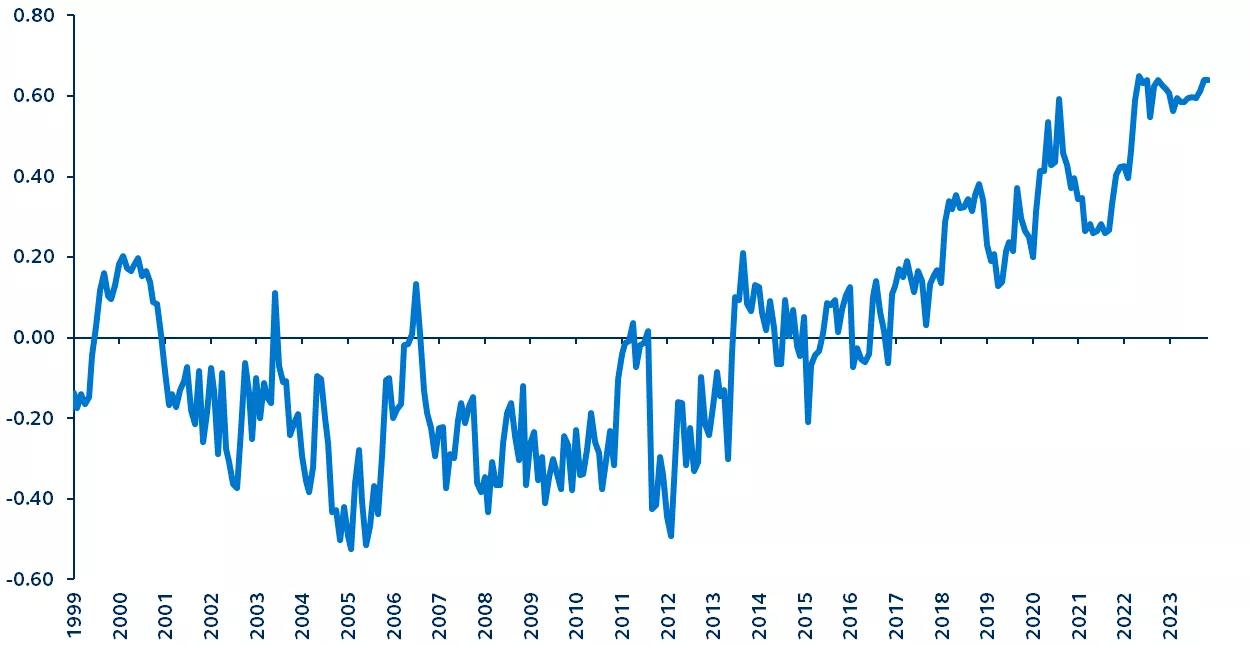

Convexity conceptualizes bond prices’ upside and downside potential in response to interest rate movements. Today, convexity in the Bloomberg U.S. Aggregate Index is at record-high levels, which means that bond prices currently have more potential for gains when interest rates fall and are less exposed to losses if interest rates rise. With the Fed at or near the peak of its hiking cycle, investors should consider acting early by increasing the duration of their fixed income exposure to capitalize on the potential outsized gains when rates begin to fall.

Bloomberg U.S. Aggregate Index convexity

1999–present

Source: Bloomberg, Principal Asset Management. Data as of October 31, 2023.

The recent sell-off in U.S. Treasury yields has sent shockwaves through the market, with the 10-year yield crossing the 5% threshold for the first time since June 2007. For investors looking to capitalize on the sell-off but are wary of higher yields, the concept of convexity remains key.

Convexity measures the sensitivity of a bond's duration to changes in interest rates. In essence, it adjusts the bond’s total return either up or down after accounting for changes due to duration. Positive convexity signifies that the potential gain in price appreciation resulting from a drop in yields is more substantial than the price depreciation caused by an equivalent increase in yields.

At the end of October 2023, the price on the Bloomberg U.S. Aggregate stood at $84.77 per $100 of face value, significantly lower than the $99.14 recorded in June 2007. This disparity in prices has resulted in a record-high positive convexity in the Index. Consider that over the next 12 months, a mere 50 basis point drop in yields could translate to an 11% higher price appreciation on the U.S. Aggregate Index.

With the Federal Reserve pausing its rate hikes and yield levels hovering at pre-GFC highs, investors should be considering extending duration in high-quality fixed income. The benefits of acting early, thanks to the market’s record high convexity, seem to far outweigh the advantage of a wait-and-see approach in fixed income.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3225074