Investing in infrastructure represents a unique opportunity for long-term investors to allocate capital at the intersection of environmental, social, and economic progress.

At-a-glance—

- Listed infrastructure businesses are uniquely positioned at the intersection of environmental, social, and economic progress.

- Publicly traded infrastructure strategies may have some advantages over private infrastructure when it comes to potential for sustainable contributions.

- Prioritizing bottom-up analysis of sustainability in the listed infrastructure space can support a dual objective of compelling excess return generation alongside positive sustainability outcomes.

- A targeted allocation to listed infrastructure may further support positive sustainability outcomes for clients.

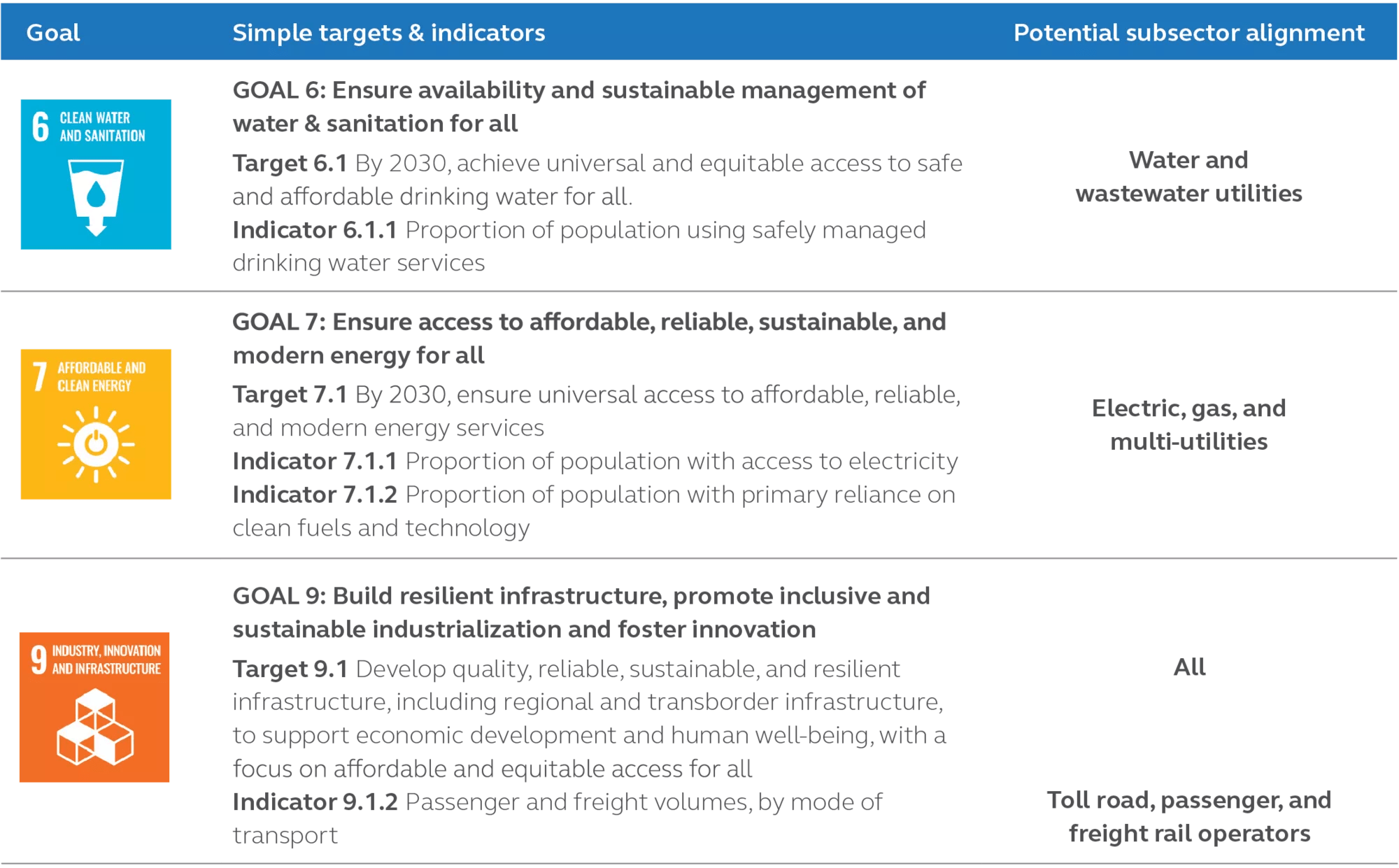

A 2018 study from the Inter-American Development Bank makes the case that infrastructure has the potential to explicitly and directly support progress toward over 70 percent of the 169 Sustainable Development Goal (SDG) targets outlined in the United Nation’s 2030 Agenda for Sustainable Development.1 OECD calculations demonstrate that nearly seven trillion of annual investment in infrastructure will be required in the coming decade to support economic growth while meeting the SDGs.2

EXHIBIT 1: The social and environmental objectives outlined in the SDGs are fundamental for infrastructure companies

The public company advantage

Many institutional investors have historically accessed infrastructure investing exclusively through the private markets. We identify several factors that support listed infrastructure companies in their ability to drive impact beyond what may be typically achieved by private operators.

Scale

Across our portfolios, the amount of customers touched daily numbers in the hundreds of millions. A single listed infrastructure company may manage hundreds of assets, often in close geographic proximity. These companies are frequently among the largest employers in their national or local markets, which enables efforts to lead policy direction and champion sustainable development. Scale also typically has a favorable correlation with cost to serve. In contrast, private equity portfolios usually comprise only 10-15 assets. Each is likely to be in different regions and entirely different sectors, making a private equity owner less likely to enjoy the influence conferred to large operators.

Emphasis on innovation and new project development

Public market infrastructure investors are generally more accepting of growth investment, whereas private infrastructure portfolios have typically focused on mature assets. Different expectations from providers of capital mean listed infrastructure businesses are more likely to fund innovation and new project development. It is a critical distinction today more than ever, as much of the technology required to deliver the next phase of the clean energy transition is not yet commercially available. Scale also helps in this regard. Investments in innovation need not crowd out maintenance investments or dividends to shareholders for the largest of businesses. One of the top U.S. utilities by market capitalization sees green hydrogen, a carbon-free alternative to natural gas created using renewable energy, as potentially cost-competitive in the 2030–2035 time frame. That’s not stopping the company from deploying hundreds of millions in green hydrogen pilot projects today. Given the company’s track record as a first mover in renewable generation and battery storage, public market investors may be willing to support such investment.3

Trust and transparency

Private infrastructure may be further disadvantaged when it comes to the potential for sustainable impact because many private equity owners have historically relied on leverage and other financial engineering methods to boost returns. These practices not only put financial sustainability at risk, but they have real implications for public perception. The outgoing chairman of UK water utility regulator Ofwat has frequently criticized the complicated financing and tax structures utilized by private equity owners, for example. Listed water utility companies are seen to offer a degree of transparency and customer focus not evident at their private equity-owned counterparts.

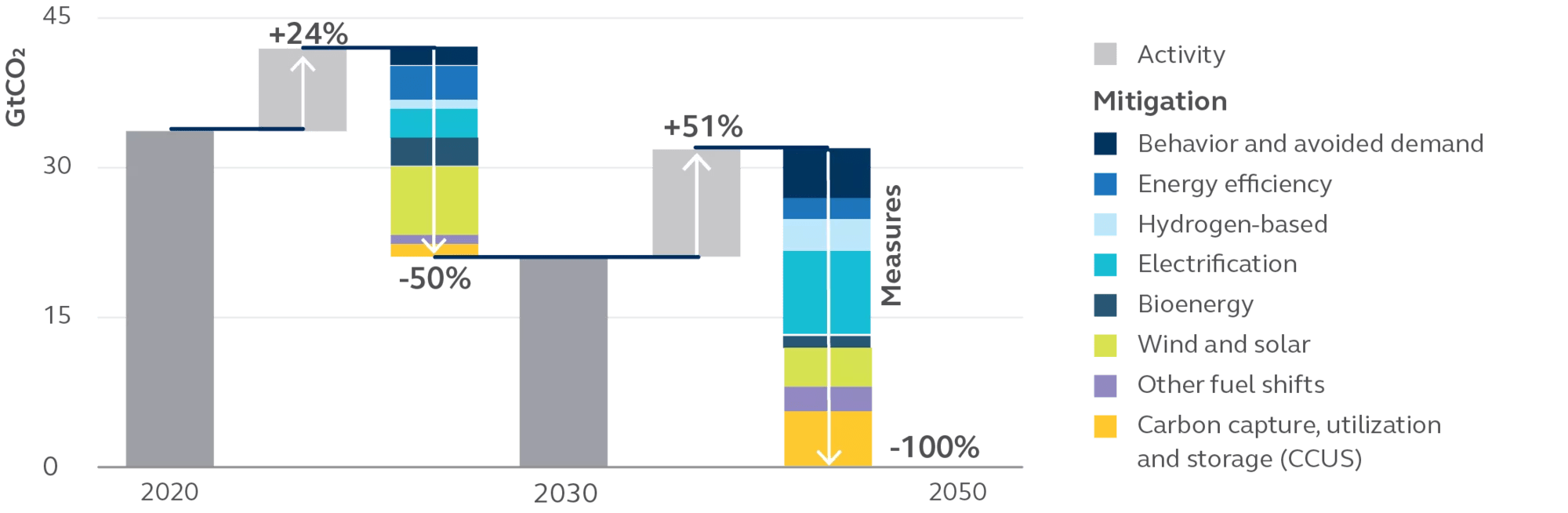

EXHIBIT 2: Nascent technologies are essential to delivering emissions reductions beyond 2030

Notes: Activity = energy service demand changes from economic and population growth. Behaviour = energy service demand changes from user decisions, e.g. changing heating temperatures. Avoided demand = energy service demand changes from technology developments, e.g. digitalization. Other fuel shifts = switching from coal and oil to natural gas, nuclear, hydropower, geothermal, concentrating on solar power or marine.

Source: International Energy Agency (IEA). Chart from the IEA’s Net-Zero Emissions by 2050 Scenario (2021).

The case for a bottom-up analysis of sustainability

Listed infrastructure strategies are highly focused on a small subset of public companies, each of which provides services that are critical to the functioning of our society. While some approaches to sustainable investing seek to establish a universe of sustainable companies by first applying a top-down screen, we caution that such an approach may frequently lead to missed opportunities when applied to listed infrastructure. Instead, prioritizing in-depth, bottom-up analysis may be better suited to delivering positive outcomes in the realm of listed infrastructure.

We discuss here three common drawbacks of relying on top-down screens to assess the sustainability characteristics of listed infrastructure companies.

1. Social responsibilities must be prioritized

Factors of critical social importance like reliability and affordability set natural limits on the pace of decarbonization and electrification. What may look like a less ambitious decarbonization pathway under some frameworks is often a response to a social constraint. For example, reliability, affordability, and job creation is heavily influenced by resource availability, weather, policy priorities, customer demographics and other legacy considerations that are unique to an infrastructure company’s service territory or territories.

Some practitioners of sustainable investing may advocate prohibiting investment in companies that continue to have a percentage of revenues tied to specific activities or do not meet top-down standards for decarbonization efforts. None of these factors in isolation consider how an infrastructure company’s environmental stewardship is shaped first and foremost by its social responsibilities. This does not mean that infrastructure companies should adopt less ambitious responses to climate-related opportunities and risks. Given the widely available substitutes to thermal coal-based power generation, for example, we expect companies with exposure to coal generation to align their emissions pathways with a below 2-degree climate change scenario to be eligible for our portfolios. It does mean, however, that environmental considerations are best assessed alongside any social constraints that are unique to a company.

We also find that the social value of infrastructure businesses may be systematically overlooked. The data points that comprise third-party scoring of a company’s social contributions typically focus on factors that can be broadly applied across industries like diversity and employee engagement, rather than factors of unique operational relevance to infrastructure businesses like affordability and reliability. In addition, the perceived materiality of social factors for an infrastructure company may not reflect the unique role a company plays in meeting the basic needs of its community.

CASE STUDY: U.S. utility companies

Two upper Midwest U.S.-based electric and natural gas utility holding companies have separately highlighted the challenges associated with full electrification of the heating system in certain geographies, such as in areas where winter temperatures rarely rise above 32 degrees Fahrenheit (0 degrees Celsius). Due to differences in efficiency, one of the companies estimated that a key subsidiary’s electric generation capacity would have to increase five-fold to replace winter gas demand. Although the company would be a net beneficiary of full electrification, customer bills would increase 3x. The other company has also highlighted that electric heat pumps are substantially more costly than natural gas heating in its region. Since the cost to customers is prohibitive, decarbonizing gas is a more viable way forward. Technologies that enable the use of carbon-free alternatives to natural gas at scale are not yet available; however, both companies are making exploratory investments with the support of regulators.

2. Monopolies require unique considerations

Most listed infrastructure companies operate as regulated monopolies or oligopolies. Progress towards environmental and social goals stems from ongoing collaboration with regulators and users of the infrastructure and such cooperation is a prerequisite of a company’s social license to operate. An infrastructure company’s carbon emissions and involvement in fossil fuel activities reflects as much on the current state of our society as on the company itself. Ultimately, an infrastructure company must pursue environmental progress while continuing to deliver on its social obligation to serve.

Traditional screening methodologies also often fail to account for the bonus/malus concept present in regulatory frameworks and for the outsized politicization of regulated monopolies. When a politician seeks to open an investigation into a company purely for political gain, or when an infrastructure company is criticized by its regulator for business performance, these events show up in controversy flags in ESG data sets. Assessing the materiality of these controversies requires an awareness of how infrastructure companies typically engage with regulators and politicians.

In addition, the monopolistic nature of these businesses raises the stakes should a company fall out of favor with the broader market. If public equity investors shy away en masse, a company may have challenges remaining well-capitalized. This has potentially disastrous consequences for our society and the individuals and businesses that rely on an infrastructure company for access to basic services. We therefore see a willingness to challenge the conventional wisdom regarding what is truly sustainable as a key source of our potential impact as investors.

CASE STUDY: European airport operator

A European airport operator that manages a network of assets in Spain, the UK, and Latin America, frequently discusses its ongoing engagement with local governments, regulators, and airline partners to examine the changes needed to infrastructure to support the deployment of sustainable aviation. The group is working on a national program around sustainable aviation fuels that would coordinate the logistics of bringing sustainable aviation fuel (SAF) to airports, with a plan to provide visibility on demand and coordinate logistics which could remove some of the bottlenecks to greater adoption. Furthermore, engagement with the Ministry of Transport could see the adoption of incentives for use of SAF by airlines through a discounted landing fee. Pilot projects around the use of hydrogen and geothermal are also underway at the group’s airports. Finally, the company is also utilizing the land that typically surrounds its airports to produce its own photovoltaic renewable energy with plans to become self-sufficient by 2025.

3. Emerging markets companies rarely screen well

Relying on simplistic screens may be viewed as being relatively detrimental to emerging markets companies. The MSCI ESG rating for the MSCI World Index is ‘AA’ compared to a rating of ‘BBB’ for the MSCI Emerging Markets Index.4 Among transportation infrastructure companies covered by MSCI ESG Research, 12 of 14 companies rated an ESG laggard operates in an emerging market.5 Emerging markets companies are also disproportionately represented among the utility sector laggards. Environmental progress is more likely to be heavily constrained by affordability in developing countries and higher growth creates its own challenges when it comes to protecting the environment. We often see Governance scores impacted due to control by government entities. Disclosures and transparency are often less robust than is typical at developed markets peers as well, though in our experience this typically relates more to resourcing than malintent.

The generally weaker third-party ESG scores of emerging markets companies may create a commercial incentive for some asset managers to reduce investment in certain countries. Yet, these companies have an irreplaceable role to play in delivering the SDGs and the different circumstances facing emerging market countries is recognized throughout the SDG framework. In emerging markets, simply connecting a community to clean water and providing access to electricity or data transmission will quickly make the lives of many dramatically better. Government participation in shareholding structures may even be additive to impact potential in instances where government ownership has positive implications for regulatory treatment and/or ability to achieve scale.

CASE STUDY: Chinese utility company

A gas utility in China that is controlled by a state-owned enterprise has historically benefitted from its relationship with its parent company. Over time, the connection has helped the company strengthen its relationships with local governments and acquire and invest in attractive gas projects in growing Tier 1 and 2 cities. In a period of industry consolidation, the company has provided a home for and created synergies with sub-scale gas distributors whose returns have been pressured by China’s push for lower energy costs. As coal still fuels more than half of China’s electricity production, natural gas plays an important role in the country’s decarbonisation and energy transition. To support China's environmental and economic goals, the company continues to facilitate gas adoption by large industrial and commercial customers in strategic regions of the country, in addition to enhancing affordability via the procurement and diversification of a stable fuel supply. Furthermore, the company is a natural investor in innovative businesses that add value to its customers across the residential, industrial, and commercial segments while helping them to reduce their carbon footprints. These initiatives include selling energy-efficient gas appliances, IOT-connected energy systems, and safety-related equipment and services; developing integrated energy projects featuring renewable energy and waste heat recycling; and deploying EV charging and hydrogen refueling stations to support development of a clean energy network for transportation.

At Principal, we believe a willingness to think critically about mainstream approaches to sustainability is what enables us to deliver excess returns while also contributing to social and environmental progress. This may lead us to own companies that are out of favor with other market participants, and companies whose sustainability credentials are not yet reflected in market valuations.

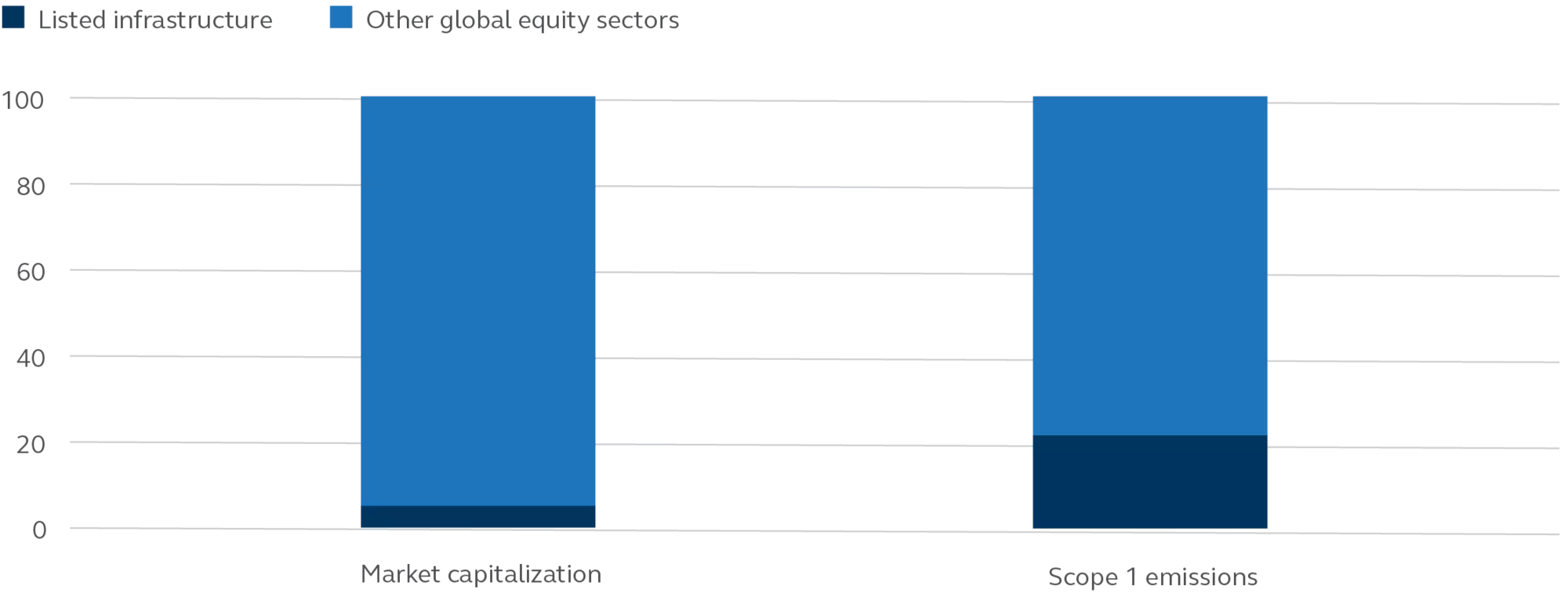

Consider a targeted allocation

Listed infrastructure companies typically represent less than five percent of major stock market indices. In addition, generalist ESG index providers and investment strategies have increasingly adopted structural underweights to the most carbon intensive industries as the basis for their ESG credentials. This suggests that listed infrastructure companies may be even more underrepresented within a broader global equity allocation going forward.

A targeted allocation to listed infrastructure may also be of specific appeal to investors focused on tangible social contributions and absolute carbon emissions reduction in the real economy. The latest data shows that those same listed infrastructure companies that represent only a small component of the broad market contribute more than 20 percent of scope 1 carbon emissions today, and thus represent a major source of opportunity for impact.

EXHIBIT 3: Potential for direct carbon emissions reduction is greater among Listed Infrastructure companies

Source: FactSet, MSCI ESG research. As of 31 December 2022. Scope 1 emissions are direct greenhouse (GHG) emissions that occur from sources that are controlled or owned by an organization.

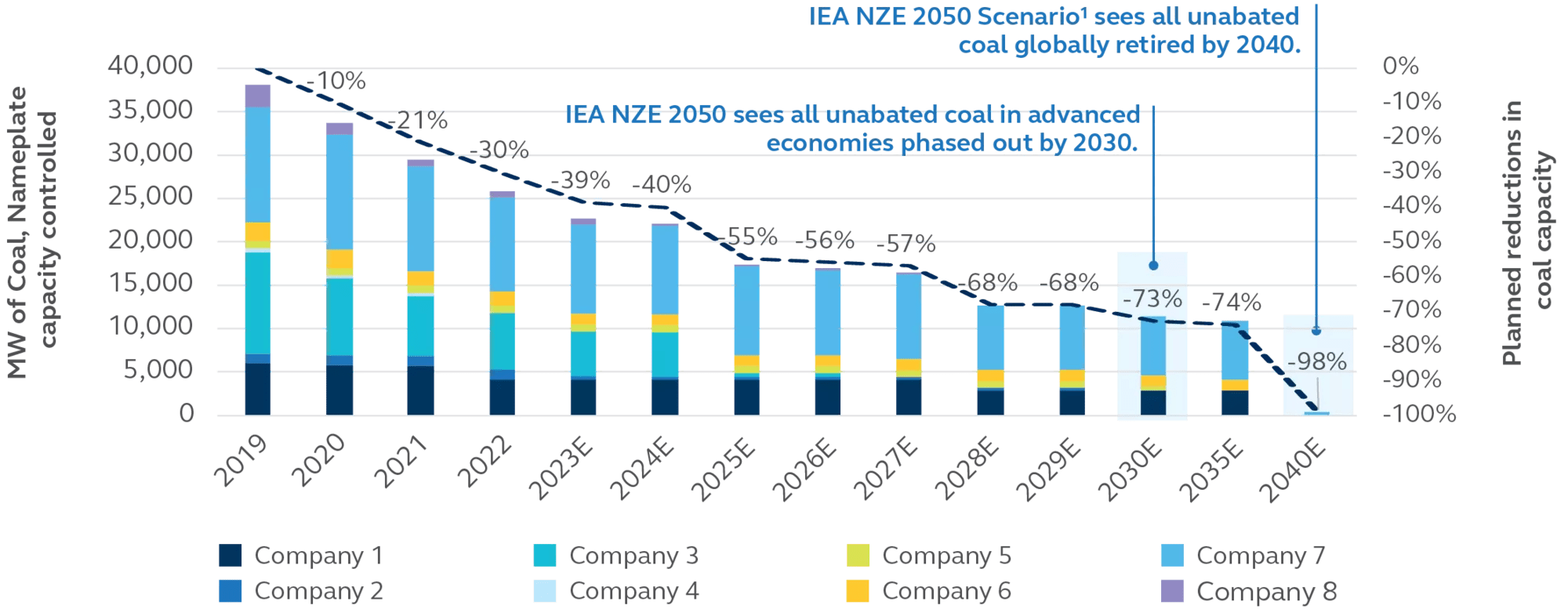

Infrastructure companies are also in a prime position to support users, be it households or businesses, airlines or other passenger vehicles, in reducing reliance on carbon-intensive energy. We often note the potential contradiction as users of fossil fuel-based energy are readily afforded the latitude to reduce dependency over the coming decades, while listed infrastructure companies are more likely to be excluded today because they earn revenues from meeting the demand of their customers. This is despite the visibility we have already in terms of both planned coal capacity reductions and overall carbon emissions reductions by our portfolio companies, and despite our ongoing efforts to push for improvements in these timelines through active ownership activities.

EXHIBIT 4: Planned trajectory of coal capacity closures by portfolio companies is encouraging

Source: Company reports, Principal Real Estate, International Energy Agency. The chart depicts actual and planned coal capacity closures by companies held in the representative portfolio of our Global Listed Infrastructure Strategy as of 31 January 2023.

1 IEA NZE 2050 Scenario refers to the International Energy Agency’s Net Zero Emissions by 2050 Scenario.

This information is shown for illustrative and informational purposes only should not be relied on in any way as a guarantee, promise, forecast or prediction of future events or investment returns for any investor. Actual results may differ materially from that depicted above based on numerous factors.

Another reason to consider a targeted listed infrastructure allocation is that leveraging sector specialists may lead to better engagement outcomes. We find that company executives are most likely to respond to constructive dialogue after we have demonstrated a deep knowledge of their business and respect for the trade-offs inherent in their efforts to strive for progress along all three pillars of sustainability. They are also more willing to provide meaningful access to their sustainability leaders—whether typically market-facing or not—if they believe the conversation will be mutually beneficial. Establishing these relationships requires regular discussions over the course of many years, a near impossibility for senior decision makers on generalist investment teams despite best efforts. Further, the nature of the relationships maintained by sector specialists facilitate the ability to have a voice greater than that implied by percentage of ownership.

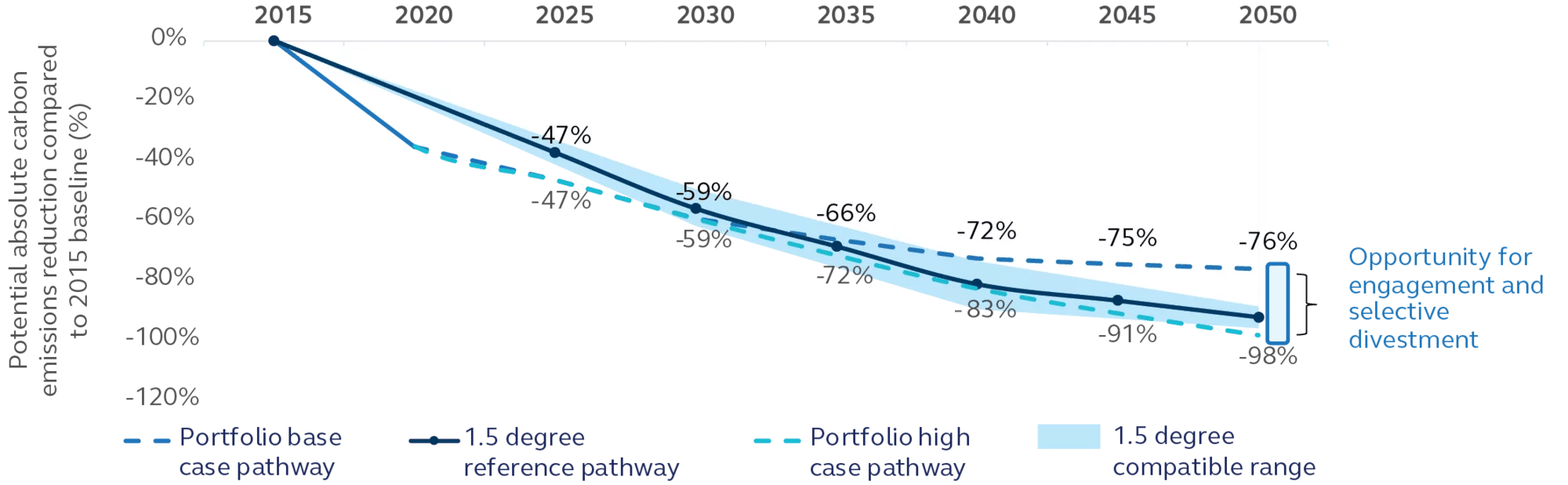

EXHIBIT 5: We see a clear role for engagement to drive emissions reductions beyond what’s currently planned

As of 31 December 2022. Sources: MSCI, Climate Analytics, company reports, Principal Global Investors. The chart compares potential carbon emissions reductions trajectories of the representative portfolio of our Global Listed Infrastructure Strategy with a 1.5-degree Celsius reference pathway. This information is shown for illustrative and informational purposes only should not be relied on in any way as a guarantee, promise, forecast or prediction of future events or investment returns for any investor. Actual results may differ materially from that depicted above based on numerous factors. See important information for further information.

Finally, in cases where investment team members support more than one strategy, individuals responsible for manager selection should seek to understand how key investment personnel allocate their time across strategies. Ideally, portfolio managers and analysts will be adequately incentivized to spend their time on those strategies that specifically incorporate sustainability into their investment objectives. Elements of a manager’s background—including education, certifications, prior professional experiences, and investment team diversity— should also demonstrate an enduring commitment to ESG and sustainable investing. Investment team diversity is frequently linked to strong investment performance, and we believe diversity of thought may be even more important when the stated investment objective is to deliver strong financial returns alongside positive social and environmental contributions.

1 What is Sustainable Infrastructure

2 Sustainable Infrastructure Policy Initiative

3 Utility net-zero carbon goals 'disingenuous,' says NextEra CEO

4 FactSet. As of 31 December 2022.

5 MSCI ESG Research. Industry Report – Transportation Infrastructure. September 2022. ESG laggards are those with a rating of BB or below.

Final thoughts

Listed infrastructure represents a unique opportunity to invest in a subset of public companies that have long track records of delivering positive financial and social outcomes while acting as stewards of the environment. Infrastructure has the potential to contribute to over 70 percent of the SDG targets, and ongoing investments in innovation leave listed infrastructure companies well-positioned to fulfill this promise. Still, mainstream approaches to assessing sustainability may not fully capture important aspects of an infrastructure company’s value proposition. We believe that an approach that embraces proprietary views on sustainability can support both alpha generation and enable out-of-favor companies to continue their efforts to achieve positive social and environmental outcomes. Dedicated listed infrastructure investment teams with a differentiated ability to analyze sustainability and ESG topics may be best positioned to execute such a strategy.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk Considerations

Past performance is no guarantee of future results. Investing involves risk, including possible loss of principal. Asset allocation and diversification do not ensure a profit or protect against a loss. Infrastructure companies may be subject to a variety of factors that may adversely affect their business, including high interest costs, high leverage, regulation costs, economic slowdown, surplus capacity, increased competition, lack of fuel availability, and energy conservation policies. Foreign securities involve special risks, including currency fluctuation and lower liquidity. Some global securities may represent small and medium-sized companies, which may be more susceptible to price volatility than larger companies. Inflation and other economic cycles and conditions are difficult to predict and there Is no guarantee that any inflation mitigation/protection strategy will be successful. Integration of environmental, social and governance (ESG) factors is qualitative and subjective by nature. There is no guarantee that the criteria used, or judgment exercised, will reflect the beliefs or values of any particular investor.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided. All figures shown in this document are in U.S. dollars unless otherwise noted.

Portfolio pathways are calculated using holdings and weightings from the representative portfolio, actual Scope 1&2 carbon emissions data for each portfolio company and PGI analysis of the forward-looking carbon reduction potential of each portfolio holding. Portfolio pathways from 2015-2020 reflect reported carbon emissions reductions of the representative portfolio’s holdings assuming portfolio end weights on 31 December 2022 and the carbon emissions reductions illustrated post-2020 are projections. There is no assurance that such events or projections will occur and may be significantly different than that shown here. The 1.5-degree reference pathway and compatible range are calculated using 1.5-degree Celsius national pathways derived from global IPCC pathways compatible with the Paris Agreement and published by Climate Analytics. National pathways are then weighted by portfolio country weights to construct the reference pathway. More information about the methodology for the national emissions pathways published by Climate Analytics can be found here: https://1p5ndc-pathways.climateanalytics.org/methodology/. There is no guarantee that the 1.5-degree reference pathway will occur and what is required to limit global temperature change to 1.5 degrees may be significantly different than that shown within this paper. This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (EU) Limited, Sobo Works, Windmill Lane, Dublin D02 K156, Ireland. Principal Global Investors (EU) Limited is regulated by the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID). The contents of the document have been approved by the relevant entity. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (EU) Limited (“PGI EU”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGI EU, PGIE or PGI EU may delegate management authority to affiliates that are not authorized and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland.

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorised and regulated by the Financial Conduct Authority (“FCA”).

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission. This document is intended for sophisticated institutional investors only.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission and is directed exclusively at professional investors as defined by the Securities and Futures Ordinance.

- Other APAC Countries, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Funds are distributed by Principal Funds Distributor, Inc.

© 2023 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal Real Estate is a is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

MM12507-01 | 02/2023 | 2709936-122024