The recent run in equities appears to be at odds with weakening labor market signals, which has led to questions about the sustainability of the rally and the broader health of the U.S. economy. However, resilience in consumer spending and capital expenditures continues to underpin this year’s earnings momentum. Going forward, stimulative monetary and fiscal policies, along with improvements in lagging sectors such as manufacturing and housing, could further support the economy and extend the equity market rally.

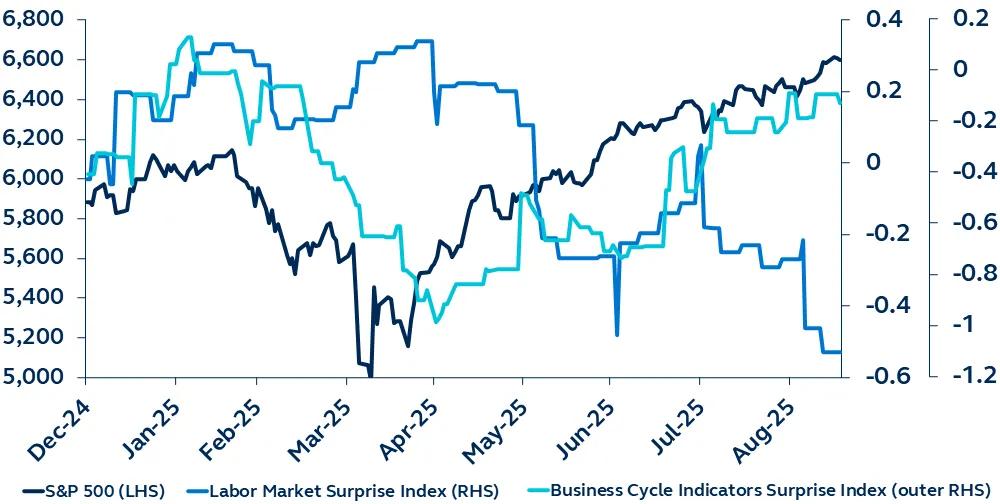

S&P 500 Index vs. Labor Market and Business Cycle Surprise Indices

An acknowledgement of the recent weakness in employment trends backed the Fed’s decision to cut policy rates at its September meeting. While the Fed’s projections hint at a labor market in “curious balance,” concerns about the hiring environment still cast uncertainty over the health of the U.S. economy.

Despite labor demand eroding for much of the year, and following April’s Liberation Day selloff, the S&P 500 has reached record highs. The divergence between market strength and labor weakness has raised questions about the true underpinnings and sustainability of the market rally.

Behind challenged labor market headlines, underlying consumer and capex resilience remains a backbone of this year’s earnings strength. Additionally, business cycle leading indicators—ISM Services and regional manufacturing Fed surveys—have surprised to the upside in recent months. The broader picture of economic robustness, further supported by tight credit spreads, continues to underpin the strength in the equity market.

Looking ahead, the combination of monetary easing alongside fiscal and regulatory stimulus could bolster an economy that has proven resilient to this year’s headwinds. A policy-driven recovery may help revive the more sluggish segments of the economy, including housing, manufacturing, and employment, suggesting that equities, beyond the large tech leaders, could be poised for further modest gains.

Investing involves risk, including possible loss of principal. Past Performance does not guarantee future return. All financial investments involve an element of risk. Equity investments involve greater risk, including higher volatility, than fixed-income investments. Equity markets are subject to many factors, including economic conditions, government regulations, market sentiment, local and international political events, and environmental and technological issues that may impact return and volatility.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800‐547‐7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

In Europe, this communication is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients.

© 2025, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

4835360