There has been no shortage of bad news this year for equities. Despite lingering concerns over Fed policy, tariffs and unsettling geopolitical headlines, the S&P 500 continues to grind higher and is hovering around all-time highs. Healthy economic fundamentals are an ultimate buffer for negative headlines, after all. As such, equities should remain resilient unless an adverse event materializes into something larger that curtails household spending and company earnings.

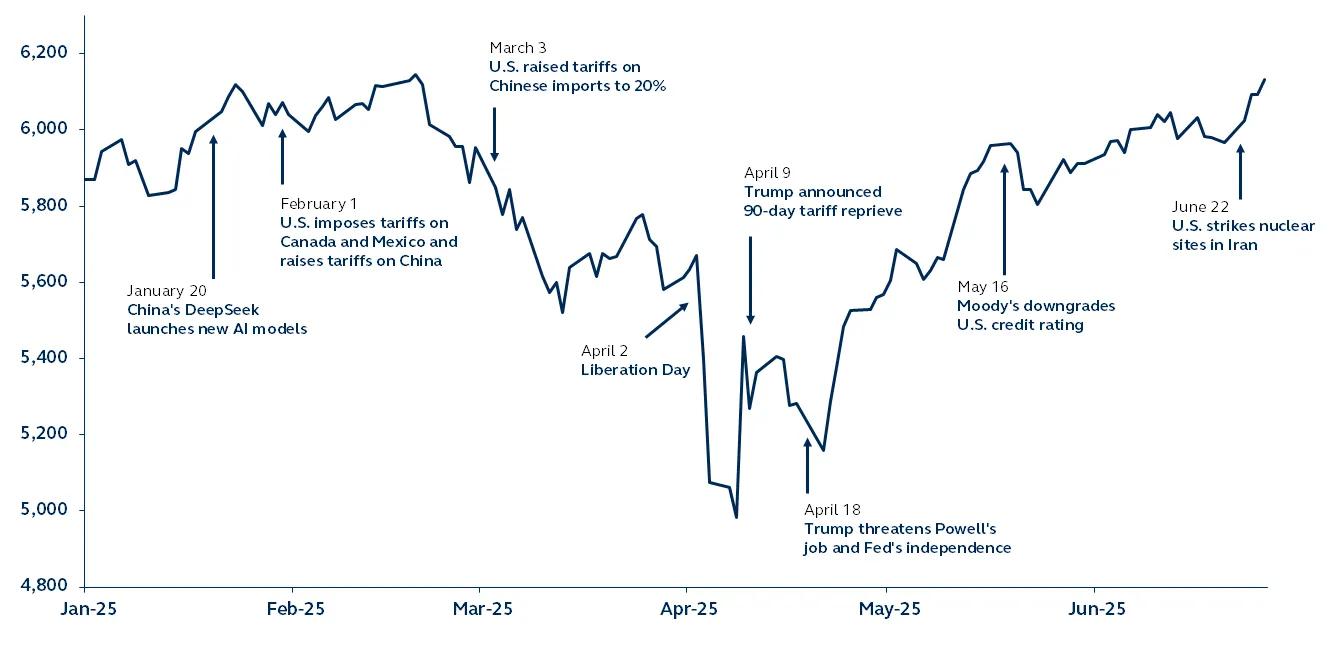

Amidst negative headlines, U.S. equities remain resilient

S&P 500 Index, January 1, 2025 - present

Source: Bloomberg, Reuters, CNBC, BBC, White & Case, Nextstar Media, Euro News, Yahoo Finance, Principal Asset Management. Data as of June 26, 2025.

This year’s investment landscape resembles a classic ‘buy the rumor; sell the news’ environment, making it difficult for investors to distinguish noise from trends amidst rapid change. Despite uncertainty encompassing Fed policy, fiscal policy, tariffs, and geopolitical tensions in the Middle East, the equity market has demonstrated remarkable resilience.

Tariff announcements initially triggered a sharp sell-off as investors worried that the trade levies would present significant headwinds for large and small businesses, and households by extension. The U.S./China trade truce and the 90-day reprieve reduced those concerns, but, perhaps more importantly, robust economic activity data reassured investors of the resilience of the U.S. economy, supporting a market recovery.

Similarly, as geopolitical tensions permeated headlines in recent weeks, markets produced only a small wobble, quickly shaking off concerns amidst a strong economic backdrop.

The muted market response is valid. Periods of high uncertainty typically do not warrant dramatic portfolio changes unless events escalate to have a material and sustained impact on economic fundamentals. After all, the equity market reflects earnings, which remain healthy courtesy of solid household spending, a robust labor market, and strong corporate balance sheets.

That said, given the uncertain policy backdrop, a broader hit to market sentiment cannot be ruled out. In this environment, it’s essential for investors to maintain well-diversified portfolios designed to navigate periods of heightened uncertainty.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Real estate investment options are subject to risks associated with credit, liquidity, interest rate fluctuation, adverse general and local economic conditions, and decreases in real estate values and occupancy rates. Commercial real estate (CRE) investments carry several inherent risks, including those related to the economy, interest rates, and tenant behavior. These risks can impact property values, rental income, and overall investment returns.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Securities are offered through Principal Securities, Inc., 800‐547‐7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

In Europe, this communication is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients.

© 2025, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

4618654