The 2023 Principal Global Financial Inclusion Index indicated that despite many economies navigating through a period of supply-side shocks, heightened inflation, and the consequent adjustments in interest rates, financial inclusion is improving on a global level. For investors, financial inclusion is tightly correlated to economic resilience, human development, and productivity, and could be read as a leading indicator of what might begin to appear in the hard economic data over time.

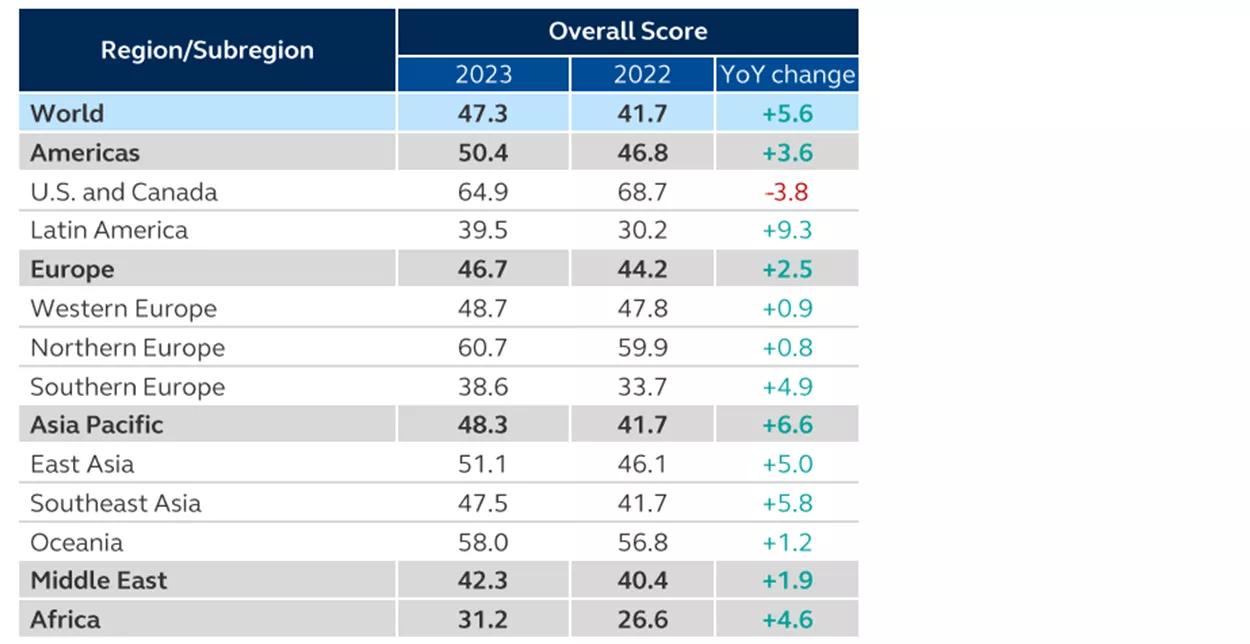

Global Financial Inclusion Index scores by region

2022 versus 2023 and YoY change

Source: Principal Financial Group, Centre for Economics and Business Research. Data as of October 4, 2023.

The 2023 Global Financial Inclusion Index data reveals four trends with potential effects on global economies, markets, and investors during the period ahead:

- Financial inclusion in the U.S. has significantly decreased, possibly due to employers preparing for leaner times ahead. Despite a stronger-than-expected economy, businesses are showing increased caution due to elevated interest rates, persistent inflation, and potential economic slowdown.

- Southeast Asian economies like Thailand, Malaysia, and Singapore are rapidly advancing in financial inclusion. This progress allows a larger portion of their population to participate in the financial system, reducing their reliance on China in the long term. Improved access to banking services, credit, and capital enhances their potential for independent economic growth.

- The weakening Chinese economy is impacting global markets, and particularly in Europe, where financial inclusion is stagnating. Unlike Southeast Asia’s rapidly evolving and supportive financial system, Europe’s is failing to inspire greater confidence in businesses and is struggling under traditional manufacturing industries and inflexible market conditions.

- Emerging markets (EMs) are transitioning from facing headwinds to benefiting from tailwinds. Quick central bank actions in EMs have helped control inflation sooner than developed markets. This highlights the significance of proactive government policies that drive growth and boost domestic productivity, fostering a greater sense of financial inclusion.

From an investment perspective, these trends illustrate the importance of a granular approach. Against this macro backdrop, active asset allocation is critical.

Click here for more information on the Global Financial Inclusion Index and to read additional findings from the 2023 report.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Global Financial Inclusion Index is a proprietary model output based upon certain assumptions that may change, are not guaranteed and should not be relied upon as a significant basis for an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3154921