Forward

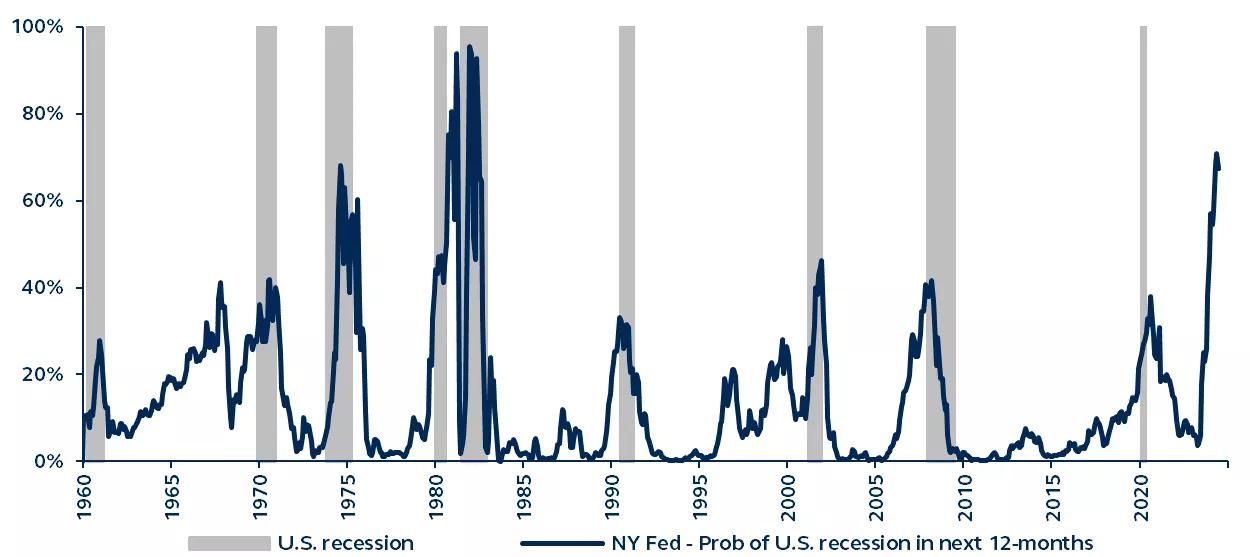

The global economic landscape faces challenges heading into the second half of 2023. With Europe weakening, China disappointing, and the U.S. approaching recession, markets are becoming more volatile, and seizing the right investment opportunities requires an increasingly active focus.

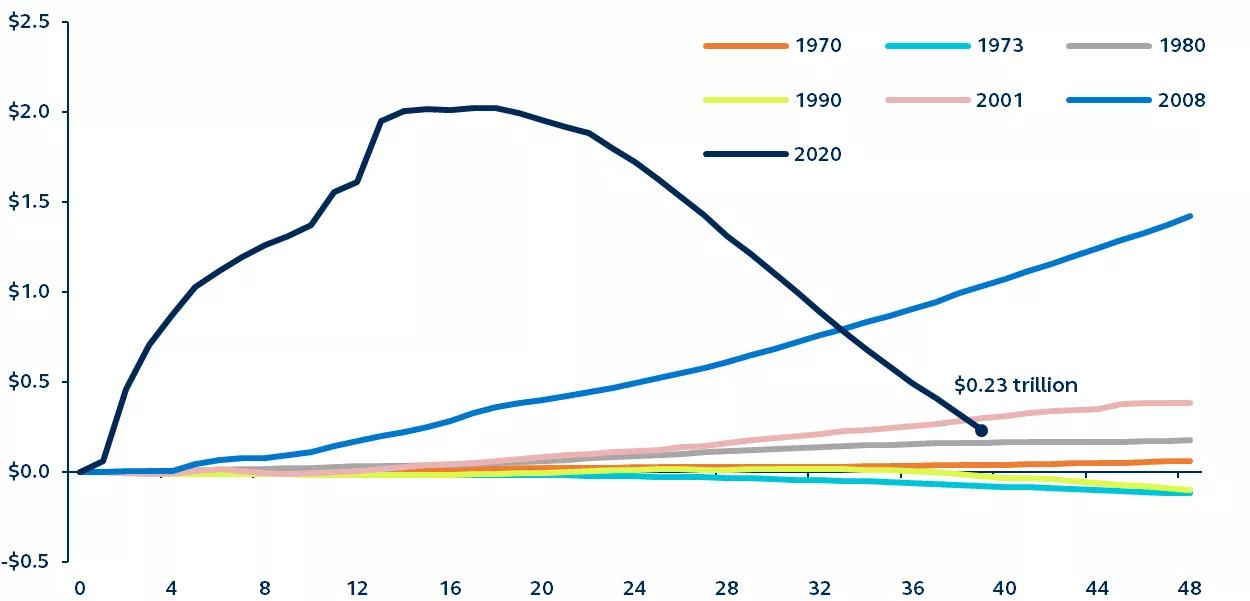

As we outline in this year’s Midyear perspective, the top of the 2023 investment theme list: The painful spike in inflation last year has meant that many global developed market central banks have been forced to aggressively tighten monetary policy. It is doubtful that any rate cuts will come this year, and the U.S. economy is still to face the lagged effects of policy rate increases to date.

For global investors, the year's second half will likely see equities face pressure from earnings declines. At the same time, riskier fixed income assets have yet to entirely discount the impending economic slowdown. And with the slowing growth outlook likely further depressing select alternatives, such as commodities and natural resources, preparing portfolios for the future will, more than ever, require innovative solutions aligned with client investment goals.

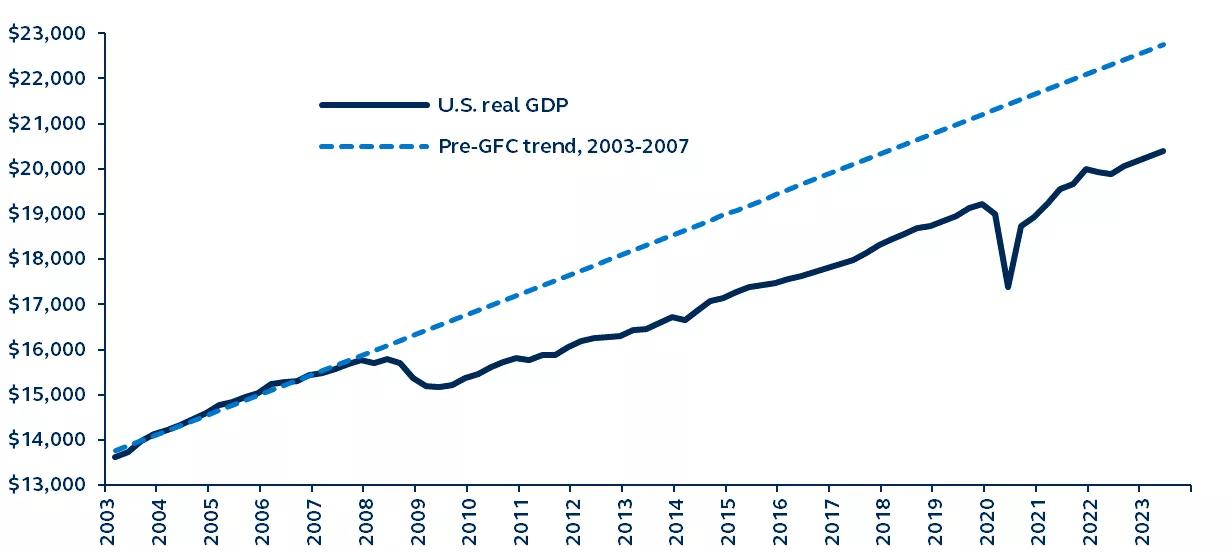

Despite the gloom, the second half of 2023 arrives with plenty of opportunity. For starters, any equity market pullback will likely be brief due to the short and shallow nature of the expected U.S. recession, and the subsequent swift recovery will demand an agile and proactive response from investors. Non-U.S. and and small cap equities may provide opportunities, benefitting from more attractive valuations, a structurally weaker USD and, in the case of Japan, an inflation renaissance.

In this evolving environment, look to high quality fixed income investments for stability and income. And although high quality duration is likely to outperform as the economy slows, as the short and shallow nature of the recession suggests that defaults in the broad credit space should not significantly spike—spreads offer reasonable compensation for the additional risk as investors move down the quality spectrum.

Alternative investments will also play a vital role in diversifying future portfolios beyond traditional equities and fixed income, and listed infrastructure investments can be sought to mitigate ongoing inflation risks.

Every day, the teams at Principal Asset Management leverage deep knowledge and experience to help you, our clients, stay ahead. I am exceedingly proud of the forward-thinking perspectives, insights, and solutions they are developing, and we look forward to working with you to achieve your own investment goals.

As we pass the mid-year mark, we hope the following perspectives empower you with knowledge and insights to make informed investment decisions. We greatly appreciate the trust and confidence you have placed in us, and we are committed to continuing our work together. Thank you for your continued support.