With the 2022 midterm elections less than two weeks away, a rapidly changing campaign season has analysts, investors, and citizens asking the same question: Who will control the House and Senate come November? General outlooks have been changing from month to month, but the potential for Democrats to maintain their majorities in both the House and Senate is growing increasingly difficult by the day, and history is certainly not on their side. Since World War II, the president’s party has lost House seats in 17 and Senate seats in 13 midterm elections, with an average of 27 seats lost in the House and three to four seats lost in the Senate. Going into this election, significant headwinds and substantial pre-election moves over the summer leave this race too close to call.

The state of the race

Early in the election cycle, redistricting as a result of the 2020 Census was viewed as providing a clear path for Republicans to gain a substantial majority in at least the House—especially when combined with a high number of Democrats retiring, low approval ratings for President Biden, and a perception that Democrats had failed to advance their legislative agenda.

Ultimately, however, redistricting provided Republicans with only a handful of pickup opportunities— enough to flip control of a narrowly divided House, but short of expectations. Over the summer, Democrats produced a string of legislative wins—including the CHIPS Act, bipartisan gun control legislation, and the Inflation Reduction Act. Paired with White House action on student loan forgiveness, these legislative wins appeared to energize the party’s base to vote this cycle—particularly younger voters who are less reliable in their resolve to show up to the polls. The Supreme Court ruling overturning Roe vs. Wade and subsequent trigger laws that went into effect in numerous states across the country further mobilized the Democrats’ base and female suburban voters. Overall, while President Biden’s approval rate remains at a historically challenging level, polling data shows a meaningful increase over recent months, moving from mid/high-30s to low/mid-40s—softening Democratic candidates’ need to outperform Biden’s numbers in various congressional districts and key states.

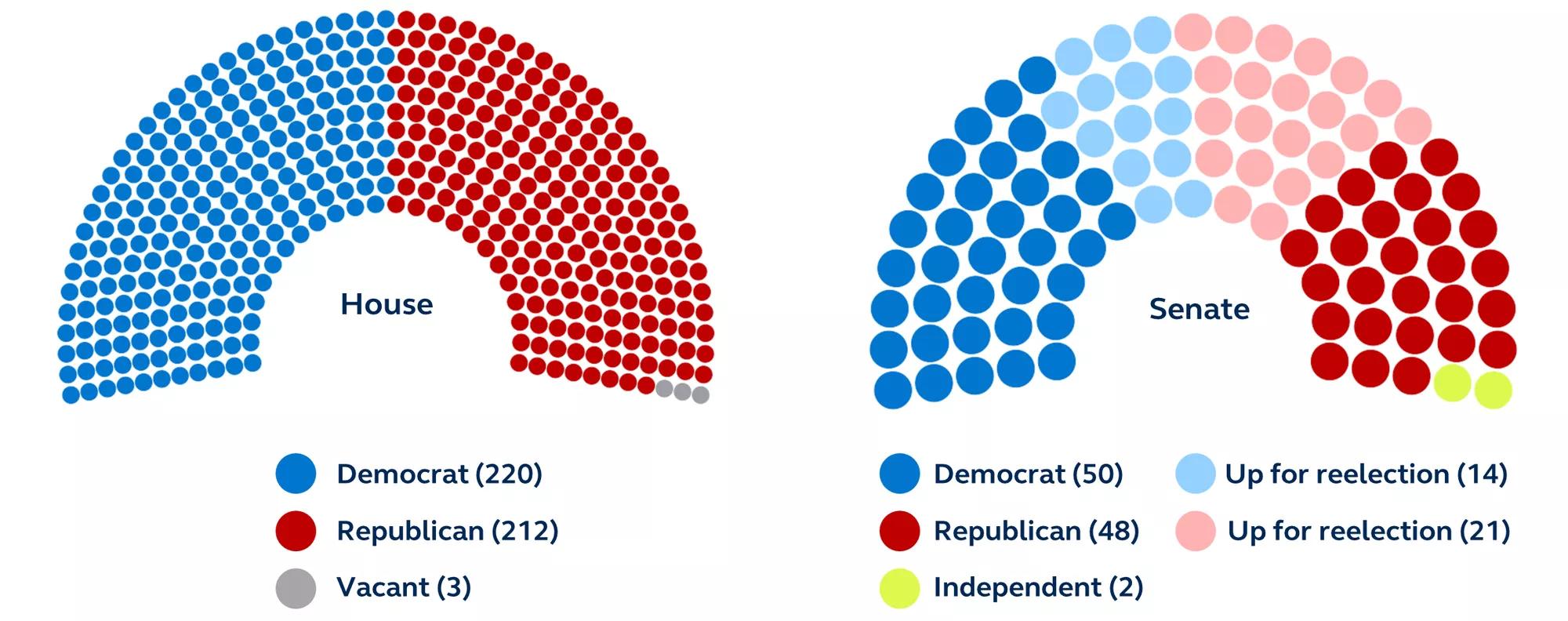

Exhibit 1: House of Representatives and Senate control

By party affiliation

U.S. House of Representatives, U.S. Senate, Principal Asset Management. Data as of October 27, 2022.

Going into this election, 35 seats are up for grabs in the Senate—21 held by Republicans and 14 by Democrats. All 435 House seats are up for reelection including the almost 30 Democrats not seeking reelection this year (Exhibit 1). Despite claims by Democrats that they see a path to retaining their majority in the House, forecasts suggest the House will flip to Republican control. A more pressing question regarding the House seems to be whether Republicans emerge with a governing majority or a fractured conference. The Senate, however, remains a virtual coin toss at this point with missed opportunities present on both sides. According to data from FiveThirtyEight as of October 26, Republicans have an 81% chance of gaining control of the House, and Democrats have a 54% chance of controlling the Senate. Although most see a divided government as the most likely outcome, nothing is guaranteed until the polls close.

Potential market impacts

So, what does this all mean for the markets? If history tells us anything, midterm elections have very little impact on market performance.

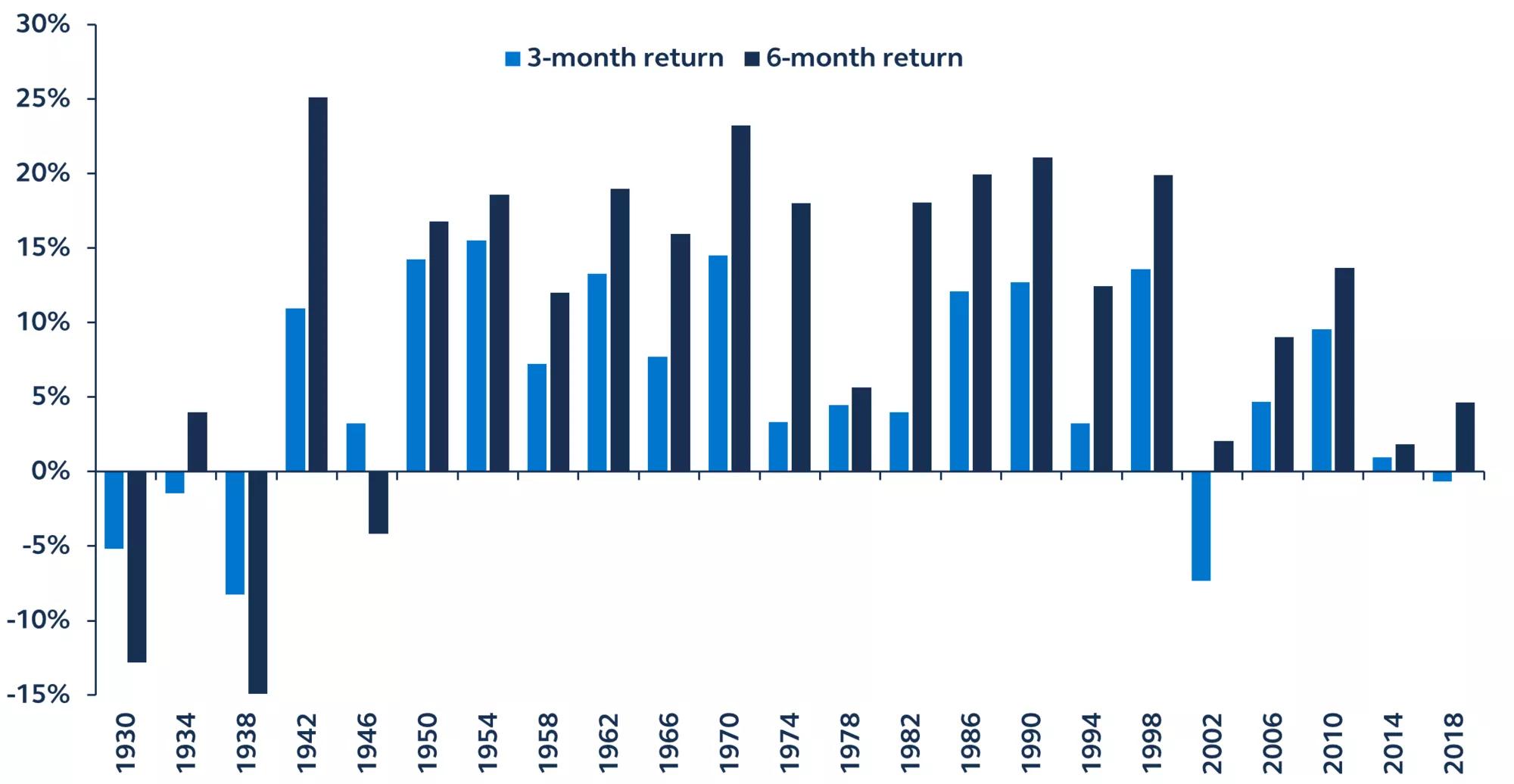

Exhibit 2: Equity market performance following midterm elections

3-month and 6-month forward S&P 500 price returns, 1930 - 2018

Bloomberg, Principal Asset Management. Data is through 2018 midterm election cycle.

The correlation between stock market performance and midterm elections is well-documented. In 17 of the 19 midterms since 1946, the market performed better in the six months following an election than it did in the six months leading up to it—up on average 6% at three months and 11% at six months. However, this positive market reaction is most often a result of resolved uncertainty rather than a response to any specific policy agenda or election outcome. In short, the new makeup of the government does not have a statistically significant impact on market returns.

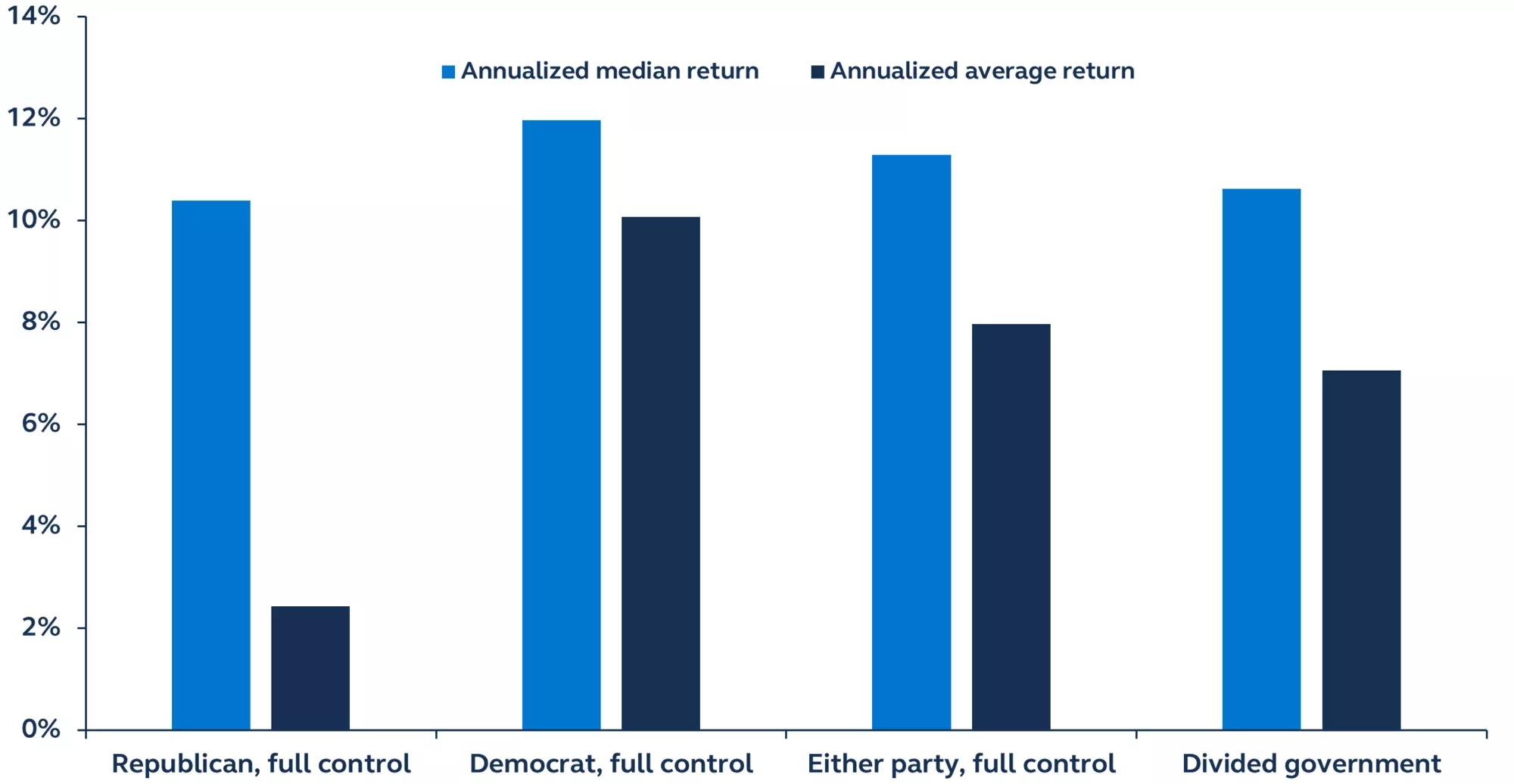

Exhibit 3: Equity market performance by government control

S&P 500 price returns, 1928-July 2022

Bloomberg, Principal Asset Management. Assumes being wholly in or out of the market based on political control. Data as of October 13, 2022. Note: A Republican controlled government had a lower average return over the analysis period, but this was skewed significantly lower by the Great Depression period. The median return, on the other hand, was meaningfully higher.

Both unified and divided governments typically don’t have strong impacts on S&P 500 returns. Republican-controlled governments have a lower average return due to the great depression periods, but it’s not statistically significant (Exhibit 3). Ultimately, there are bigger market issues to consider going into 2023.

Structural policy decisions to watch in 2023

Rather than allowing political uncertainty to dictate investment decisions, investors should focus on the economics that will be responsible for market returns in the periods ahead. We have identified three key structural policy decisions to watch in 2023:

- Unites States/China relationship: It would be a mistake for investors to view the CHIPS Act as the end of the legislative process on Capitol Hill regarding China as a strategic competitor. Bipartisan political pressure continues to mount in Washington for the creation of a national security review mechanism for U.S. outbound investment to China. Debate in Congress has focused on attaching a proposal to the annual National Defense Authorization Act or pursuing standalone legislation in 2023. The Biden Administration has even established an interagency working group contemplating an executive order to establish a review process. The outbound investment provisions seem largely focused on the tech industry, however an impact to additional industries cannot be ruled out.

- The debt ceiling: Should Republicans win back control of either congressional chamber, a vote to raise the debt ceiling will likely be leveraged to extract spending cuts (potentially around entitlement programs) during negotiations with the White House. President Biden has publicly stated he would not support any effort to eliminate the debt ceiling entirely, calling it “irresponsible.” Debt ceiling discussions likely won’t materialize until the third quarter of 2023.

- Fiscal stimulus: Despite the election’s outcome, Congressional leaders’ hands will be tied by the economic background given ever-present inflation and growth fears. As recently witnessed in the United Kingdom, where the government temporarily announced unfunded tax cuts, any additional fiscal stimulus announced in the U.S. would add to inflationary concerns and potentially result in significant market upheaval. Conversely, fiscal tightening would add to recession concerns. As such, a status quo in policy is the most likely result of the midterm election.

Tune out the political noise

For the past decade, easy financial conditions driven by historically accommodative monetary policy and ample liquidity have significantly supported markets. The 2022 midterm elections, however, are coming at a time in which American citizens are facing an onslaught of struggles including rising interest rates, elevated inflation, and the looming potential of recession. While there may be elevated volatility around the election, the outcome is unlikely to have a meaningful bearing on investment portfolios over the long term. Investors should focus on the economics that will be responsible for market returns in the periods ahead and tune out the political noise.

Risk considerations

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Important Information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is intent for use in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (EU) Limited, Sobo Works, Windmill Lane, Dublin D02 K156, Ireland. Principal Global Investors (EU) Limited is regulated by the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID). The contents of the document have been approved by the relevant entity. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (EU) Limited (“PGI EU”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGI EU, PGIE or PGI EU may delegate management authority to affiliates that are not authorized and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority ,or the Central Bank of Ireland.

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority ("FCA").

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organization.

- Singapore by Principal Global Investors (Singapore)Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS License No. 225385), which is regulated by the Australian Securities and Investments Commission. This document is intended for sophisticated institutional investors only.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- Hong Kong SAR (China) by Principal Global Investors (Hong Kong) Limited, which is regulated by the Securities and Futures Commission and is directed exclusively at professional investors as defined by the Securities and Futures Ordinance.

- Other APAC Countries, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

- Nothing in this document is, and shall not be considered as, an offer of financial products or services in Brazil. This presentation has been prepared for informational purposes only and is intended only for the designated recipients hereof. Principal Global Investors is not a Brazilian financial institution and is not licensed to and does not operate as a financial institution in Brazil.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800 547-7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

© 2022, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

MM13133 | 2563373