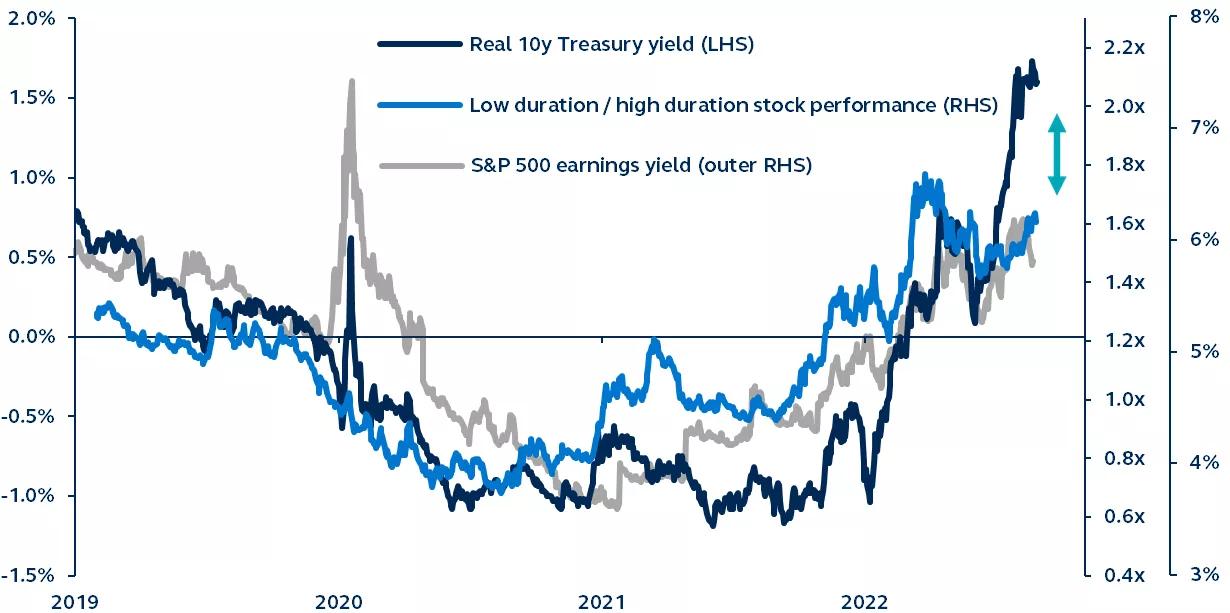

Elevated real yields are dampening the relative performance of growth and high duration (interest rate sensitive) stocks, while income and dividend-payers have held up better. Near-term, investors can expect dividend-paying and value stocks to remain favorable. Watch for peak Fed hawkishness, deteriorating economic fundamentals and a weaker U.S. dollar before shifting focus back to higher multiple growth stocks.

Real yields, earnings yield, and U.S. equities duration styles

Real U.S. 10y Treasury yield, S&P 500 earnings yield, and low duration versus high duration stocks, 2019–

present

Federal Reserve, U.S. Treasury, Goldman Sachs, Bloomberg, Principal Asset Management. Data as of October 26, 2022. Note: GS equity duration indices comprise the top 50 (sector-neutral) highest and lowest equity duration components of the Russell 1000 index.

For several years, negative real yields had provided support for risk assets. Today’s investing environment paints a much different picture, with the 10-year real yield recently breaching 1.7%—exceeding the S&P 500 dividend yield.

A rise in real yields is typical during periods of robust economic growth. In 2022, however, the surge into positive territory can be attributed to tightening financial conditions, both from Federal Reserve rate hikes and quantitative tightening, and a strong U.S. dollar.

In this challenging economic environment, stocks without immediate income streams have underperformed their high dividend counterparts, and high duration (interest rate sensitive) equities have underperformed low duration equities. Indeed, value stocks have a lower duration than growth stocks—due in part to their higher dividend payouts—and have outperformed.

The rise in earnings yield is consistent with the outperformance of low duration stocks. However, the rise in real yields has been so sharp that it’s now disconnected with the broader market earnings yield and, by association, the ratio of low-to-high duration equities. Therefore, the potential outperformance of both low duration and dividend-paying stocks has further room to run as they “catch up” with elevated real yields.

For investors, growth stocks (high duration, low dividend) are likely to remain under pressure until U.S. economic growth shows consistent signs of deterioration, the dollar weakens, and the Fed institutes its long-awaited pause. Until then, value stocks are likely to remain favorable.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2022, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

Principal Asset Management leads global asset management at Principal.®

2562977