High-quality, U.S. agency mortgage-backed securities continue to offer favorable yields, and have historically outperformed through recessions, a scenario that looks increasingly likely in the fourth quarter of this year. MBS also stands to benefit from the Federal Reserve’s eventual pause in rate increases, which will bring lower rate volatility and spread tightening to the asset class.

MBS coupon spread and implied rate volatility

2013–present

Source: Bloomberg, Principal Asset Management. Data as of February 28, 2023.

With valuations remaining attractive and growth and financial stability concerns currently outweighing inflation fears, the investment thesis for fixed income is getting stronger. In particular, high-quality securitized debt is positioned to potentially outperform as a recession approaches and the U.S. economy slows.

Historically, the risk-adjusted returns of U.S. agency mortgage-backed securities (MBS) are some of the most attractive in the asset class, with lower volatility than similar, high-quality, fixed income sectors. In fact, with fundamental and technical factors within the MBS market remaining stable (there is currently little-to-no refinancing risk, and both slowing house price appreciation and housing activity continue to reduce organic net supply), the asset class is especially favorable during a risk- off period.

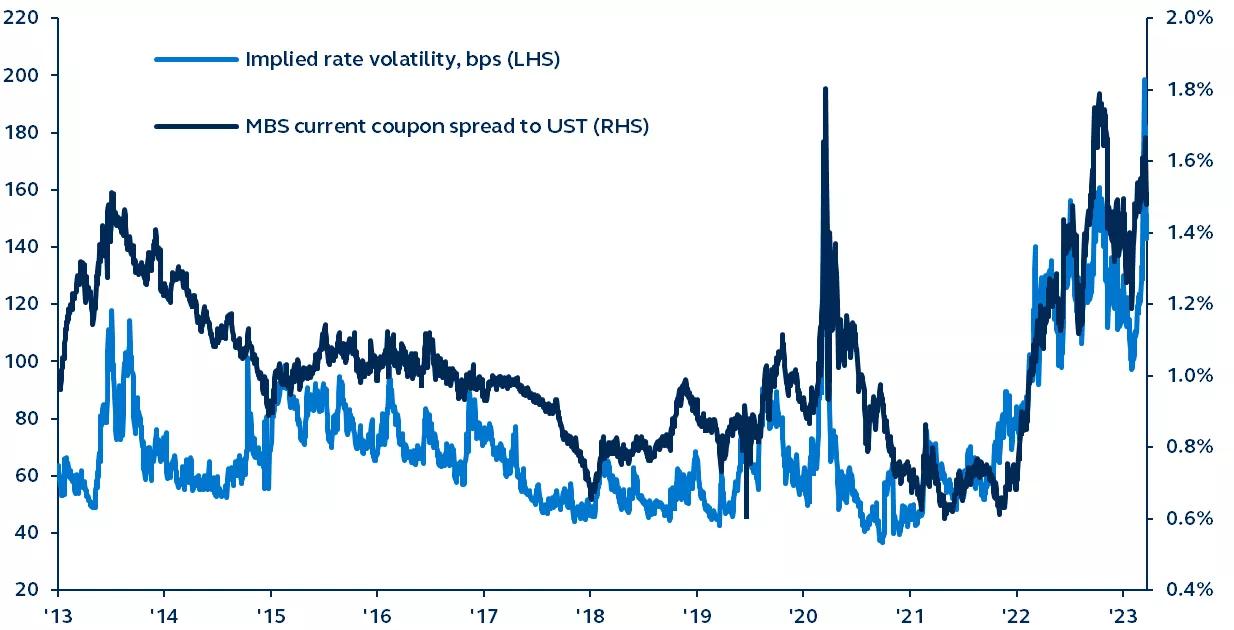

Through most of the Federal Reserve’s (Fed’s) current hiking cycle, MBS spreads have closely followed implied bond market volatility (as measured by the ICE BofA MOVE Index). This suggests that as the Fed nears a pause in rate hikes, and as rate volatility consequently eases, MBS spreads will narrow—making now a potentially attractive entry point to the asset class.

As recession nears, a growing premium will likely be placed on solid earnings performance, and this will be reflected in disparate performance of high- vs. low-quality credits. With sound fundamentals and technicals, coupled with attractive valuations, high-quality U.S. agency MBS is in a position to be rewarded in the period ahead.

Read the full quarterly outlook from Principal Fixed Income for more themes, opportunities, and investment implications across global fixed income markets.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2859695