Themes, outlook, and investment implications across global fixed income markets.

As we enter the final quarter of 2025, the fixed income landscape is shaped by slowing economic growth and the Federal Reserve’s anticipated rate cuts. With inflation running above target, the Fed faces a delicate balance between price pressures and a weakening labor market, which is expected to lead to additional measured rate cuts. This macroeconomic backdrop suggests that returns could more closely align with the long-term averages of the asset class, particularly for higher-quality segments like investment grade and securitized credit, which are more sensitive to interest rate shifts.

Policy volatility: Navigating geopolitical and economic challenges

Markets are contending with persistent inflation and a slowing U.S. labor market. The resumption of the Fed's easing cycle amid elevated inflation rooted in tariff impacts and geopolitical tensions will likely introduce volatility as investors seek clarity. The ongoing potential for a one-off, or possibly extended, inflation shock tied to tariffs adds another layer of complexity. At the same time, the stagflationary tilt persists, contributing to a steepening yield curve.

Credit fundamentals: Resilience amidst market dynamics

Investor focus should remain on the underlying economic conditions, but also on strong technicals and robust credit fundamentals within the fixed-income market. While slow growth may not equate to recession and stubborn inflation may yet be contained, the impact of headline risks and trade sensitivities could lead to significant sector dispersion. In this context, active issuer selection and credit discipline become increasingly vital for navigating the complexities of the current environment.

Valuations: Further compression may be limited, but opportunities exist

Given the tightening of spreads following spring’s volatility, further compression may be limited. Nevertheless, emerging markets, securitized assets, and private credit continue to offer compelling risk-adjusted opportunities for long-term investors. In this dynamic market, active management will be essential for uncovering value and successfully navigating the ongoing volatility.

Market environment

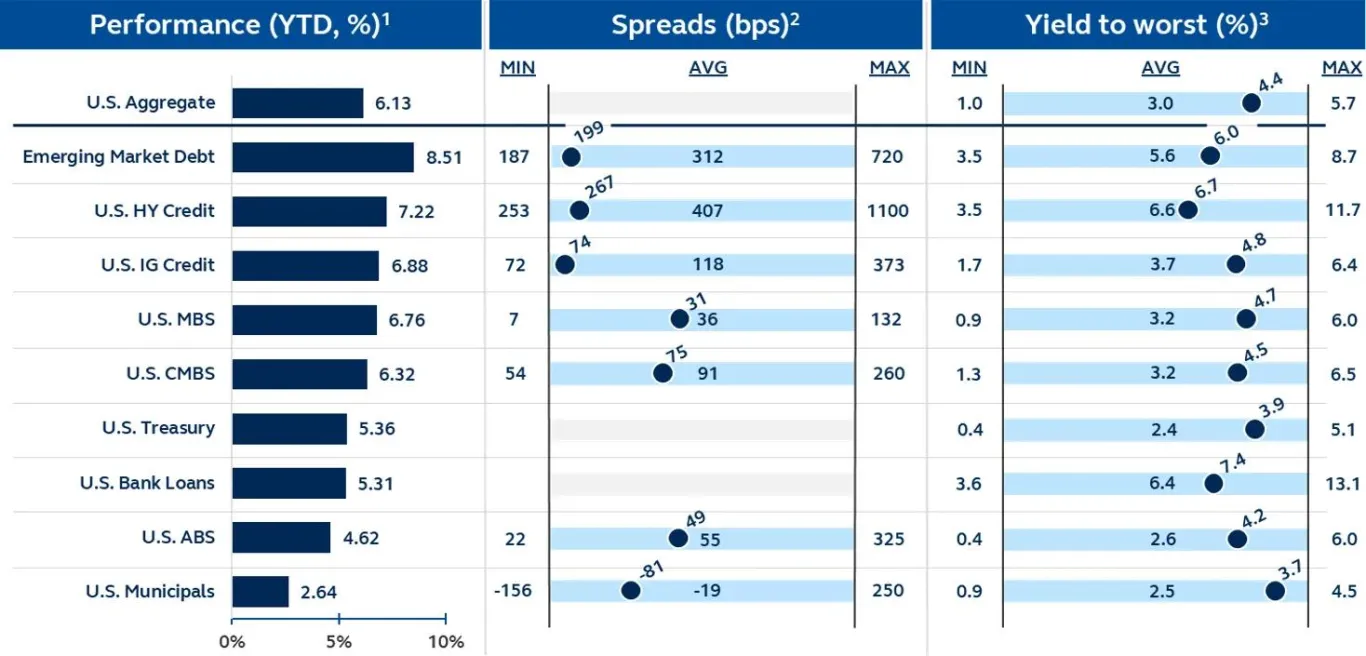

Year-to-date performance, spread, and yield for various fixed income indices

Source: Bloomberg, Principal Asset Management. Data are as of September 30, 2025. 1 Total returns for representative indices. 2 Spread to Treasury. Min, max, and average based on last 10 years. 3 Index yield to worst. Min, max, and average based on last 10 years. Weighted average yield-to-maturity reflected for U.S. Bank Loans. Indices are unmanaged and do not take into account fees, expenses, and transaction costs, and it is not possible to invest in an index.

U.S. outlook

With the Fed initiating what is expected to be a gradual easing cycle, U.S. fixed income markets are entering a supportive policy environment. Labor market softening and slowing job creation have shifted the Fed’s focus toward employment, even as core inflation remains elevated and tariffs add further upside risk to prices. As long as inflation expectations stay anchored and price pressures remain goods-driven, the Fed is likely to prioritize growth stability through measured rate cuts. Consumer strength continues to support economic momentum, though bifurcation persists, with high-income households driving spending through wealth effects and real wage gains.

Corporate fundamentals are solid, and recession risks appear limited. In this context, fixed income stands out: yields remain attractive versus equities, and slowing growth without contraction favors high-quality credit. While valuations are tight, the combination of policy support, strong technicals, and stable fundamentals justifies a modest risk-on positioning, with active management essential to navigating dispersion.

Global outlook

As we move into 2026, global markets face a more fragmented macro environment, marked by diverging monetary policies, shifting fiscal dynamics, and evolving geopolitical risks. While the U.S. enters a pronounced easing cycle, other developed markets are expected to ease more modestly—widening rate differentials, steepening yield curves unevenly, and placing downward pressure on the U.S. dollar. Europe’s growth prospects are improving, supported by Germany’s fiscal expansion, particularly in defense and infrastructure, while the U.S. faces relative fiscal restraint. This contrast may influence relative asset class performance and capital flows.

Meanwhile, rising geopolitical risks—particularly in the Middle East—introduce longer-term uncertainties that may reshape global alignments beyond traditional energy concerns. Stabilization in China and selective strength in emerging markets offer tactical opportunities, but idiosyncratic risks remain. In this less synchronized global cycle, regional agility and active risk management are critical. Investors should remain attuned to policy asymmetries and structural shifts that could alter the global opportunity set.

Investment implications

While economic challenges remain, we see opportunities in fixed income.

Investment grade credit remains well-positioned heading into year-end, supported by strong technicals, resilient fundamentals, and a macro backdrop that historically favors high-quality credit. Slower but stable growth, combined with the Fed’s easing cycle, reinforces IG’s role as a portfolio ballast. A rare environment of net supply scarcity continues to support spreads, while robust reinvestment demand provides a durable bid for new issuance.

Financials remain a high-conviction overweight, benefiting from attractive valuations, regulatory relief, and solid capital positions. Conversely, consumer-linked credits—particularly in retail and food & beverage—face margin and event risks, warranting caution. A steepening Treasury curve is creating opportunity in the 5–10-year part of the curve, where carry and roll-down are most favorable. While long-end issuance may rise with M&A activity, the belly currently offers the best risk-adjusted value. In a market defined by dispersion, active management and disciplined credit selection remain key to capturing relative value.

High yield credit remains supported by strong technicals, solid issuer fundamentals, and refinancing-driven issuance that has kept net new supply limited. Companies are using the Fed’s renewed easing cycle to extend maturities and reduce near-term refinancing risk, leading to improved credit quality and a more stable foundation heading into 2026. While spreads are tight and valuations no longer cheap, opportunities remain in rate-sensitive sectors like capital goods and building materials, where lower rates and resilient demand support earnings.

Caution is warranted in retail and consumer products, where tariff-related cost pressures and uneven pricing power challenge margins. With spreads likely to remain rangebound, future returns will rely more on issuer selection than beta exposure. Active, bottom-up credit analysis remains critical, with a focus on shorter to intermediate maturities and higher-quality structures as the market navigates slower growth and policy transition.

Structured credit markets remain fundamentally sound, though narratives vary widely across subsectors. Agency MBS is poised to benefit from accelerating prepayments and the potential return of GSE demand, while technical support remains firm amid low net supply. In credit-oriented segments—ABS, CMBS, RMBS—demand has kept pace with record issuance, even as fundamentals diverge. Consumer credit bifurcation is a key theme: middle- and upper-income borrowers remain resilient, while delinquencies among subprime borrowers, especially in autos, continue to rise.

CMBS refinancing remains challenging, with many borrowers seeking extensions as valuations remain under pressure. Positioning favors high-quality structures and short-dated instruments that benefit from modest curve steepening. Near-par agency coupons, prime RMBS, select ABS, and AAA-rated SASB CMBS offer compelling relative value. As dispersion increases and structural features drive performance, active management remains essential. A disciplined focus on quality, collateral, and curve positioning will be key to capturing value while managing risk across securitized sectors.

Municipals enter year-end on a firmer footing, with normalized valuations, improving technicals, and broadening demand. Earlier concerns—around tax policy, record supply, and delayed Fed action—have largely faded. Elevated tax-equivalent yields are drawing renewed interest from both traditional and nontraditional buyers, including insurance companies and crossover accounts seeking high-quality, income-generating assets. The steepening muni yield curve, particularly relative to taxable markets, creates compelling opportunities in intermediate and long maturities, where roll-down potential and income are most attractive.

Credit fundamentals remain strong, with robust state revenues and well-funded reserves, though selective credit work is key—particularly among sectors tied to speculative or opaque projects. Infrastructure-linked issuance, such as airports and transportation, offers attractive long-term entry points, while corporate-style munis provide higher yields and familiar structures for crossover buyers.

With liquidity improving and supply well-absorbed, municipals are transitioning from a challenged backdrop to one defined by opportunity—offering a favorable setup for tax-aware investors into 2026.

Emerging market debt enters the final quarter with solid momentum, supported by easing inflation, resilient macro fundamentals, and growing monetary policy divergence from developed markets. Many EM central banks have already begun cutting rates, ahead of the Fed, enabled by contained inflation and currency stability—particularly in local markets. While capital continues to flow into both hard and local currency debt, compressed spreads and rising geopolitical risks make selectivity essential.

Opportunities are concentrated in large domestic markets like Brazil, India, and Indonesia, where structural reforms and domestic demand provide insulation from external shocks. In Asia, a stabilizing tech cycle and weaker U.S. dollar support EMFX strength in markets like Korea, Taiwan, and Malaysia. Hard currency valuations remain tight, but improving fundamentals and policy autonomy continue to support the asset class. Active management and disciplined country and sector selection are critical, particularly amid global uncertainty, evolving trade dynamics, and diverging monetary paths.

Private credit continues to benefit from resilient fundamentals, elevated yields, and structural shifts in capital markets. Middle market direct lending remains a core opportunity, as traditional bank lending constraints push more borrowers toward private capital. The focus is on durable, cash-generative businesses in essential services, with targeted exposure to secular growth themes like digitization, electrification, and infrastructure modernization. Floating-rate structures have supported income, and as policy rates ease, lower debt service costs should sustain credit quality and unlock renewed deal flow.

On the institutional side, investment-grade private placements remain a strategic allocation, offering incremental spread, structural protections, and tailored capital solutions backed by real assets and predictable cash flows. Transactions tied to digital infrastructure, structured finance, and NAV-based lending continue to attract strong investor demand. Despite lingering concerns about liquidity, private credit offers diversification, downside mitigation, and consistent income—making it a compelling complement to public fixed income in a maturing cycle.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk considerations

Investing involves risk, including possible loss of principal. Past Performance does not guarantee future return. All financial investments involve an element of risk. Therefore, the value of the investment and the income from it will vary and the initial investment amount cannot be guaranteed. Fixed‐‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise. Potential investors should be aware that Investment grade corporate bonds carry credit risks, default risk, liquidity risks, currency risks, operational risks, legal risks, counterparty risk and valuation risks. Lower‐rated securities are subject to additional credit and default risks. Asset backed securities are affected by the quality of the credit extended in the underlying loans. As a result, their quality is dependent upon the selection of the commercial mortgage portfolio and the cash flow generated by the commercial real estate assets. Commercial Mortgage‐Backed Securities carry greater risk compared to other securities in times of market stress. There may be less information on the financial condition of municipal issuers than for public corporations. The market for municipal bonds may be less liquid than for other bonds. Emerging market debt may be subject to heightened default and liquidity risk. Private credit involves an investment in non‐publicly traded securities which are subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss. Asset allocation and diversification do not ensure a profit or protect against a loss. International and global investing involves greater risks such as currency fluctuations, political/ social instability and differing accounting standards.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. Information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

This material may contain ‘forward‐looking’ information that is not purely historical in nature and may include, among other things, projections, and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

All figures shown in this document are in U.S. dollars unless otherwise noted. All assets under management figures shown in this document are gross figures, before fees, transaction costs and other expenses and may include leverage, unless otherwise noted. Assets under management may include model‐only assets managed by the firm, where the firm has no control as to whether investment recommendations are accepted, or the firm does not have trading authority over the assets.

Index performance information reflects no deduction for fees, expenses, or taxes. Indices are unmanaged and individuals cannot invest directly in an index.

This document is intent for use in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorized and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- United Arab Emirates by Principal Investor Management (DIFC) Limited, an entity registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as an Authorised Firm, in its capacity as distributor / promoter of the products and services of Principal Asset Management. This document is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No.199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- Hong Kong SAR by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission. This document may only be distributed, circulated or issued to persons who are Professional Investors under the Securities and Futures Ordinance and any rules made under that Ordinance or as otherwise permitted by that Ordinance.

- Other APAC Countries/Jurisdictions. This material is issued for Institutional Investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Global Investors, LLC (PGI) is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA), a commodity pool operator (CPO) and is a member of the National Futures Association (NFA). PGI advises qualified eligible persons (QEPs) under CFTC Regulation 4.7.

Principal Asset Management℠ is a trade name of Principal Global Investors, LLC.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800‐547‐7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

Principal Fixed Income is an investment team within Principal Global Investors.

© 2025 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

MM13225‐11 | 10/2025 | 4886091