At the beginning of the year, we sat down with George Maris, Chief Investment Officer, Global Equities, to discuss his outlook for the equity markets in 2024, where he sees opportunities, and potential performance drivers.

Q: Equity markets proved surprisingly resilient in 2023. In 2024, what factors will drive equity markets and investors’ portfolios?

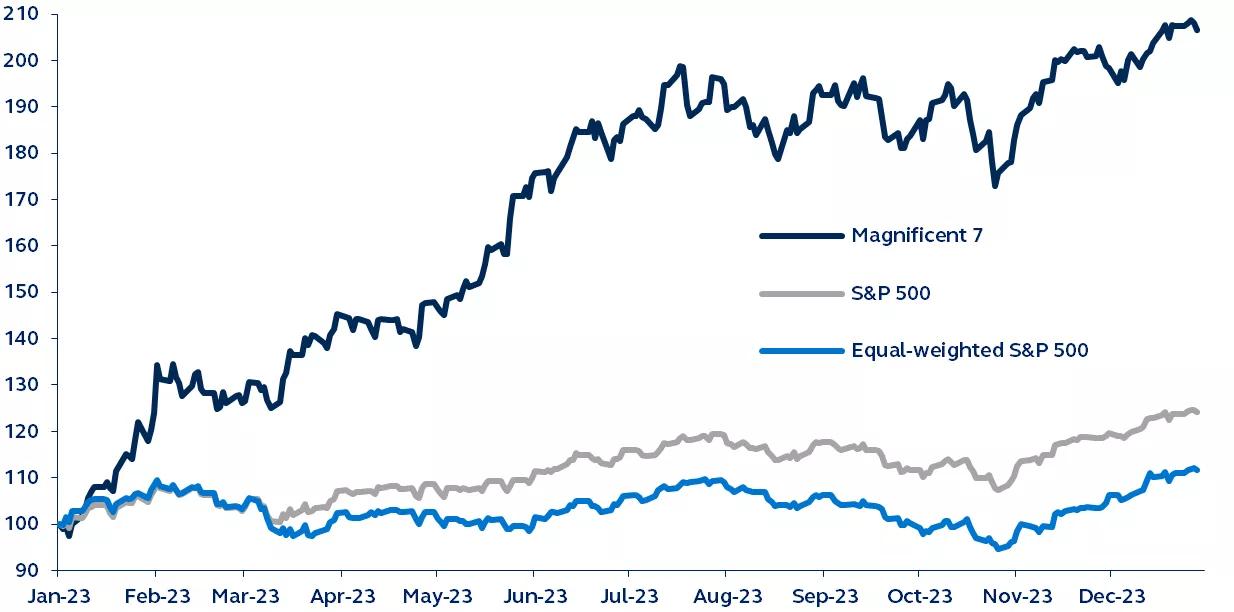

While the equity markets appeared strong in 2023, the story for the average stock was much different. By and large, the markets were driven by the Magnificent Seven, a group of mega-cap stocks that generated the overwhelming majority of return for the year. However, the rest of equities – particularly value equities – did not have such a great year. From a mathematical perspective, it was the biggest spread between growth and value stocks seen since the late 1990s. So, what does that mean for 2024? With significant concentration into a few names, many interesting opportunities may be overlooked. For managers doing deep fundamental work, multiple opportunities exist across the equities landscape.

Magnificent 7 performance vs. S&P 500 equal-weighted and market-cap-weighted

Calendar year 2023, rebased to 100 at January 1

Source: Standard & Poor’s, Bloomberg, Principal Asset Management. Data as of December 31, 2023.

One clear opportunity relates to continued advances in innovation across a swath of areas, including– biotech, artificial intelligence, semiconductors and semi-cap equipment, weight-loss drugs, robotics, and more. Capturing the beneficiaries of this rampant innovation will be critical to generating substantial returns in the future. Additionally, there are many companies with solid balance sheets that are growing and generating healthy cash flows. Some are in cyclical industries, like energy and materials, while others are in financials and consumer. Many companies in these industries can generate strong growth and are attractively priced for their cash generation going forward. Ultimately, we see ample opportunity to invest in equities over the next few years.

Q: Many innovative sectors you mentioned have companies based in the U.S. Are there opportunities outside of the U.S. that investors should also consider?

As U.S. domestic investors, we often think the U.S. is where all the innovation happens – great innovators like Apple, NVIDIA, Microsoft, Lilly, and Salesforce are a few that come to mind. But two of the most important companies in the world right now in terms of enabling leading-edge technology transformation are Netherlands-based semiconductor capital equipment manufacturer ASML Holding and Taiwan-based semiconductor manufacturer Taiwan Semiconductor Manufacturing Company. Both are critical in powering future growth in technology, including AI and cloud. It serves to highlight that great innovation is also happening outside the U.S., which is one of the reasons investors should approach investing from a global perspective.

Q: Where should equity investors put new cash to work in 2024?

There are multiple areas in equities for investors to be excited about in 2024. While U.S. equities performed well on average, small-cap and particularly small-cap growth, did not, so there are opportunities to explore there. Outside the U.S., both emerging markets and developed markets trailed. The U.K., for example, is one of the cheapest markets in the world despite being home to multiple global companies; at present, it trades on valuations similar to China but without the sovereign risk. There are opportunities to purchase shares in U.K. companies doing substantial business in the U.S. but trade at a fraction of the valuations of related U.S. peers. The landscape is wide open for true active management in 2024.

Q: You mentioned some sectors where you see opportunities this year. Are there specific factors, either from a macro perspective or in equities, that will drive performance in 2024?

From a high level, there are two things to remember when investing in companies that will generate profitable growth going forward.

The first is a supply shortage of something necessary for the future. Take, for example, critical materials like copper. Copper is essential in supporting the electronification and infrastructure development happening across the globe. However, the world is short on copper due to underinvestment following the Great Financial Crisis. New development was limited, and older mines were allowed to run down during more challenging periods, leading to a deterioration of mine quality and shallower supply. As an investor, I want to invest where supply is constrained and has the potential to generate substantial returns.

The second is investing in companies with significant pricing power, whether due to supply constraints or customer demand. In many ways, technological developments such as artificial intelligence are disintermediating prior ways of doing business, so there is an incredible opportunity to invest in new and legacy companies that are changing how the world works. These companies will be able to grow into the future, and investors will be willing to pay for it.

Q: As an asset manager, how is Principal Asset Management poised to take advantage of these equity opportunities?

Asset managers need to roll up their metaphorical sleeves and do strong fundamental work to succeed in this environment. At Principal Asset Management, we engage in deep research to thoroughly understand opportunities and risks, allowing us to invest with conviction in a world that can seem short-sighted. To deploy capital in a way that works best for clients, managers must invest with visibility in terms of what will likely happen in the future instead of focusing on the 24/7 short-term news cycle. It boils down to our ability to anticipate the future direction of the companies we invest in and make sound, fundamentally driven decisions that drive excess returns for our clients.

Learn more about our equity market investing capabilities.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk Considerations

Past performance is no guarantee of future results. Investing involves risk, including possible loss of principal. Equity investments involve greater risk, including heightened volatility, than fixed income investments. Small- and mid-cap stocks may have additional risks including greater price volatility.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account.

Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorised and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission.

- Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Funds are distributed by Principal Funds Distributor, Inc.

© 2024 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal Equities is an investment team within Principal Global Investors.

3372063