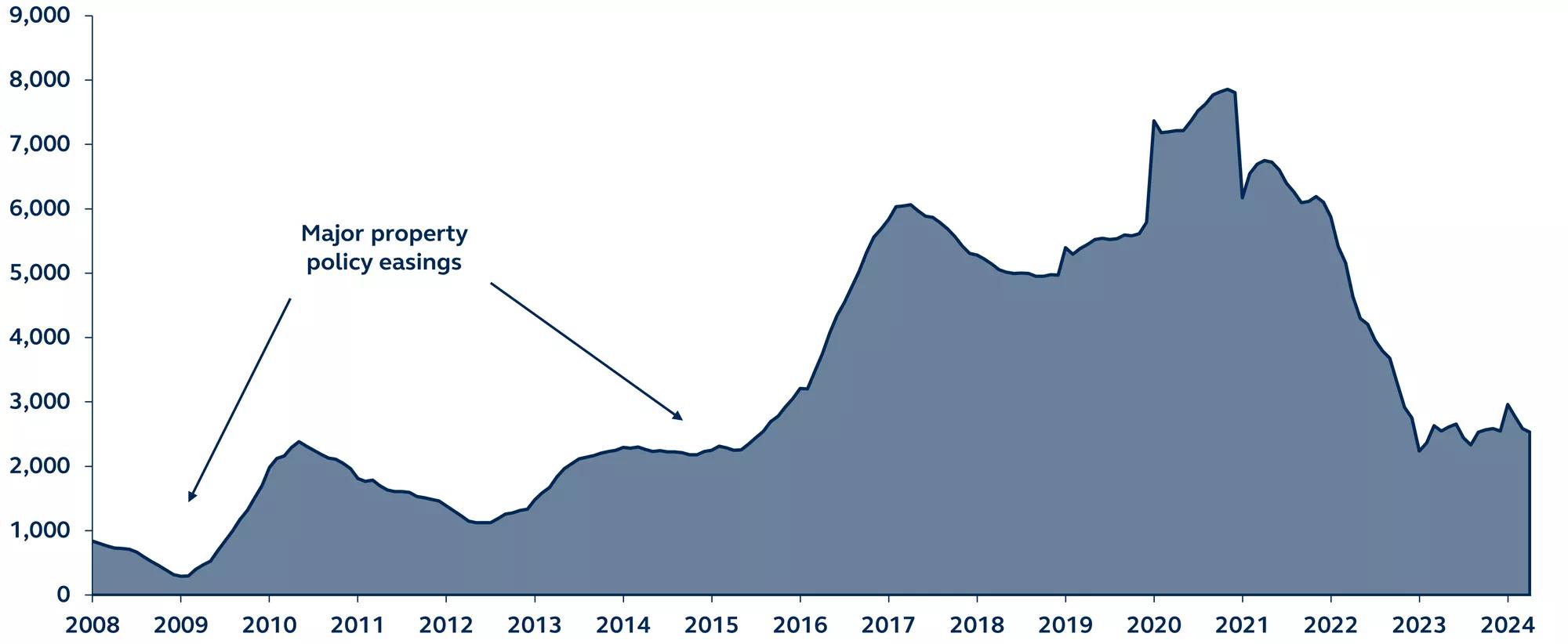

China’s cautious approach to property policy easing gained significant traction following the April politburo meeting. Notably, the new measures resemble the successful policy actions of 2008 and 2015, both of which led to "V" shaped property recoveries. Although the current macroeconomic environment presents more challenges, these measures could still provide a stabilizing effect on the property market.

China new household long term loans

RMB billions, trailing 12-month aggregate, 2008–present

Investors initially welcomed China's July 2023 politburo meeting as a watershed moment for the country's property sector. Policy intent shifted from alleviating property developers' financing difficulties to stirring up home demand. However, progress has been disappointingly slow, with home prices and transaction volumes sliding further, casting a cloud on China's fragile economic recovery.

Policymakers now appear to be finally matching action to words. After the most recent politburo meeting in April, policy momentum accelerated with the easing (and, in some cases, removal) of home purchase restrictions across cities. More significantly, down payment ratios and mortgage rates were cut to the lowest levels in history. The government has also started buying unsold properties directly and transforming them into public housing.

The recent stimulus measures are comparable to those in 2008 and 2015, which led to soaring home prices and sizeable credit expansion. However, the macro environment this time is more challenging. Despite a significant build-up in excess savings and ample property inventory, household income prospects and confidence remain low, suggesting the policy measures may be less impactful.

While the new policy measures may not trigger a credit expansion, as they have previously, they should at least stabilize the property market—the key precondition for an economic turnaround. Negativity towards China has been extreme, but with economic prospects now improving, China presents a compelling investor opportunity.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. International investing involves greater risks such as currency fluctuations, political/social instability, and differing accounting standards. Risk is magnified in emerging markets, which may lack established legal, political, business, or social structures to support securities markets.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3602585