiasm around artificial intelligence.

- Markets were looking forward to what they thought was the end of Fed tightening.

- Continued resilient economic data has raised hopes that the Fed may successfully navigate a soft landing.

However, many risks still lie ahead. Despite surprisingly stable U.S. economic growth and a historically strong labor market, leading indicators still point to a recession. Core inflation is stubbornly above policy target, requiring further Fed tightening and reducing the likelihood of near-term rate cuts. Bond yields have already risen sharply just two weeks into the third quarter. Additionally, with broad equity valuations having once again become stretched and market breadth extremely narrow, the market is priced for perfection, leaving it vulnerable to earnings disappointments. So, while recent market gains are positive, investors should maintain a cautious perspective in the second half of the year.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2988305