The environment was quite constructive to start 2025, with significant deal flow carrying over from 2024 and expectations for improved business conditions. That momentum was paused with the unveiling of tariff policy in early April.

Expanding transaction activity, supported by the lower rate environment and clarity on economic and regulatory conditions, gave way to a new uncertainty and middle market direct lending deal flow slowed considerably. Sellers had been actively seeking transactions with expectations for somewhat higher enterprise values (EV), but buyers pulled back with the newfound uncertainty while sellers continued to hold out for their “right” price.

Throughout much of 2025, the clouds of policy uncertainty slowly cleared, which led to a notable resumption of U.S. middle market deal flow post Labor Day.

The transaction environment is now back to the favorable setting experienced at the beginning of 2025, and there is even more reason to believe that growth will continue.

We believe the improving and supportive market and economic backdrop, coupled with appealing credit structures, should create an environment ripe with attractive investment opportunities in 2026.

Improved economic clarity, easing Fed policy, and private equity sponsors’ eagerness to realize investment returns and deploy over $2 trillion in dry powder after years of slower activity, are driving strong momentum for increased transaction volumes in 2026.

As rates decline, lower and core middle market direct lending’s yield premium becomes even more valuable to investors, and coupled with strong covenants and disciplined underwriting, should deliver compelling risk-adjusted returns in 2026.

Middle market direct lending’s credit structures with meaningful covenants as well as committed and steady capital sources provide protection from BSL credit events and public market volatility.

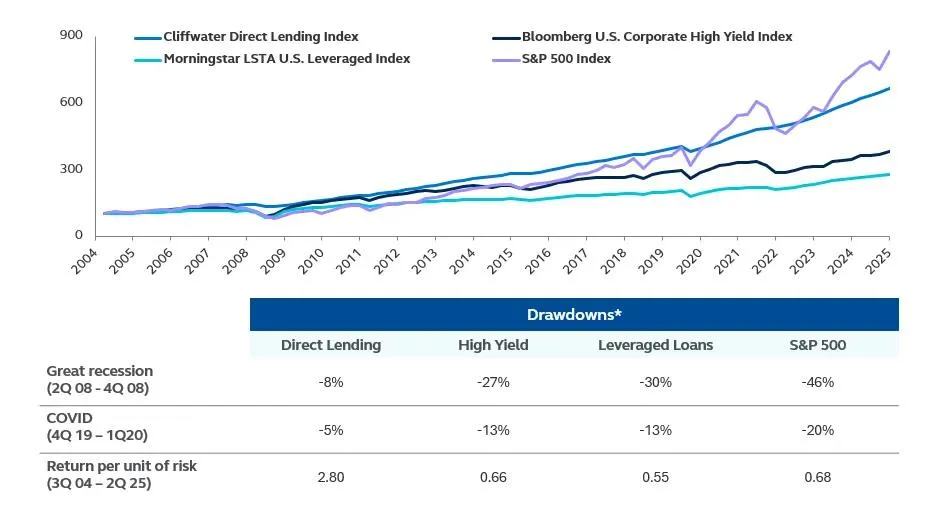

*Drawdowns are reflective of quarter end index values.

Source: Bloomberg U.S. Corporate High Yield Bond Index, Cliffwater Direct Lending Index, S&P/LSTA Leverage Loan Index, SPX (S&P 500 Index) MSCI ACWI Index, Bloomberg U.S. Corporate Investment Grade Index, Bloomberg U.S. Aggregate ABS, and Infrastructure (Dow Jones Brookfield Global Index), 30 June 2025. Past performance is not a reliable indicator of future performance and should not be relied upon for an investment decision. Indices are unmanaged and do not take into account fees, expenses, and transaction costs and it is not possible to invest in an index.

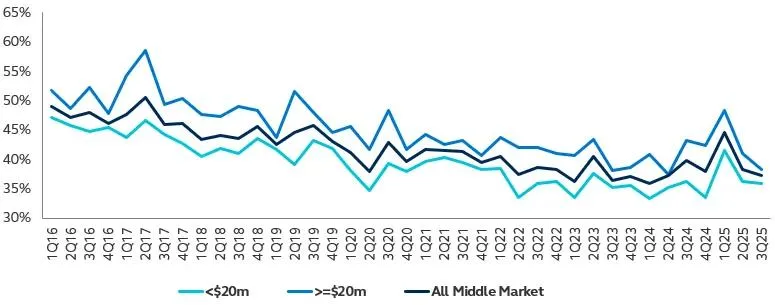

Loan to value for middle market LBOs by EBITDA size (%)

Source: LSEG, 30 September 2025.

The improving and supportive market and economic backdrop, coupled with appealing credit structures, should create an environment ripe with attractive investment opportunities in 2026. And the discipline of the market continues to be intact with lower and core middle market direct lending transactions continuing to represent the credit structure and underwriting standard that has set middle market direct lending apart from the public high yield and BSL markets.

We are focused on alignment with clients and approach direct lending with an investor mindset, always seeking to achieve the strong value proposition that is available with lower and core middle market direct lending through both PE sponsor-backed and non-sponsored lending opportunities.

The path ahead in 2026 will likely take a few twists and turns along the way. At Principal Alternative Credit, we look forward to maintaining our disciplined process and delivering strong risk-adjusted returns.

Read our full report for the complete view.

Risk considerations

Past performance is no guarantee of future results. Investing involves risk, include possible loss of principal invested. Investments in private debt, including leveraged loans, middle market loans, and mezzanine debt, are subject to various risk factors, including credit risk, liquidity risk and interest rate risk.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Indices are unmanaged and do not take into account fees, expenses, and transaction costs and it is not possible to invest in an index.

Principal Global Investors, LLC (PGI) is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA), a commodity pool operator (CPO) and is a member of the National Futures Association (NFA). PGI advises qualified eligible persons (QEPs) under CFTC Regulation 4.7.

“Cliffwater,” “Cliffwater Direct Lending Index,” and “CDLI” are trademarks of Cliffwater LLC. The Cliffwater Direct Lending Indexes (the “Indexes”) and all information on the performance or characteristics thereof (“Index Data”) are owned exclusively by Cliffwater LLC, and are referenced herein under license. Neither Cliffwater nor any of its affiliates sponsor or endorse, or are affiliated with or otherwise connected to, Principal Life Insurance Company, or any of its products or services. All Index Data is provided for informational purposes only, on an “as available” basis, without any warranty of any kind, whether express or implied. Cliffwater and its affiliates do not accept any liability whatsoever for any errors or omissions in the Indexes or Index Data, or arising from any use of the Indexes or Index Data, and no third party may rely on any Indexes or Index Data referenced in this report. No further distribution of Index Data is permitted without the express written consent of Cliffwater. Any reference to or use of the Index or Index Data is subject to the further notices and disclaimers set forth from time to time on Cliffwater’s website at https://www.cliffwaterdirectlendingindex.com/disclosures.

© 2026 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal Alternative Credit is an investment team within Principal Global Investors.

MM13781-02 | 01/2026 | 5074739-122027