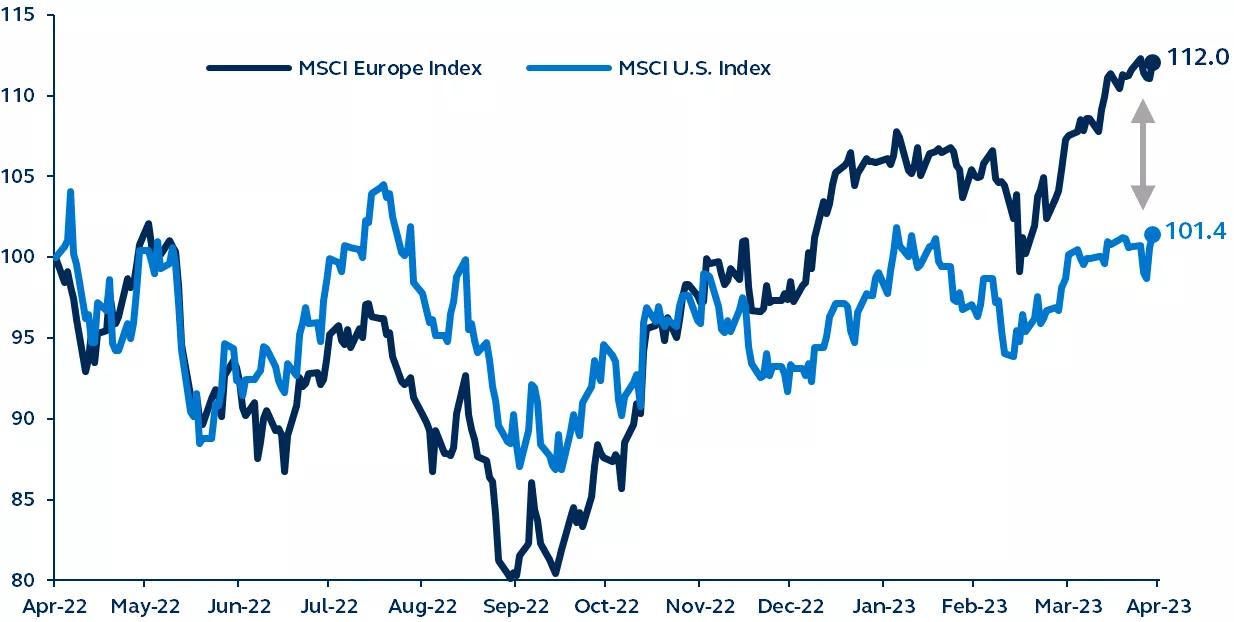

In a surprise to many investors, European equities have advanced sharply over the past several months, including significant outperformance relative to U.S. stocks. The improved backdrop for European markets reflects a confluence of factors, including a stronger currency and a manufacturing renaissance, underpinning opportunities for improved diversification at attractive valuations for global investors.

U.S. versus European equities

Net total return, Rebased to 100 at April 30, 2022

Source: MSCI, Principal Asset Management. Data as of April 30, 2023.

For most of the past decade, U.S. stocks have outperformed European stocks on the back of a strong U.S. dollar, solid earnings growth, and a high concentration of mega-cap tech companies. However, over the past several months, European equity markets have outperformed U.S. stocks, reigniting optimism about the diversification benefits of investing abroad.

Dating back to the Global Financial Crisis, foreign investors have broadly shunned European stocks, reflecting lingering pessimism for the region. The onset of the war in Ukraine, and its implications for energy prices and security, hit European stocks especially hard. However, as some of these concerns have abated, the focus on Europe is shifting to structural changes: its innovative approach to energy independence, digitalization, and a manufacturing renaissance driven by the global reshoring of supply chains. Also, the region's financial system has improved significantly after nearly 15 years of deleveraging and consolidation.

Like other international markets, Europe has benefitted from a weaker U.S. dollar, which peaked in October 2022 after its decade-long rise. And despite recent outperformance, European companies continue to trade at historically low valuations compared to U.S. peers, providing a significant runway for further valuation improvement.

As U.S. markets navigate bouts of uncertainty and volatility, European equities may be an attractive diversifier for investors—offering a potential gateway to global growth at a discount.

For a deeper dive into the evolving landscape for equity markets outside the U.S., read The resurgence of international equities.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Asset allocation and diversification do not ensure a profit or protect against a loss.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal®.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2910182