Themes, outlook, and investment implications across global fixed income markets.

Entering 2026, the fixed income landscape is increasingly being defined by a combination of sustained economic growth and the Federal Reserve’s anticipated slow drip rate cuts. With U.S. inflation elevated, the Fed faces the challenging task of balancing persistent price pressures against a cooling labor market, but with healthy growth in the background. This situation is likely to result in fixed income returns aligning more closely with long-term averages, particularly in higher-quality segments such as investment-grade and securitized credit, which are known for their sensitivity to interest rate movements.

Policy volatility: Navigating geopolitical and economic challenges

The current environment is marked by policy volatility, as markets grapple with ongoing inflationary pressures and a decelerating U.S. labor market. The Fed’s easing cycle, occurring against a backdrop of sustained inflation exacerbated by geopolitical tensions (with Venezuela and Iran now added to the list) and the ever-present threat of tariff-based instability from the Trump Administration, creates a background of uncertainty. This scenario complicates investor sentiment and contributes to a steepening yield curve.

Credit fundamentals: Resilience amidst market dynamics

From a credit perspective, resilience is key. Investors should maintain a focus on robust technicals and credit fundamentals while remaining attentive to overall economic conditions. The burst of growth in the third quarter of 2025 should help mitigate concerns about a recession, and that stubborn inflation can still be managed. Nevertheless, geopolitical headline risks and sensitivities to trade can lead to significant sector dispersion, underscoring the importance of active issuer selection and credit discipline.

Valuations: Further compression may be limited, but opportunities exist

Valuations present a complex picture: while further spread compression may be constrained, opportunities persist, especially within emerging markets, municipal bonds, securitized assets, and private credit. As dispersion replaces broad beta as the primary driver of returns, success in 2026 will hinge less on market direction and more on security selection. In this environment, disciplined active management will be essential to identify durable income, manage downside risks, and capture pockets of value amid ongoing volatility.

Market environment

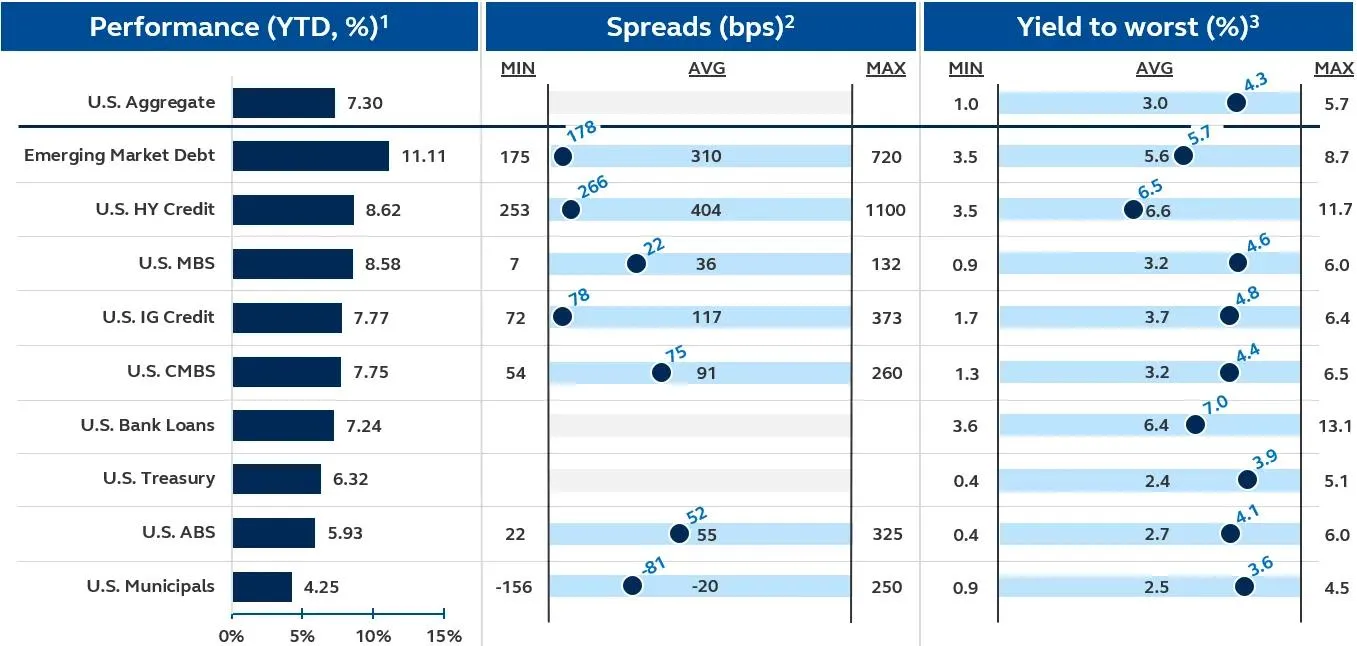

Year-to-date performance, spread, and yield for various fixed income indices

Source: Bloomberg, Principal Asset Management. Data are as of December 31, 2025. 1 Total returns for representative indices. 2 Spread to Treasury. Min, max, and average based on last 10 years. 3 Index yield to worst. Min, max, and average based on last 10 years. Weighted average yield-to-maturity reflected for U.S. Bank Loans. Indices are unmanaged and do not take into account fees, expenses, and transaction costs, and it is not possible to invest in an index.

U.S. outlook

Despite inflation, labor market softening, and policy uncertainty, fixed income delivered strong performance in 2025—supported by disinflation, Fed rate cuts, and resilient consumer and corporate fundamentals. Looking ahead, 2026 offers a favorable backdrop: slowing employment should maintain the Fed’s easing path, inflation is expected to trend toward target, and AI-related capex is poised to accelerate.

Consumer spending remains stable, corporate balance sheets are healthy, and fiscal policy is shifting toward tax cuts and deregulation, adding to the growth impulse. Yields remain attractive by historical standards, creating compelling entry points across fixed income.

Risks include tight valuations, potential disappointment in AI-driven productivity, and increased supply from infrastructure and tech investment. Still, we view 2026 as an opportunity-rich environment. Volatility is more likely to present tactical buying opportunities than sustained downside risk.

Global outlook

Global fixed income markets face a dynamic 2026 shaped by diverging monetary policy, reaccelerating fiscal expansion, and evolving geopolitics. Central banks are no longer easing in sync—while the Fed is expected to cut, others like the ECB and Bank of Canada are pausing, and the Bank of Japan has pivoted toward rate hikes for the first time in decades.

Meanwhile, fiscal stimulus is gaining momentum across the U.S., Europe, and Japan, supporting growth but keeping global yields elevated. A weaker U.S. dollar and persistent geopolitical recalibration, especially in Europe and China, are influencing capital flows and cross-border risk appetite.

We see limited scope for further rates-driven capital appreciation, placing more emphasis on carry, credit selection, and regional diversification. While structural risks remain, particularly in China and parts of Europe, the global macro landscape offers selective opportunities in 2026, especially for investors prepared to navigate policy divergence and tactically allocate across markets.

Investment implications

While economic challenges remain, we see opportunities in fixed income.

Investment grade (IG) credit enters 2026 on solid footing, supported by strong carry, improving supply-demand dynamics, and a steepening curve. While gross issuance is expected to rise, driven in part by AI-related capital investment, net supply remains manageable amid elevated maturities and robust investor demand. All-in yields remain historically attractive, even with spreads near the tighter end of their range, reinforcing IG’s appeal as a source of income with low default risk and moderate duration exposure.

The 5- to 10-year part of the curve is appealing, where rate stability and roll-down potential offer compelling relative value. Sector-wise, opportunities lie in large U.S. banks, AI-linked BBB tech names, and defensively positioned consumer and industrial issuers. Risks include potential oversupply or rapid yield shifts, but barring surprises, the setup remains favorable for credit selection and carry-focused strategies.

High yield remains on stable footing, supported by strong carry and declining defaults, but tight valuations and rising issuance suggest more two-way risk. Spreads are expected to widen modestly from post-pandemic tights, particularly in BB credits, while default rates should fall to around 2.75% as refinancing activity picks up.

Issuance is projected to grow as companies pre-fund ahead of a 2028 maturity wall—suggesting volume, not stress, will define supply trends. Meanwhile, sector rotation is underway: AI-linked tech, building materials, and utilities are gaining prominence, while caution is warranted in energy and healthcare.

With market composition evolving and credit dispersion rising, carry remains attractive, but broad beta exposure is less compelling. 2026 will favor selective positioning—emphasizing strong structures, disciplined underwriting, and sector-level differentiation to drive performance amid modest volatility.

Securitized debt begins the quarter with strong technicals and stable fundamentals, but greater dispersion is creating a more selective opportunity set. Investor demand remains firm across ABS, CMBS, and MBS, supported by attractive relative value and manageable supply. In agency MBS, we favor call-protected conventional pools over Ginnie Maes, where net issuance may be heavier.

Credit bifurcation is rising, particularly across consumer ABS and commercial real estate. Subprime auto remains viable for experienced issuers, while single-asset/single-borrower CMBS offers transparency and high-quality collateral in top-tier metros.

Duration remains limited in many securitized sectors, but selective opportunities exist, particularly in agency MBS near par, seasoned RMBS, and 10-year conduit CMBS deals. Convexity and consumer health are key watchpoints, especially if rates fall sharply.

Overall, securitized debt continues to offer a differentiated, risk-adjusted income profile. Navigating credit quality, collateral type, and structure will be essential to capturing value in 2026.

Municipals enter 2026 with strong credit fundamentals, elevated tax-equivalent yields, and a steeper curve that supports duration extension. With federal tax exemption uncertainty resolved, investor confidence has improved, and demand is expected to strengthen, even as supply remains elevated.

We continue to favor revenue-backed bonds tied to infrastructure, housing, and energy projects, where fundamentals are resilient and income potential remains strong. Airports, subways, and prepaid gas bonds are especially well-aligned with fiscal stimulus trends and investor demand for tangible, long-duration assets.

By contrast, general obligation bonds warrant caution in states facing fiscal headwinds from tax reform debates or slowing revenue growth. Active selection is increasingly important as federal aid recedes and credit dispersion rises.

Overall, the muni market offers a high-quality source of income and total return potential in 2026. As rates decline and money moves out the curve, we see municipals playing a strategic role in core fixed income allocations.

EMD maintains solid fundamentals, attractive yields, and renewed investor demand. Many emerging markets have strengthened their domestic debt frameworks, built FX reserves, and maintained disciplined monetary policies, creating a more resilient backdrop for both sovereign and corporate debt.

Investment-grade EM bonds yield near 5%, with high yield above 7%, offering strong risk-adjusted income as developed market yields trend lower. While early-year supply is expected to be heavy, any resulting spread widening may offer tactical entry points rather than signaling stress.

Themes shaping the landscape include AI-driven demand for EM commodities, selective opportunities in distressed sovereigns, and a shift toward income compounding as price gains moderate.

EMD continues to offer strategic diversification, particularly as developed market valuations tighten. With fundamentals intact and central banks retaining policy flexibility, we see EMD as a compelling complement to core credit allocations in 2026.

Private credit enters 2026 with renewed momentum as macro clarity, easing rates, and pent-up sponsor demand drive a sharp rebound in deal flow. Middle market direct lending remains supported by conservative capital structures, improving valuations, and disciplined underwriting, creating a favorable backdrop for new deployment.

The market continues to evolve, with structural innovations such as continuation vehicles and secondaries enhancing flexibility without signaling stress. These features, alongside limited liquidity pressures, help insulate private credit from the volatility seen in public markets.

Fundamentals remain strong: cash flow coverage is improving, non-accruals are low, and credit events remain concentrated outside the core direct lending space. As LBO and M&A activity picks up, 2026 is shaping up as an attractive vintage for private credit, with risk-adjusted returns supported by robust structural protections and resilient borrower performance.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk considerations

Investing involves risk, including possible loss of principal. Past Performance does not guarantee future return. All financial investments involve an element of risk. Therefore, the value of the investment and the income from it will vary and the initial investment amount cannot be guaranteed. Fixed‐‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise. Potential investors should be aware that Investment grade corporate bonds carry credit risks, default risk, liquidity risks, currency risks, operational risks, legal risks, counterparty risk and valuation risks. Lower‐rated securities are subject to additional credit and default risks. Asset backed securities are affected by the quality of the credit extended in the underlying loans. As a result, their quality is dependent upon the selection of the commercial mortgage portfolio and the cash flow generated by the commercial real estate assets. Commercial Mortgage‐Backed Securities carry greater risk compared to other securities in times of market stress. There may be less information on the financial condition of municipal issuers than for public corporations. The market for municipal bonds may be less liquid than for other bonds. Emerging market debt may be subject to heightened default and liquidity risk. Private credit involves an investment in non‐publicly traded securities which are subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss. Asset allocation and diversification do not ensure a profit or protect against a loss. International and global investing involves greater risks such as currency fluctuations, political/ social instability and differing accounting standards.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. Information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

This material may contain ‘forward‐looking’ information that is not purely historical in nature and may include, among other things, projections, and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

All figures shown in this document are in U.S. dollars unless otherwise noted. All assets under management figures shown in this document are gross figures, before fees, transaction costs and other expenses and may include leverage, unless otherwise noted. Assets under management may include model‐only assets managed by the firm, where the firm has no control as to whether investment recommendations are accepted, or the firm does not have trading authority over the assets.

Index performance information reflects no deduction for fees, expenses, or taxes. Indices are unmanaged and individuals cannot invest directly in an index.

This document is intent for use in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorized and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- United Arab Emirates by Principal Investor Management (DIFC) Limited, an entity registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as an Authorised Firm, in its capacity as distributor / promoter of the products and services of Principal Asset Management. This document is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No.199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- Hong Kong SAR by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission. This document may only be distributed, circulated or issued to persons who are Professional Investors under the Securities and Futures Ordinance and any rules made under that Ordinance or as otherwise permitted by that Ordinance.

- Other APAC Countries/Jurisdictions. This material is issued for Institutional Investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Global Investors, LLC (PGI) is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA), a commodity pool operator (CPO) and is a member of the National Futures Association (NFA). PGI advises qualified eligible persons (QEPs) under CFTC Regulation 4.7.

Principal Asset Management℠ is a trade name of Principal Global Investors, LLC.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800‐547‐7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

Principal Fixed Income is an investment team within Principal Global Investors.

© 2026 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

5112960