The 3Q22 earnings season has been generally positive, alleviating some investors’ immediate concerns of a slowing economy’s impact on corporate profitability. However, as the macroeconomic backdrop is likely to deteriorate further, challenges to corporate margins and sustainable growth may still be on the horizon.

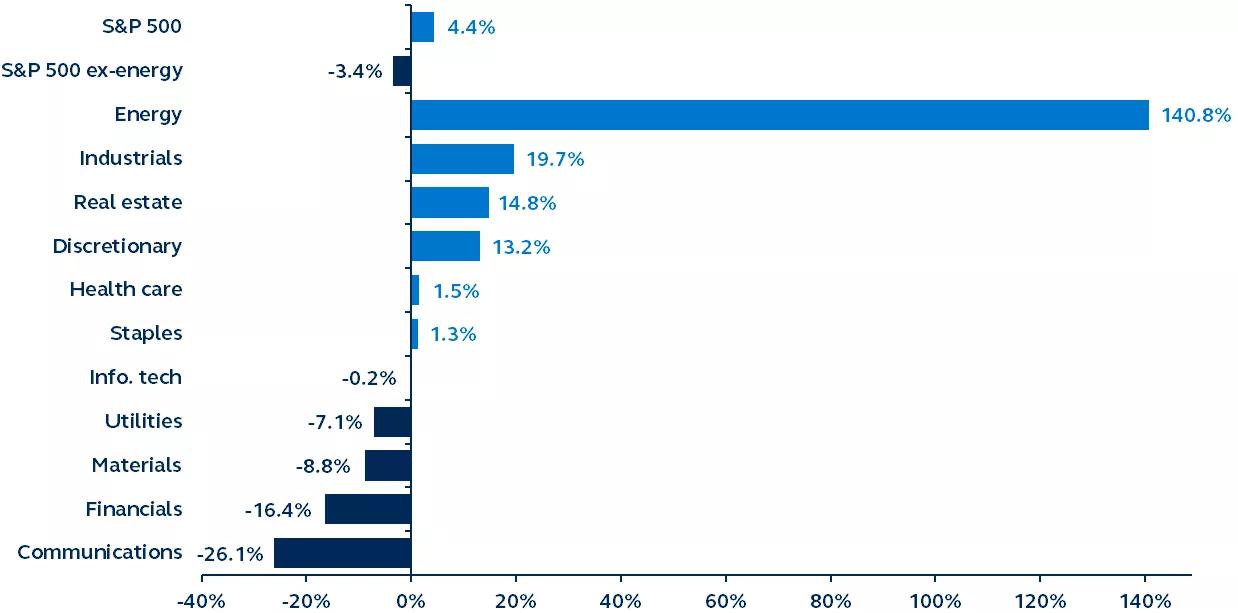

3Q22 earnings growth by sector

Year-over-year, S&P 500 index and sectors

Refinitiv, Principal Asset Management. Data as of December 2, 2022.

While results for the 3Q22 earnings season have generally been positive, closer examination reveals pockets of weakness.

During the third quarter, S&P 500 earnings growth slowed to 4.4%, from 8.8% in 2Q22. And while 71% of earnings beat expectations, a sectoral breakdown reveals energy’s outsized contribution to growth. Excluding energy, S&P 500 earnings growth (-3.4%) was outright negative for the second consecutive quarter.

- Six sectors reported an increase in earnings in 3Q, while five sectors reported declines. Financials and communications were the two worst performing sectors, challenged by a mix of macro volatility, inverted yield curves and fading growth opportunities.

- Industrials was the strongest sector after energy, supported by defense and transport. Most surprisingly, the consumer discretionary sector grew robustly, shrugging off inflation concerns.

- Defensives were mixed. Real estate performed very well, health care and consumer staples recorded meager growth, and utilities contracted.

- With costs still so elevated, overall revenue growth exceeded earnings growth, confirming that margin pressures continue to build.

Fears for next year have grown. Earnings estimates for 2023 have been steadily revised lower since the start of the 3Q earnings season, with the consensus now expecting an earnings contraction in both 1Q and 2Q next year as margin pressures grow. Certainly, with elevated inflation signaling further interest rate hikes and growing evidence of slowing economic activity, earnings face a hostile backdrop in 2023.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2022, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

Principal Asset Management leads global asset management at Principal.®

2631743