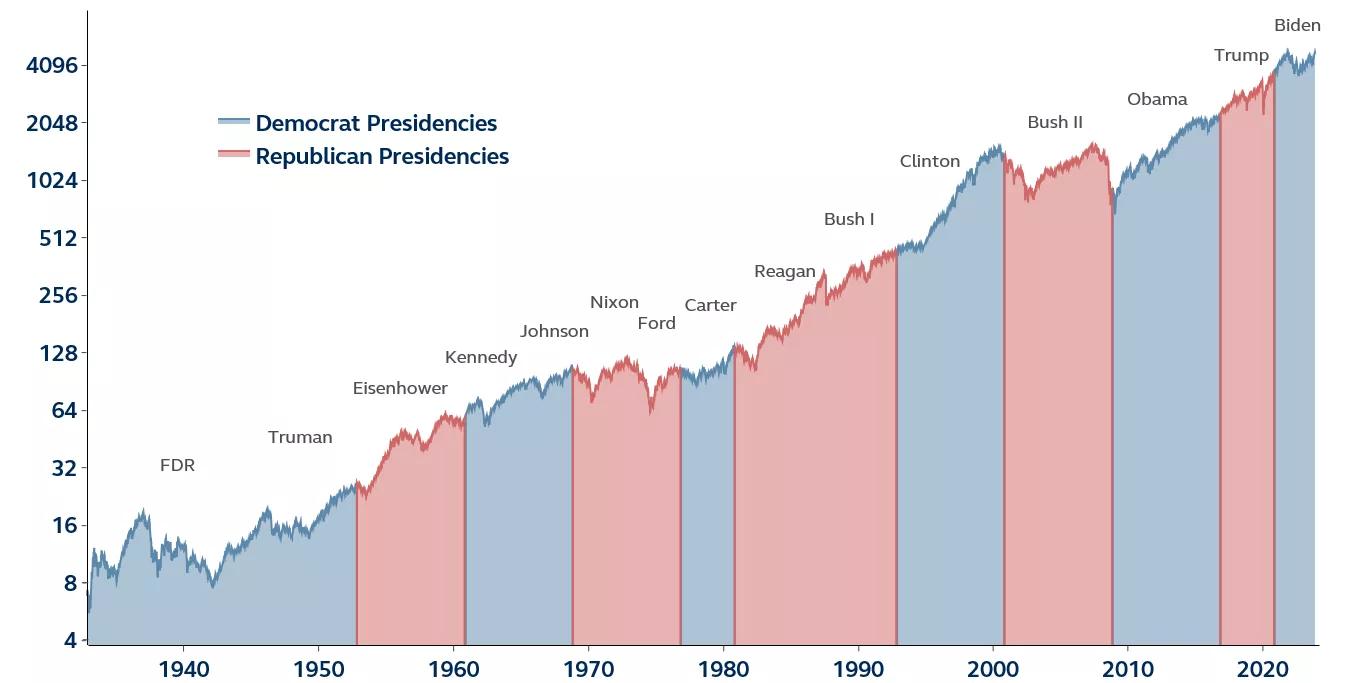

The upcoming U.S. presidential election is going to dominate the news cycle over the coming months. While these short-term headlines have the power to create market volatility, over the longer-term, markets have historically been indifferent to who occupies the White House. The market has performed strongly under both parties, and has proven to instead be more influenced by the broader business cycle.

The stock market and presidencies

S&P 500 Price Index, 1930–2023

The presidential election season is heating up, and the results of Super Tuesday have set the stage for a rematch between Joe Biden and Donald Trump. In this polarized political environment, many investors may be concerned about the impact of elections and politics on the stock market and economy.

While a lot can happen between now and election day on November 5, history suggests that markets are primarily driven by the broader business cycle. In fact, markets have historically performed well under both parties. From 2008 through 2020 across both the Obama and Trump administrations, the S&P 500 generated a total return of 236%...despite the vast perceived differences between the parties and the increasing polarization of Washington politics. This market outperformance also occurred despite many budget battles, fiscal cliffs, debt ceiling crises, U.S. credit rating downgrades, etc., not to mention the global financial crisis, the pandemic, and more.

Although political policies can have important impacts on specific industries, potentially affecting the broader economy, making decisions solely based on who is in the Oval Office would historically have been a mistake. Most investors will find it more prudent to focus on fundamentals rather than day-to-day election coverage. Paying careful consideration to portfolio allocations across sectors, asset classes, and individual securities is likely to have the greatest effect on portfolio performance as the election approaches.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Asset allocation and diversification do not ensure a profit or protect against a loss.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3436795