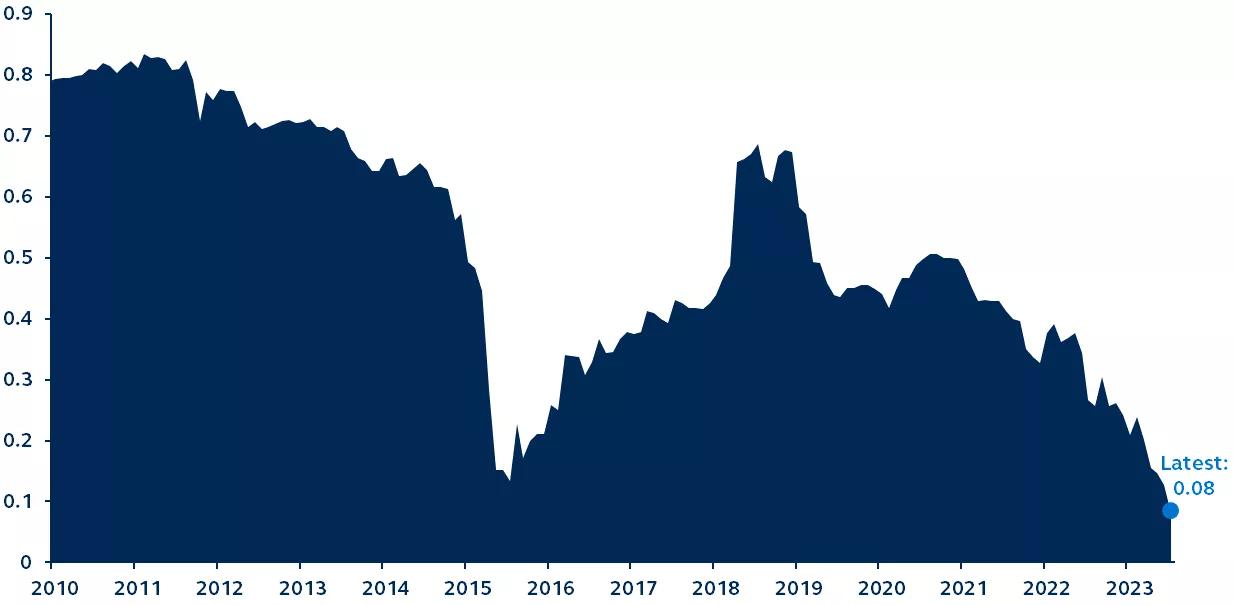

Since January, China’s economic slump has led investors to turn away from investments with high exposures to Chinese economic growth, in favor of assets which can provide a hedge to China’s disappointments. India’s domestic policy developments and distant economic ties mean that Indian equities are proving to be a solid diversifier in the EM Asia region.

MSCI China and MSCI India correlation

Rolling 36-month return correlation, 2010–present

Source: Bloomberg, Principal Asset Management. Data as of July 31, 2023.

China’s economic momentum has rapidly faded. Although authorities have introduced new stimulus, it has been insufficient to stabilize growth and confidence. For investors focusing on EM Asia, this is particularly troublesome given most countries in the region have strong ties with China. India, however, has emerged as a major outlier within Asia for its minimal attachment to China’s downward pull.

China is the top trading partner for many Asian countries, and (including Hong Kong) accounts for 11% of developing Asia’s total exports. By contrast, it accounted for just 5.5% of India’s total exports in 2022, having fallen from 12.1% in 2010. More importantly for investors, while the companies included in the MSCI Asia Pacific ex-Japan Index generate 32% of their revenue from China, companies in the MSCI India Index generate only 2% from China—a clear reflection of the Indian market’s minimal exposure to China’s economic slump.

In addition, the two economies’ contrasting approach to COVID reopening illustrates their often- different domestic policies, further driving diverging economic performances. In fact, since the beginning of 2023, MSCI China has fallen -2.8%, significantly underperforming MSCI India’s 5.8% gain.1 For investors, the low correlation between the two economies means that exploring the diversification benefits between India and China can be a good source of alpha generation.

1Return data as of August 14, 2023.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. International investing involves greater risks such as currency fluctuations, political/social instability, and differing accounting standards. Risk is magnified in emerging markets, which may lack established legal, political, business, or social structures to support securities markets.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.® For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3068234