Latin American equities have soared in 2023, raising questions about their sustainability in 2024. However, several factors suggest this robust performance can continue in the year ahead, making the region a potentially attractive option within a strategic asset allocation.

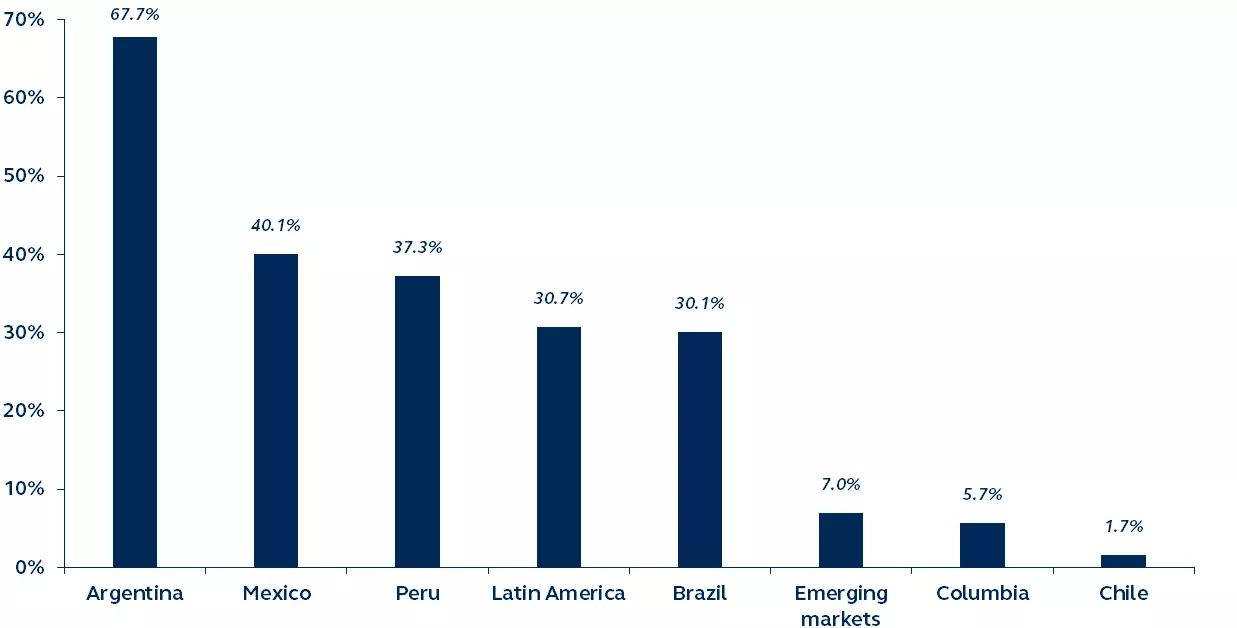

Latin America and emerging markets performance

2023 year-to-date, total return in USD

In 2023, Latin American equities staged a remarkable performance, surpassing their emerging market peers and global equity benchmarks. Heading into 2024, however, investors must determine whether this impressive market run can endure or if it's merely an aberration. Our analysis has highlighted five reasons that suggest performance can be maintained.

- Several Latin American central banks are already cutting policy rates and are set to continue easing in 2024.

- Following recent populist elections in Brazil, Chile, Mexico, and Columbia, investor concerns around misguided policies and economic mismanagement have proven unfounded.

- The region offers deep valuation discounts, as Chile and Brazil are cheaper today than 90% of their histories.

- Latin America is well-positioned to benefit from the global transition to cleaner energy — greater electrical vehicle adoption will require immense amounts of battery-critical lithium, and over 50% of global lithium resides in Latin America.

- Global supply chain reshoring and foreign direct investment are advantageous for the region, with U.S. goods imports from Mexico recently overtaking China for the first time since the early 2000s.

Despite emerging markets’ inherent risks, Latin America’s policy backdrop and discounted valuations suggest investors should consider the region within a strategic asset allocation. Profitable growth prospects and an opportunity to gain exposure to regional secular tailwinds are on the horizon in 2024.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. International investing involves greater risks such as currency fluctuations, political/social instability, and differing accounting standards. Risk is magnified in emerging markets, which may lack established legal, political, business, or social structures to support securities markets.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3297349