Companies such as utilities, railroads and energy pipeline firms offer unique appeal for ESG-minded investors.

In recent years, the capital markets have paid more attention to companies’ environmental, social and governance (ESG) policies. While some investors look to ESG as a way to align their values with the businesses in which they invest, there is increasingly a growing consensus that firms with strong ESG attributes are better positioned to manage risks and take advantage of competitive opportunities in their industries.

“Equity market investors have certainly become more aware of ESG,” says Emily Foshag, a portfolio manager focused on listed infrastructure with Principal Financial Group®. “Investors like us have been putting more pressure on companies to articulate what they’re doing about risks related to climate change, what they’re doing to support a cleaner and more modern energy-based economy, and how they’re managing social issues ranging from affordability to diversity and inclusion.”

Foshag notes that listed infrastructure represents a targeted way for investors to tap into companies with strong ESG credentials. After all, these are businesses that provide services central to the functioning of the economy and support social progress in crucial ways. They are uniquely qualified to balance the demands of a wide range of stakeholders, having been asked to do so as a condition of their licenses to operate for decades.

Listed infrastructure includes companies in the utilities sector and firms operating airports, toll roads and railroads. The opportunity set also includes the oil and gas pipeline operators that deliver energy to homes and businesses around the world. “These companies exist for a social purpose,” Foshag says. “They’re the backbone of our society. They’re what allow us to switch on our lights, have clean drinking water—and they’re the companies that transport the goods that show up on our doorstep.”

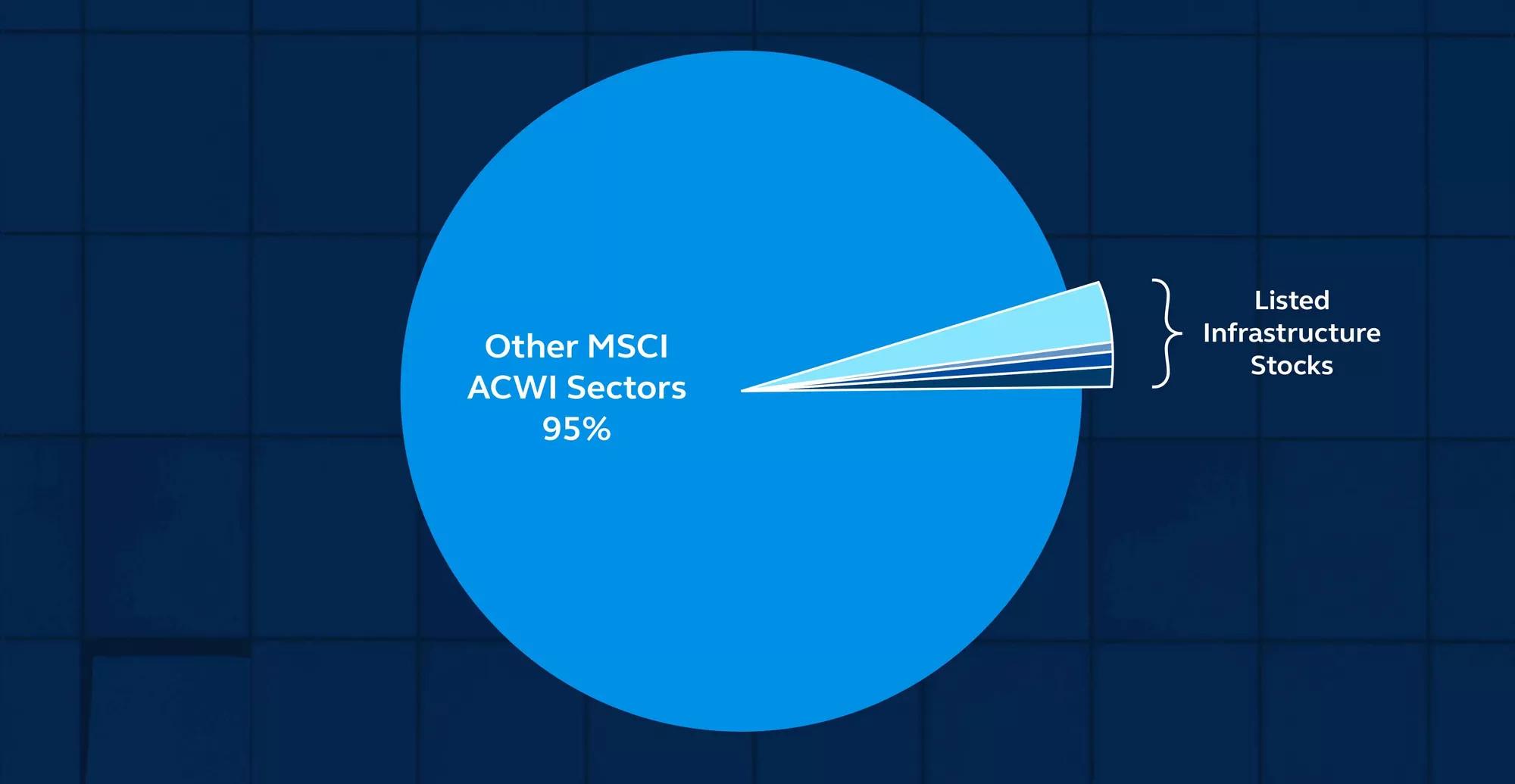

Even with the unique ESG positioning of listed infrastructure companies, the average global equity fund may not offer meaningful exposure to these businesses, Foshag notes. This is because listed infrastructure companies typically represent less than 5% of major stock market indexes. “We encourage ESG-oriented investors to consider a dedicated allocation to listed infrastructure,” she says.

Listed infrastructure stocks represent less than 5% of the MSCI All Country World Index

Source: FactSet, Principal Global Investors. For illustrative purposes only. Data as of December 21, 2021.

Taking advantage of ESG trends

Many listed infrastructure companies are well positioned to benefit from the growth of other prominent ESG trends. Take the clean energy transition: Governments are increasingly creating incentives for companies to shrink their carbon footprints and put more emphasis on renewable energy.

In turn, utilities are making significant capital investments in renewable generation and expanding transmission capabilities to handle more renewable energy. Foshag notes that European utilities are expected to increase their spending on renewables and network infrastructure by more than 50% relative to recent years. “For infrastructure companies, there’s a sizable opportunity on the clean energy side,” Foshag says. “This benefits shareholders as well, because every dollar invested often leads to highly visible returns on that investment.”

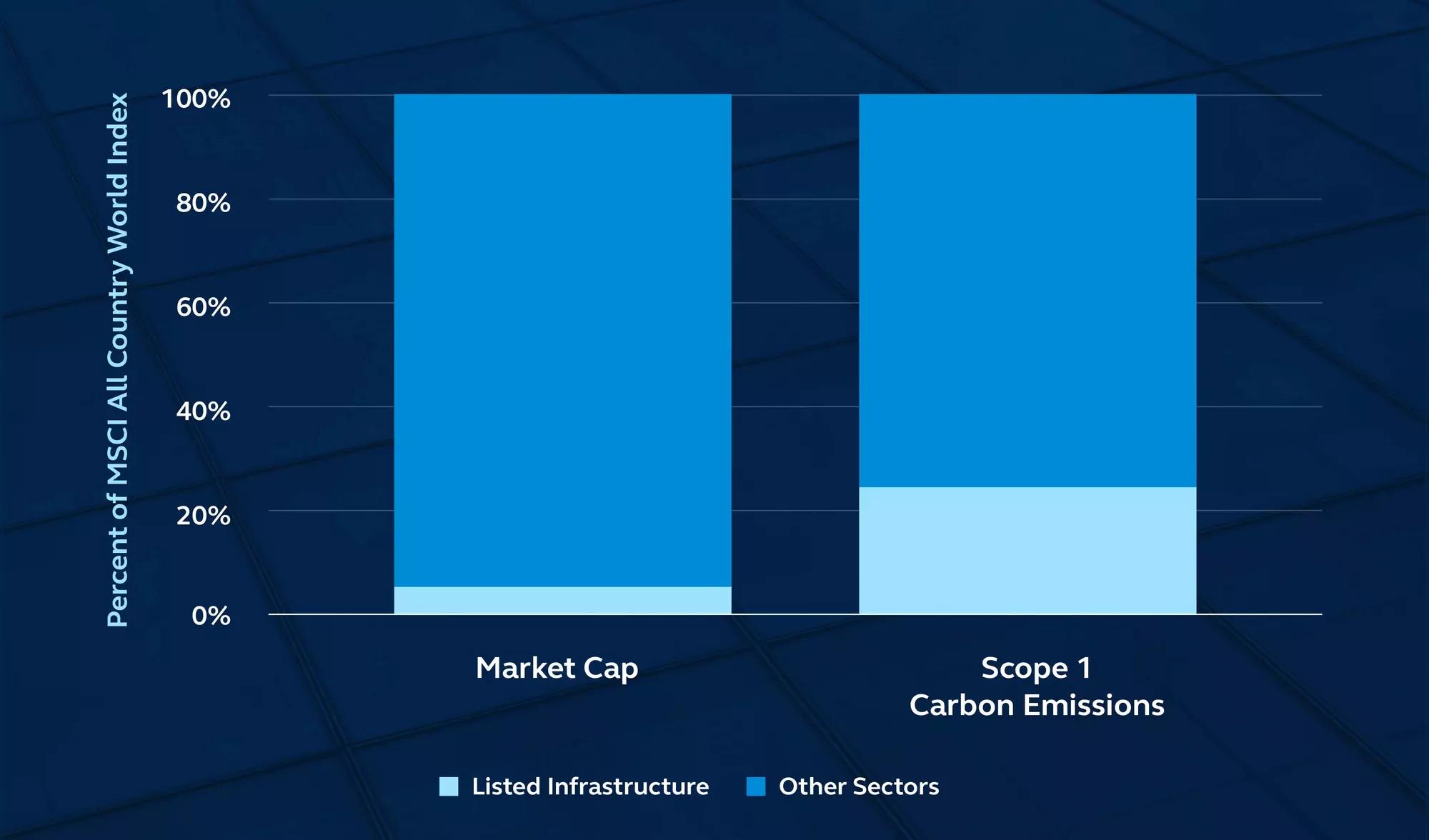

Potential for carbon emissions reduction is greater among listed infrastructure companies

Source: FactSet, MSCI, Principal Global Investors. Data as of July 31, 2021.

Finding opportunities

One benefit of Principal’s active strategy for identifying the best investment opportunities among the roughly 350 companies in the listed infrastructure space is being able to take advantage of market dislocations. The escalation of the Russian conflict in Ukraine has led many investors to reduce exposure to European infrastructure companies because of the continent’s partial reliance on Russian energy supplies and proximity to the conflict. Principal’s listed infrastructure team, however, has found attractive opportunities amid the market sell-off, zeroing in on companies with solid fundamentals and leading market positions. “General equity market volatility creates opportunities for us to buy sustainability leaders at an attractive price,” Foshag says.

Elsewhere, oil and gas pipeline companies that are generally less appreciated by most ESG-oriented investors may actually provide opportunity. Foshag notes the asset bases of many of these companies have the potential to store and transport more climate-friendly energy sources, such as hydrogen and renewable natural gas, and that investors often aren’t fully valuing that growth opportunity. “While renewables can go a long way toward reducing the carbon intensity of our energy use,” Foshag explains, “there will always be segments of the economy that are hard to electrify.” For those segments, decarbonized gas and other sustainable fuels can offer a solution.

These companies exist for a social purpose. They’re what allow us to switch on our lights, have clean drinking water—and they’re the companies that transport the goods that show up on our doorstep.

The team is also seeing potential for gains among certain listed infrastructure companies in emerging markets such as Chile and China. “Emerging-market equities have generally struggled to keep pace with developed-market equities over the past few years. Yet these companies are really well positioned in terms of the social and environmental impact potential in front of them,” Foshag says.

The Principal team works actively to ensure its portfolio companies are aware of ESG best practices among its global peers and are appropriately incentivized to deliver on ESG and diversity targets—targets that are driven by the diversity profiles of each company’s customer base. The team also identifies ways for these companies to enumerate their ESG credentials, such as net-zero carbon emissions, to other investors and third-party ratings agencies.

“We push our portfolio companies to make progress in these areas because it’s the right thing to do,” Foshag says, “but also because we believe it will help their stock price better reflect the good that they’re doing on sustainability and ESG.”

Content created with Custom Content from WSJ.

Custom Content from WSJ is a unit of The Wall Street Journal Advertising Department. The Wall Street Journal news organization was not involved in the creation of this content.

This content was explicitly created as Dow Jones confidential information by WSJ Custom Content and is owned and copyrighted by WSJ Custom Content. It is not transferable; any use of this concept, including without limitation creation of any derivative work therefrom, without the express written consent of WSJ Custom Content is strictly prohibited.

Investing involves risk, including possible loss of principal. Past performance does not guarantee future results. Investments in private debt, including leveraged loans, middle market loans, and mezzanine debt, and second liens, are subject to various risk factors, including credit risk, liquidity risk and interest rate risk. Asset allocation and diversification do not ensure a profit or protect against a loss.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

Principal Asset Management Investors leads global asset management at Principal®. Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800-5477754, Member SIPC and/or independent broker/dealers. Principal Asset Management, Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

© 2022, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2156077