Global equity valuations are stretched, characterized by the U.S., Europe and Japan all sitting at or near record highs. However, amidst the elevated valuations, pockets of opportunity are emerging—especially within U.S. small-caps, buoyed by favorable economic conditions, and in Latin America, where compelling valuations align with strong fundamentals.

Global equity returns and valuations

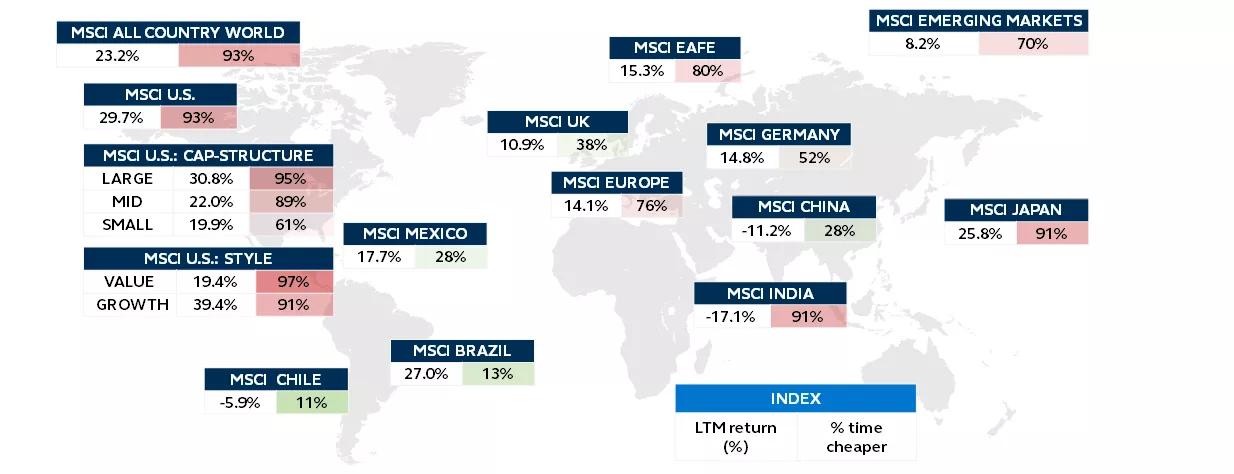

Last twelve months returns and % times cheaper, MSCI indices

Source: FactSet, Bloomberg, MSCI, Principal Asset Allocation. LTM (last twelve months) returns are total return and in USD terms. % Time Cheaper is relative to PAA Equity Composite Valuation history. PAA Equity Composite Valuation is a calculated measure, comprised of 60% price-to-earnings, 20% price-to-book and 20% to dividend yield. Composite started in 2003. EAFE is Europe, Australasia, Far East. See disclosures for index descriptions. Data as of March 31, 2024.

Global equity markets are painting a nuanced picture heading into the second quarter. While the U.S. market's ascent to record highs has been led by the Magnificent 7, pushing large-cap valuations to their limits, Europe and Japan have also etched new benchmarks.

In the U.S., the contrast between the stretched valuations of large-caps and the (slightly) more attractive figures for small- and mid-caps suggests a potential pivot point for investors. In particular, small-cap’s appeal is likely to be bolstered by the goldilocks combination of a soft landing and imminent rate cuts. Europe, on the other hand, offers a more subdued outlook despite being meaningfully less stretched than the U.S.—reflective of the region’s economic stagnation. Conversely, in Japan, the return of inflation, positive interest rates, and corporate governance reforms present opportunities for unlocking value despite its elevated valuations.

Emerging markets present a mixed bag. India remains on the pricier end, and China’s market is likely to continue struggling unless policymakers introduce new and impactful stimulus measures. However, investors should keep their eye on Latin America, which currently benefits from some of the most attractive valuations globally. When combined with its positive fundamentals, a strong investment case for the region is beginning to emerge. Global valuations undoubtedly are stretched, but a closer look reveals pockets of potential opportunity that can benefit from the constructive macro backdrop.

MSCI ACWI Index includes large and mid cap stocks across developed and emerging market countries.

MSCI Brazil Index is designed to measure the performance of the large and mid cap segments of the Brazilian market.

MSCI China Index captures large and mid cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs).

MSCI EAFE Index is listed for foreign stock funds (EAFE refers to Europe, Australasia, and Far East). Widely accepted as a benchmark for international stock performance, the EAFE Index is an aggregate of 21 individual country indexes.

MSCI Emerging Markets Index consists of large and mid cap companies across 24 countries and represents 10% of the world market capitalization. The index covers approximately 85% of the free float-adjusted market capitalization in each country in each of the 24 countries.

MSCI Europe Index captures large and mid cap representation across 15 Developed Markets (DM) countries in Europe.

MSCI Europe Banks Index is composed of large and mid cap stocks across 15 Developed Markets countries in Europe. All securities in the index are classified in the Banks industry group (within the Financials sector) according to the Global Industry Classification Standard (GICS®).

MSCI Germany Index is designed to measure the performance of the large and mid cap segments of the German market.

MSCI India Index is designed to measure the performance of the large and mid cap segments of the Indian market.

MSCI Japan Index is designed to measure the performance of the large and mid cap segments of the Japanese market.

MSCI United Kingdom Index is designed to measure the performance of the large and mid cap segments of the UK market.

MSCI USA Growth Index captures large and mid cap securities exhibiting overall growth style characteristics in the U.S. The growth investment style characteristics for index construction are defined using five variables: long-term forward EPS growth rate, short-term forward EPS growth rate, current internal growth rate and long-term historical EPS growth trend and long-term historical sales per share growth trend.

MSCI USA Index is a market capitalization weighted index designed to measure the performance of equity securities in the top 85% by market capitalization of equity securities listed on stock exchanges in the United States.

MSCI USA Large Cap Index is designed to measure the performance of the large cap segments of the U.S. market.

MSCI USA Mid Cap Index is designed to measure the performance of the mid cap segments of the U.S. market.

MSCI USA Quality Index aims to capture the performance of quality growth stocks by identifying stocks with high quality scores based on three main fundamental variables: high return on equity (ROE), stable year-over-year earnings growth and low financial leverage. The MSCI Quality Indexes complement existing MSCI Factor Indexes and can provide an effective diversification role in a portfolio of factor strategies.

MSCI USA Small Cap Index is designed to measure the performance of the small cap segment of the U.S. equity market.

MSCI USA Value Index captures large and mid cap U.S. securities exhibiting overall value style characteristics. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Equity markets are subject to many factors, including economic conditions, government regulations, market sentiment, local and international political events, and environmental and technological issues that may impact return and volatility. International investing involves greater risks such as currency fluctuations, political/social instability, and differing accounting standards. Risk is magnified in emerging markets, which may lack established legal, political, business, or social structures to support securities markets.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

3493097