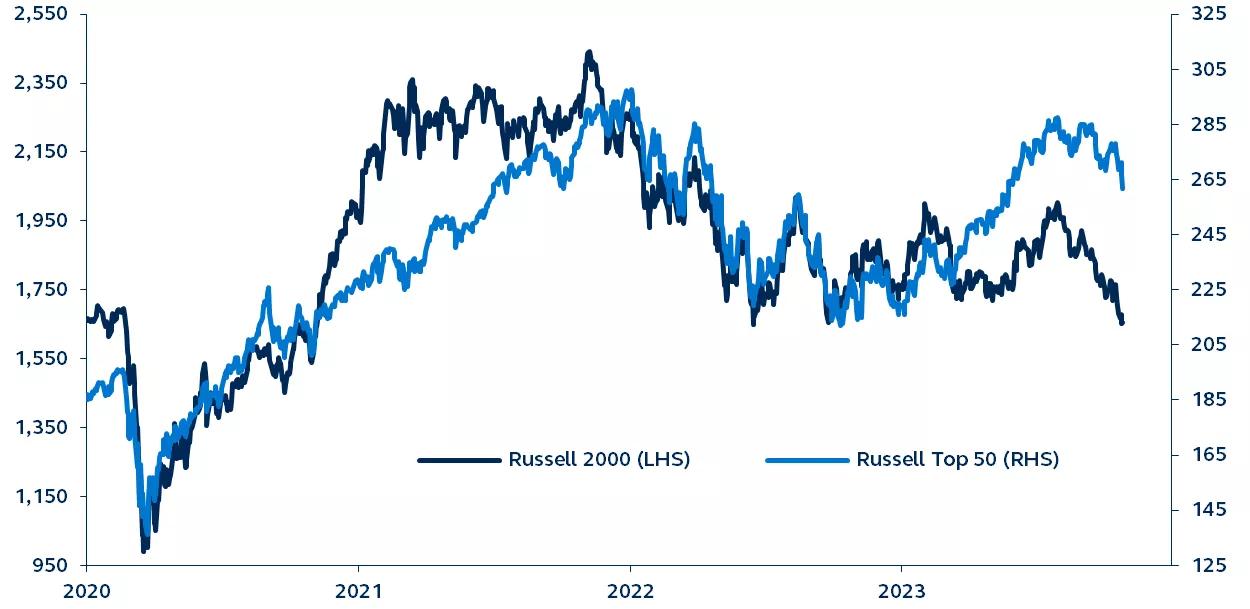

U.S. small caps recently broke below their pre-pandemic level and have vastly underperformed the largest 50 stocks in the Russell universe. Although buying when markets are cheap is generally preferred, today’s small-cap valuations appear entirely justified, if barely sufficient, when considering their weaker profits outlook and greater exposure to higher interest rates. Investors should maintain their preference for high-quality large caps, which are better positioned to weather a slowing economy in 2024.

Russell Top 50 Index versus Russell 2000 Index

Level, January 2020–present

Note: Russell Top 50 Index comprises the largest stocks by market cap in the Russell 3000 index.

Source: FTSE Russell, Bloomberg, Principal Asset Management. Data as of October 26, 2023.

It has been 19 months since the Federal Reserve embarked on its interest rate hiking campaign, and its lagged effects have yet to fully emerge. While the U.S. economy has shown resilience and delivered upside surprises, market bellwethers like small-cap stocks have not been so durable.

In glaring contrast to the largest 50 stocks, which have advanced almost 40% since their pre-pandemic highs, small-caps are now back below their pre-pandemic levels. Although small-cap underperformance has delivered tempting valuation discounts, this alone is likely to be insufficient when considering the stark difference in earnings outlooks. The largest 50 stocks are expected to grow earnings by 5 percent in 2024, versus a 7 percent contraction for small-caps.

From here, monetary tightening will increasingly challenge small-caps, as they are more dependent on free-flowing credit, and more vulnerable to higher interest rates. High-quality large-caps are comparatively immunized, with positive cashflow businesses being better placed to withstand higher rates. Large-caps’ superior profitability and more liquid balance sheets are quality distinctions which merit recent outperformance.

While “cheaper” small-caps may appear enticing to investors, their underperformance and current valuations appear justified given the challenging profits backdrop, their weaker balance sheets, and greater credit dependence. In anticipation of a slowing economy in 2024, investors should focus on quality fundamentals and continue to favor high-quality large-cap equities.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers. Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3196368