With healthy funding levels, pension plan sponsors have a unique opportunity—and more options—to de-risk their plans.

These days, the state of pensions is strong. The average U.S. corporate defined benefit pension plan is fully funded on an accounting basis. “Since the global financial crisis, the health of the average pension plan has never been better,” says Owais Rana, managing director and head of liability-driven investing at Principal Global Investors®.

How did they get here? One answer is the sustained bull market that drove equity markets to record heights in recent years. Another, more significant, answer is the unprecedented rise in the long-dated corporate yield curve over the past 12 months, which has substantially reduced the accounting liability values. As these two markets moved favorably for a pension balance sheet, the average plan’s funded status improved markedly, boosting the ability to meet future obligations.

Now, with the stock market’s uneven 2022 performance in mind, plan sponsors may want to consider a more timely question: What’s next? Rana notes that healthy funding levels are leading many corporate pension plans to reevaluate their de-risking options, including hibernating investment strategies as well as pension risk transfer options. “It’s a Goldilocks moment for pension plans to de-risk and lock in their healthy fundedness quite substantially, and buy exposure to assets that are going to behave more like the liabilities they have on their balance sheet,” Rana says.

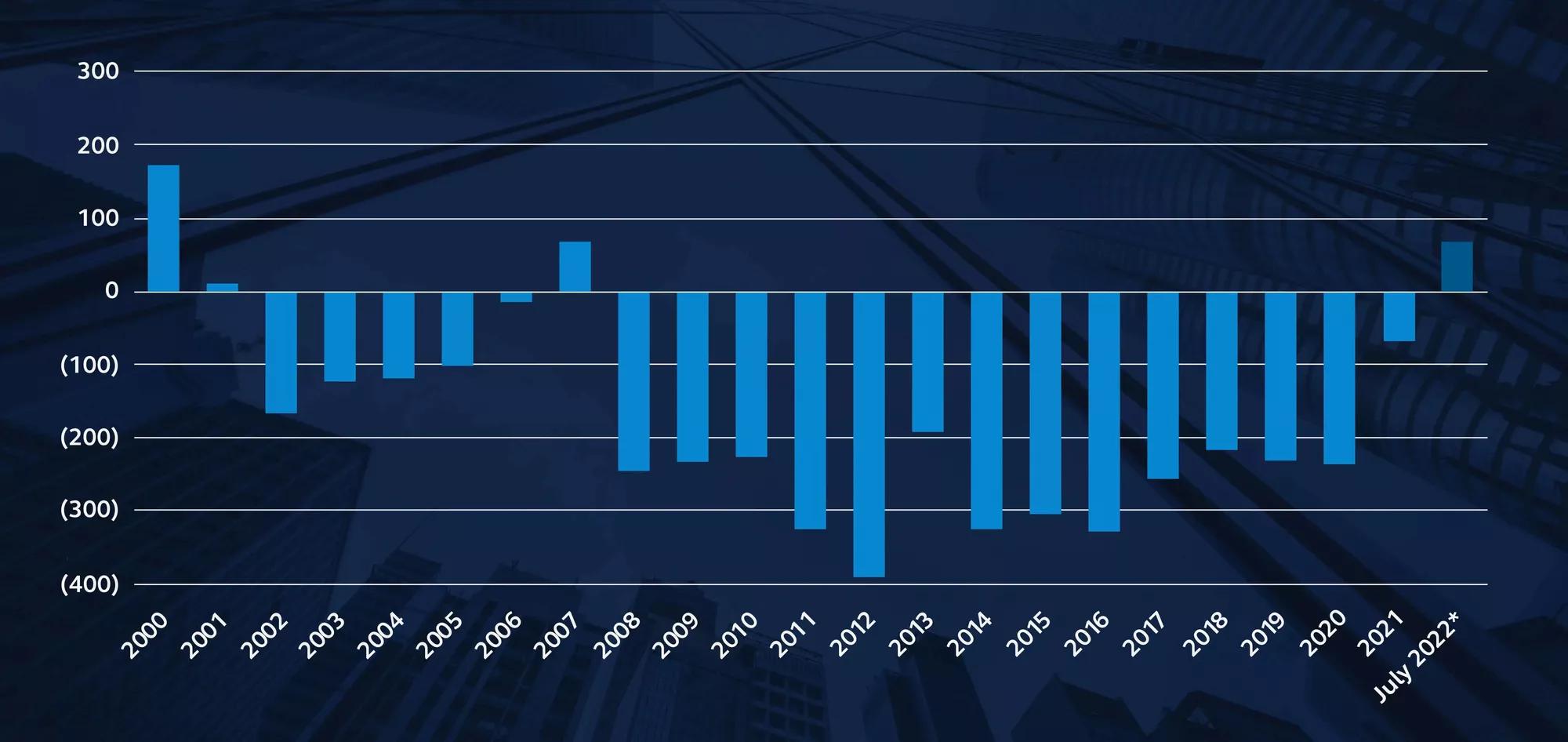

Pension Surplus/Deficit

Milliman 100 Pension Funding Index, USD bn, 2000 - 2022

Source: Milliman, Principal Global Investors. Data as of Aug. 4, 2022. *July 2022 is from the Milliman Pension Funding Index July 2022.