Idiosyncratic risk and return—performance drivers tied to specific securities rather than the market as a whole—reflect a manager’s ability to identify, evaluate, and capitalize on opportunities that passive strategies are not designed to capture. In a market environment where macro risks are increasingly difficult to predict or time, stock-specific insights offer a more durable path to outperformance. Active strategies focused on uncovering those insights are better equipped to adapt and deliver across cycles. In short, capturing idiosyncratic return is a defining trait of resilient portfolio design.

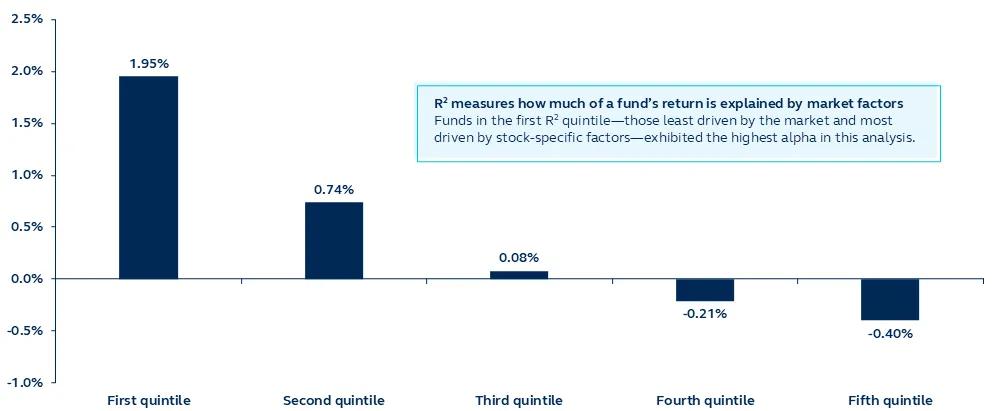

Portfolio alpha (excess return) by R² quintile

Annualized alpha sorted by quintiles of historical R², using monthly returns (1990–2010)

For illustrative purposes only. Source: Yakov Amihud, Ruslan Goyenko, Mutual Fund's R2 as Predictor of Performance, The Review of Financial Studies, Volume 26, Issue 3, March 2013, Pages 667–694, https://doi.org/10.1093/rfs/hhs182.

In an era where broad market moves dominate headlines, the real edge in investing often lies in the details others overlook. Idiosyncratic risk and return—performance drivers tied to specific securities rather than the market as a whole—reflect a manager’s unique skill in identifying, analyzing, and acting on opportunities that passive strategies cannot capture.

Recent market volatility underscored the limitations of passive investing and the value of differentiated insights and conviction-based decision making. History shows that idiosyncratic alpha can be generated across market cycles, making it a cornerstone of resilient, long-term performance.

Idiosyncratic alpha emphasizes three key elements:

- Granular knowledge of individual opportunities within the investable universe.

- Comprehensive modeling of systematic and idiosyncratic factors.

- Recognition of emerging trends before they are priced in.

Independent research is the engine of idiosyncratic alpha. Evaluating companies through measures like forward free cash flow yield can reveal value the market overlooks, while a collaborative environment—where analysts and portfolio managers challenge each other’s views—can help surface the strongest ideas and minimize bias.

In a rapidly changing investment landscape, prioritizing idiosyncratic risk and return isn’t just a strategy; it’s a necessity. It allows managers to more consistently capture unique, overlooked opportunities and build portfolios designed to thrive in all market conditions.

For a more comprehensive breakdown of idiosyncratic alpha and its role in portfolio construction, read The idiosyncratic advantage: Where unique insights drive unique returns.

Investing involves risk, including possible loss of principal. Past Performance does not guarantee future return. All financial investments involve an element of risk.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Asset Management leads global asset management at Principal.®

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800‐547‐7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

In Europe, this communication is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients.

© 2025, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

4750262