Bond yields have surged to their highest level in over 15 years, propelled by resilient economic data and revised expectations for Federal Reserve policy. Nevertheless, the looming threat of subdued growth in 2024 suggests that bond yields are likely near their peak. This presents a potential opportunity for investors—add to duration exposure as the economic slowdown approaches.

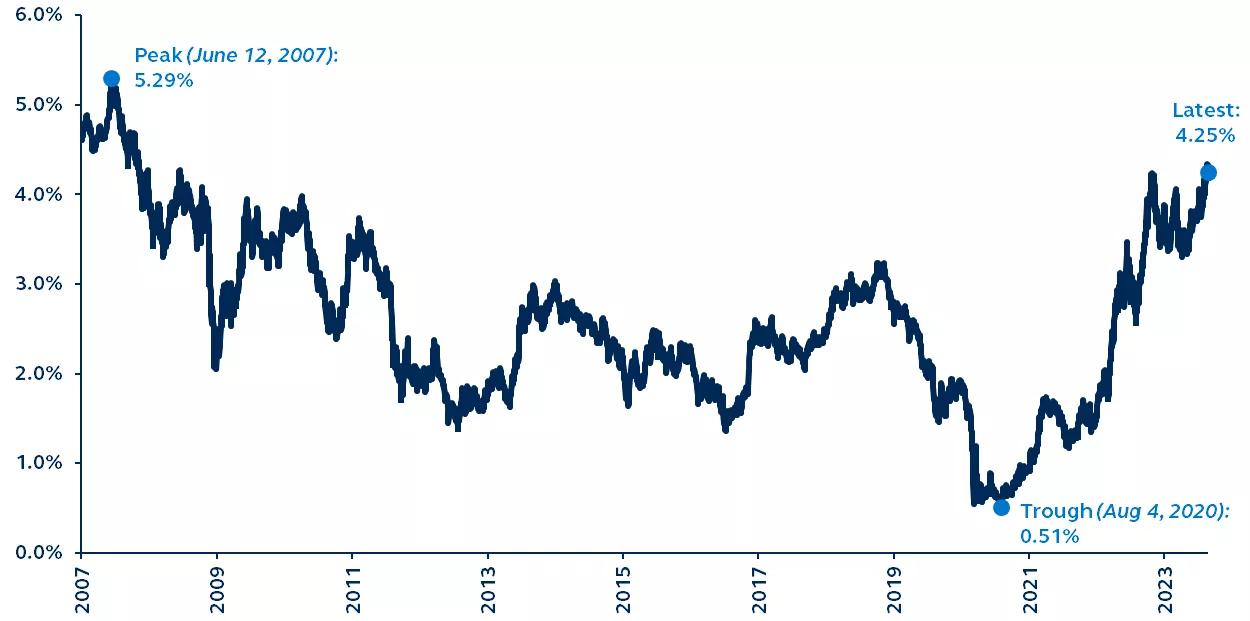

10-year U.S. Treasury yield

2007–present

Source: Bloomberg, Principal Asset Management. Data as of August 25, 2023.

Note: Peak and trough shown are for 2007–present time period.

The relentless bond sell-off has reached a new milestone. 10-year U.S. Treasury yields hit 4.34%, the highest level since 2007, up almost 110 basis points since the regional bank crisis earlier this year. Several factors have contributed to the sell-off:

- Robust economic growth: Incoming economic activity data has generally been very resilient, leading to an upward revision in growth forecasts.

- Higher for longer expectations: Markets have been revising their Fed rate path expectations, pushing out the date of the Fed’s projected first cut and reducing the number of cuts.

- Bank of Japan policy adjustment: The central bank has loosened yield curve control, allowing long-suppressed Japanese government bond yields to rise, raising concerns about weakening foreign demand for U.S. Treasurys.

- Greater issuance: The U.S. Treasury recently increased its estimates for government borrowing, implying greater longer-dated debt issuance.

The sustainability of the recent rise in bond yields hinges on the performance of the U.S. economy in upcoming quarters. Slowing growth next year (even a soft landing) would push inflation lower, opening the door for a less restrictive Fed policy stance, and putting downward pressure on bond yields.

While bond yields may have shifted to a higher range, they’re likely nearing their peak. Given the elevated level of yields and the potential risk of muted growth next year, this could be an opportune time to add to duration exposure.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.