Global listed infrastructure is set to benefit from significant structural growth drivers, including how the energy transition is leading to substantial investment into renewables and electricity networks, demographic shifts increasing infrastructure demand, and the rapid digitalization of services. These trends will likely create significant investment opportunities over the next decade and position global listed infrastructure as an attractive portfolio diversifier.

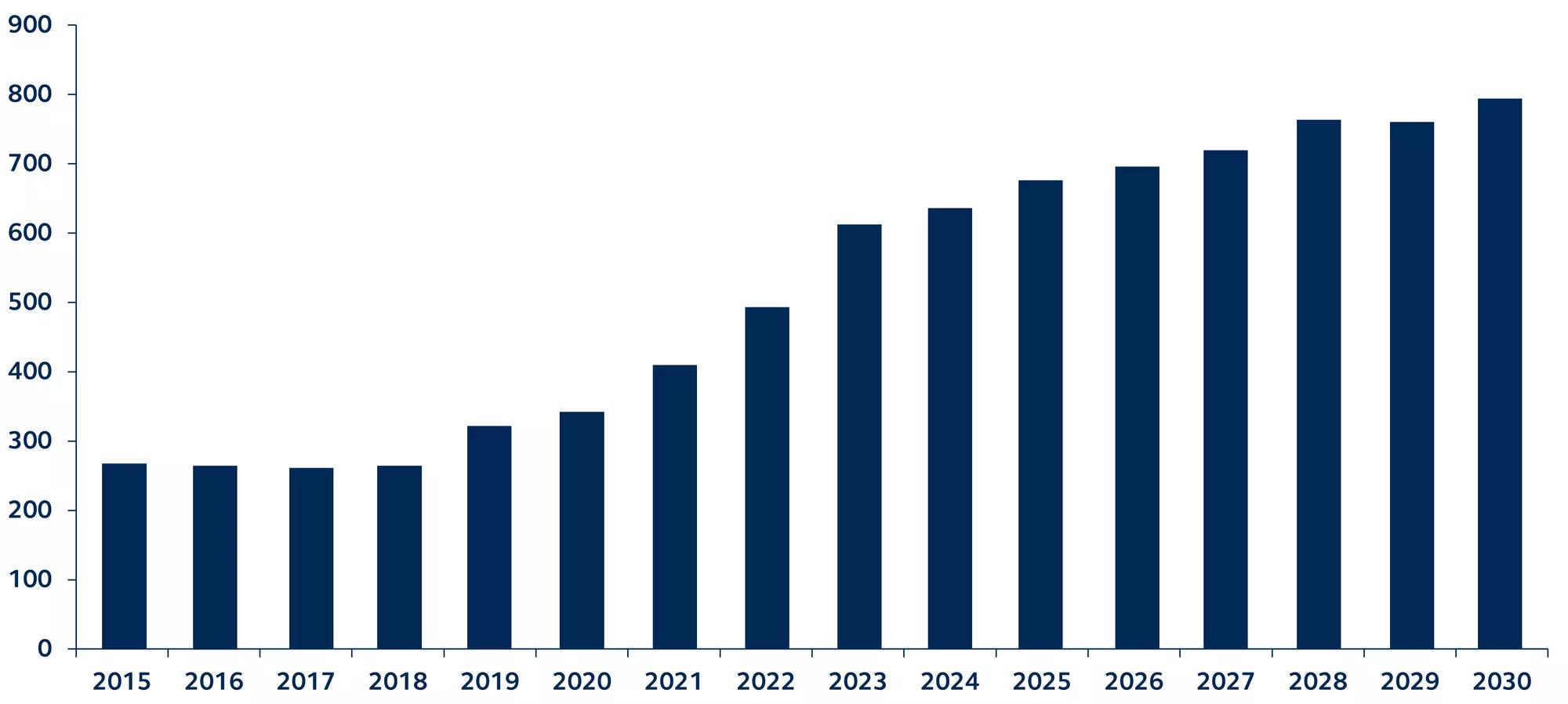

Annual investment in clean energy transition

USD billions, forecasted through 2030.

Global listed infrastructure (GLI) companies, which manage essential services like utilities, transportation, and communication systems, are poised to potentially benefit from accelerating structural growth tailwinds in the decade ahead. Key drivers, such as the energy transition, demographic shifts, and increased digitalization, are creating substantial opportunities for investment and development within the asset class:

- Energy transition: Over 85 countries are setting or declaring net-zero targets. This shift is accelerating investment into renewable energy sources, electricity networks, hydrogen, and biofuels. The growing demand for electrification, driven by government incentives, positions GLI companies—many of which are critical players in clean energy generation and distribution—to potentially benefit from this trend.

- Demographic trends: The growing global population is increasing the demand for improved infrastructure. Examples like advanced transportation systems in densely populated regions and increased energy requirements in emerging markets are both opportunities for GLI companies to benefit.

- Digitalization: The surge in global data and technology usage necessitates additional infrastructure, such as cellular towers and data centers. This modernization effort, including the enhancement of electric grids and intelligent traffic systems, underscores the essential role of GLI in supporting a more connected and efficient world.

For investors, the convergence of these structural growth tailwinds highlights the robust investment potential within GLI. As these trends unfold, listed infrastructure companies are well-positioned to capitalize on the increasing global demand for sustainable, reliable, and modern infrastructure solutions.

For a deeper dive into the benefits of an allocation to the asset class, read The case for global listed infrastructure.

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return. Infrastructure companies may be subject to a variety of factors that may adversely affect their business, including high interest costs, high leverage, regulation costs, economic slowdown, surplus capacity, increased competition, lack of fuel availability, and energy conservation policies. Infrastructure issuers may be subject to regulation by various governmental authorities and may also be affected by governmental regulation of rates charged to customers, operational or other mishaps, tariffs, and changes in tax laws, regulatory policies, and accounting standards.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3615223