Recent election surprises in Mexico, India, and the European Union have underscored the volatility that can arise from unforeseen political outcomes. These events highlight the risks of relying on pre-election polls for investment decisions, as unexpected results can swiftly disrupt equity markets and currencies. With critical elections upcoming in France, the UK, Japan, and the U.S., investors should prioritize resilience and avoid making hasty portfolio adjustments based on predicted political outcomes.

Regional market performance

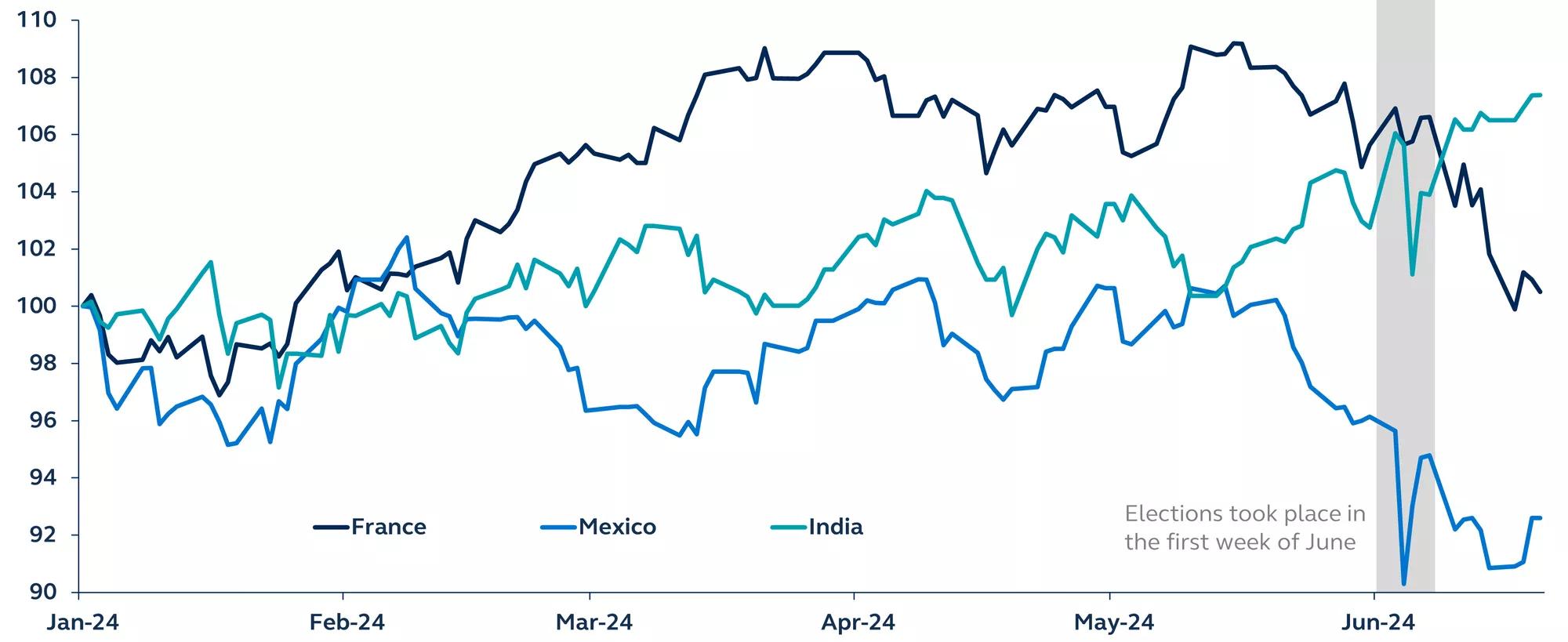

Rebased to 100 at January 1, 2024

Source: Bloomberg, Principal Asset Management. Data as of June 20, 2024. France = CAC 40 Index, Mexico = Mexico IPC Index, India = S&P SBE Sensex Index.

This year, over half of the world’s population have gone or will go to vote in national elections. The past month alone has seen three election surprises, each triggering losses in the region’s respective equity markets and currencies:

- Mexico: the Morena party won the election with an unexpected landslide victory, prompting concern that the party may amend Mexico’s constitution and may show less fiscal discipline.

- India: India re-elected Prime Minister Modi as expected but, rather than winning by a landslide, Modi’s BJP party unexpectedly lost its outright majority, casting doubt on its ability to push forward with important reforms.

- European Union: While the success of far-right parties at the recent parliamentary elections was expected, the French President’s decision to call snap elections was not. Markets fear that the result will risk policy paralysis and delayed fiscal consolidation.

While some of the market losses have now been partially reversed, the surprise results have provided a timely reminder to investors that pre-election polls do not have a perfect predictive track record, and unexpected outcomes can trigger significant volatility.

The coming months will see further elections, including in France, the United Kingdom, Japan and the big one, the U.S. presidential election. As recent elections have shown, election night shocks are not unusual, and adjusting portfolio allocation in order to position for who is most likely to win is a dangerous strategy.

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return. Indices are unmanaged and do not take into account fees, expenses, and transaction costs and it is not possible to invest in an index.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations. In Europe, this communication is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3657930