Inflation is the single biggest challenge that investors face today. The sudden and sustained jump in prices has inflicted a considerable shock to the economic system, sharply pushing up interest rates, while challenging corporations and equity markets. For individuals, inflation quietly erodes the purchasing power of savings and cash, a significant problem, regardless of time horizon. For institutional investors, higher-than-expected inflation reduces real returns and makes it difficult to generate long-term forecasts to meet objectives. In all cases, however, inflation—and the threat of persistent inflation that’s higher than expected—is a reason to reconsider the traditional asset allocations that only address market environments of the past.

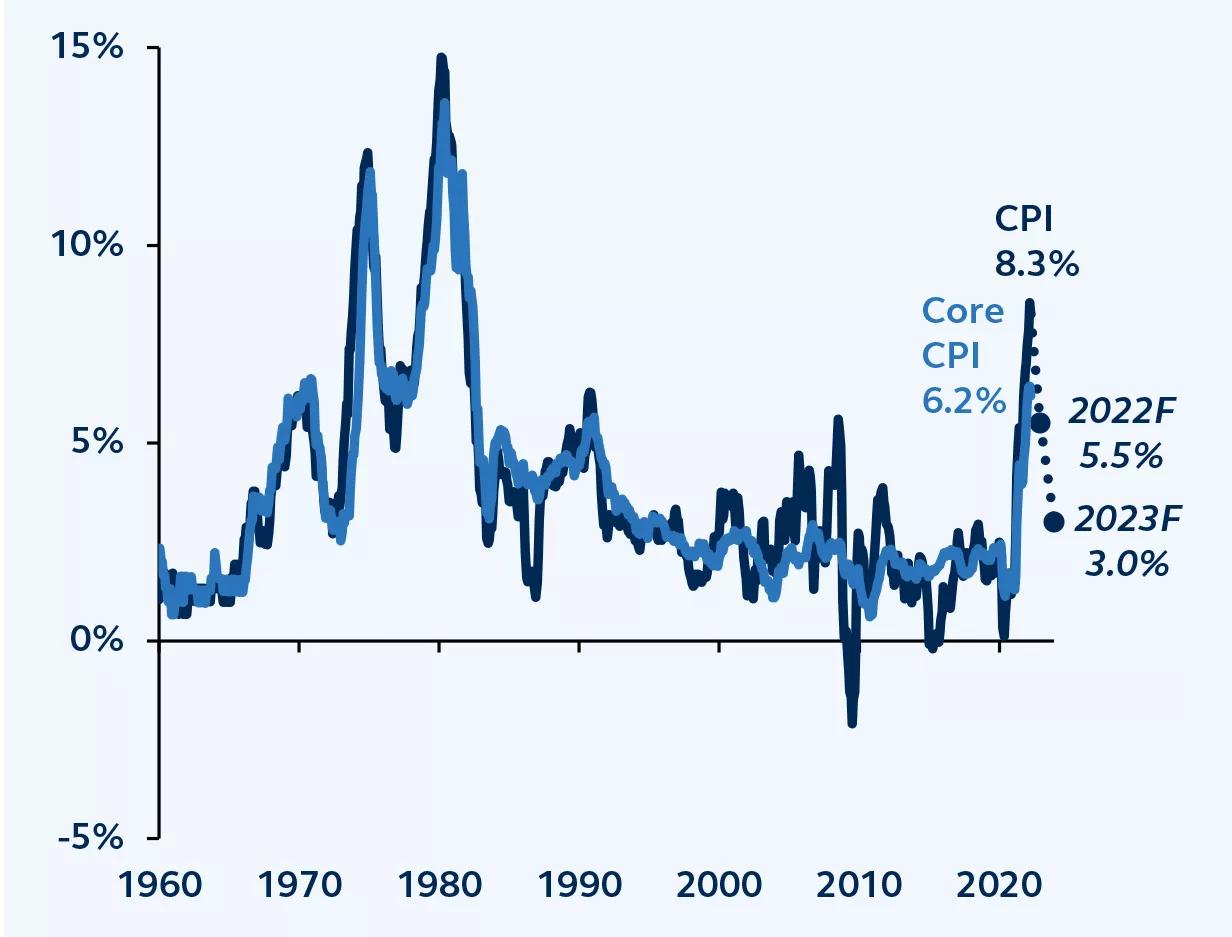

Inflation has reached four-decade highs

Many factors have driven inflation over the past two years, with the industry spilling plenty of ink over the topic. In short, the rapid economic recovery from the pandemic, surging consumer demand, excessive government stimulus and ongoing supply chain disruptions have caught many economists off guard. More recently, geopolitics have played an important role: The Russian invasion of Ukraine has pushed food and energy prices higher, directly affecting consumer pocketbooks.

To make matters worse, after falling desperately behind the inflation curve, the United States Federal Reserve (Fed) has finally recognized the urgent need to tighten policy.

Recall that after the global financial crisis, stubbornly low inflation meant that the Fed’s dual mandate of price stability and maximum employment was effectively a single mandate. The Fed could focus on keeping employment high without worrying about an overheating economy—and they extended this approach even after the pandemic with rates staying near-zero and monetary stimulus ballooning the Fed’s balance sheet to $9 trillion. This erroneously patient approach has permitted price pressures to multiply, broaden, and intensify unhindered, pushing inflation up to a 40-year high.

Although inflation may have recently peaked, it is unlikely to subside rapidly. If higher prices, which have now broadened, are allowed to persist, they can become sticky. As experienced during the 1970s and early 1980s, a wageprice spiral, where rising wages beget rising prices, which cause further pressure on wages, certainly could allow inflation to be a challenge for longer than expected.

Perhaps the silver lining is that the economy is still fundamentally strong despite these challenges. After all, inflation is a problem created partially by robust consumer and business demand. Yet, while a Volcker-era wage-price spiral isn’t the base-case, the economy can only stay strong for so long in the face of declining household purchasing power and rising interest rates. So, while the economy is on decent footing today, the risk of recession is likely to increase meaningfully in late-2023 and into early-2024.

Consumer price index (CPI)

CPI and ex-Food and Energy, YoY % change

Clearnomics, Bureau of Labor Statistics, Principal Global Investors. Forecasts are Principal Global Asset Allocation forecasts. Data as of May 11, 2022.

Traditional assets solve yesterday’s problems

The first real inflation shock in four decades means that many portfolios may not be properly positioned. In general, traditional asset classes aren’t ideally suited for high or rapidly rising inflation scenarios. This is especially true as interest rates increase in response.

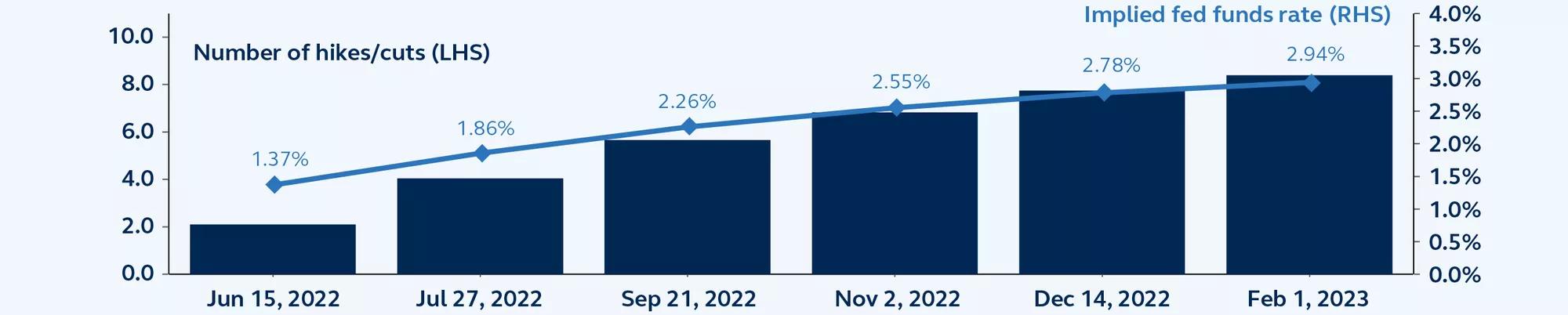

Already in 2022, the 10-year U.S. Treasury yield crossed the 3% threshold, a sharp increase from 1.5% at the start of the year and 0.9% at the start of 2021. With the Fed beginning to raise policy rates aggressively and quantitative tightening now underway, there are reasons to believe that rates will remain elevated, with bond yields ending the year around 2.5%.

Fed funds futures implied rates

Implied fed funds rates and number of hikes/cuts at each Fed meeting

Clearnomics, Bloomberg, Principal Global Investors. Data as of May 4, 2022.

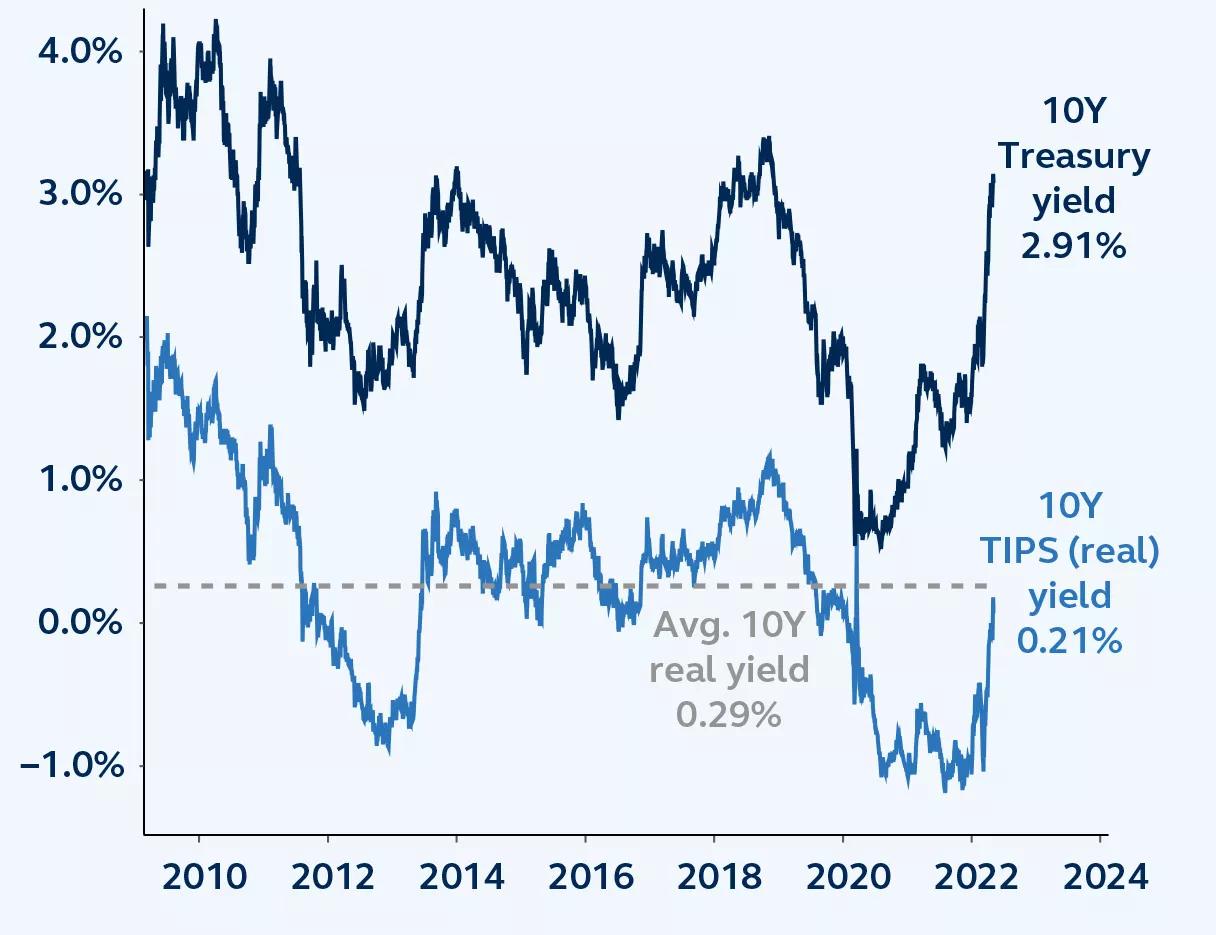

Today's environment creates the perfect storm against fixed income. Bonds, by definition, are susceptible to rapidly rising nominal rates. The devastating combination of red-hot inflation and easy monetary policy has meant that real yields have been negative. Now, with policy rates moving sharply higher and inflation pressures receding very gradually, bonds will not only be susceptible to rising nominal yields, but also to real yields moving back into positive territory.

As a result, the bond market has faced its toughest period since 1980, with the Bloomberg U.S. Aggregate Index declining 9.5% year-to-date.1 (For reference, in early 1994, after the Fed surprised the market with rate hikes, the bond market had a 6.6% peak-to-trough decline.)

Equities haven't been immune to the ravages of inflation either. The S&P 500 has dropped over 15%, year-to-date as investors have realized that high inflation can be problematic for the asset class. While stocks can perform well when inflation is moderate and rising steadily, since companies with pricing power can often pass on higher costs to their customer's, pricing power has its limits.

Higher prices will eventually dampen consumer and business spending while also raising costs. Profit margins will be under increasing pressure this year, weighing on earnings growth. For financial markets, higher discount rates reduce the value of future cash flows today, depressing asset prices.

Thus, after decades of dormant inflation and falling interest rates, investors now need better ways to diversify portfolios and to enhance real returns. In today’s environment, this may require looking beyond the public market stocks and bonds that have been the main portfolio building blocks over the last 40 years.

Real interest rates

10-year real inflation adjusted interest rate based on TIPS

Clearnomics, United States Treasury, Principal Global Investors. Data as of May 11, 2022.

Enter real assets

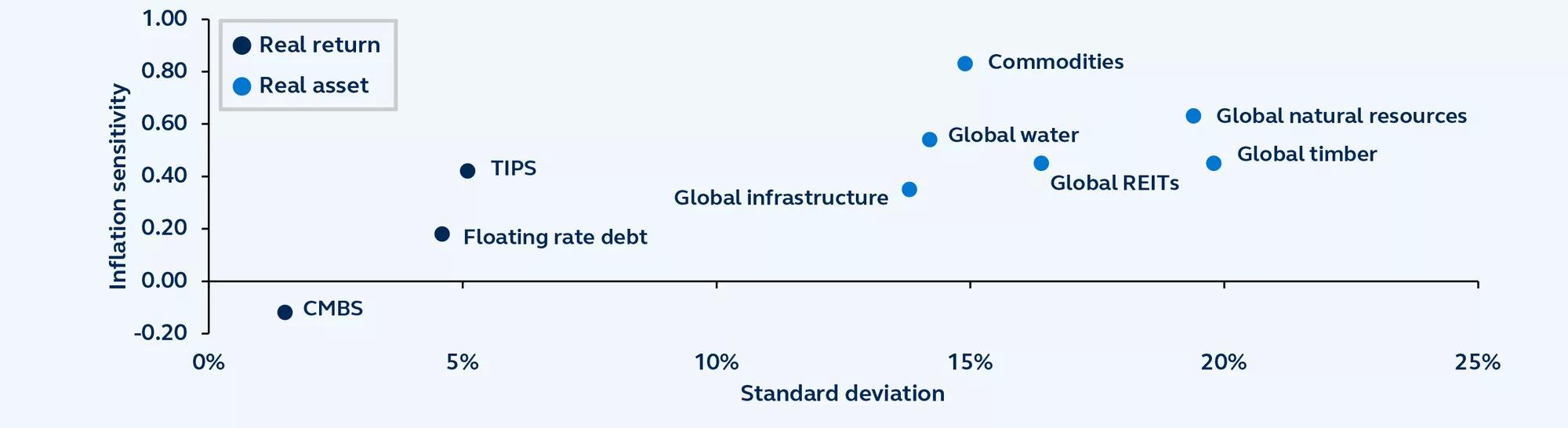

Fortunately, real assets are tailor-made solutions to these challenges, offering inflation risk mitigation as well as providing broad diversification benefits across market environments. The diverse set of asset classes that include real estate, agriculture, infrastructure, energy, commodities, natural resources, and timber—collectively, real assets—are securities whose underlying value is tied to a tangible asset or linked (inherently or contractually, implicitly or explicitly) to the rate of inflation.

When combined with the low correlations to traditional asset classes, the attractive real yields and often lower risk profiles of real assets mean that the asset class may enhance portfolio risk-adjusted returns. This is especially important if inflation is stickier and more stubborn than expected due to supply chains, consumer demand, and rising expectations, as investors are experiencing today.

Infrastructure investments are one of these attractive real assets that can outperform in the current environment. As demand for critical services is less sensitive to inflation, owners of certain infrastructure assets can sustain and increase prices without significantly impacting demand, offering important opportunity for inflation protection. Furthermore, they typically have predictable cash flows associated with the long-lived assets and offer exposure to the global theme of de-carbonization, which presents a multi-decade tailwind for utilities and renewable infrastructure companies.

In fact, certain regulated utilities even have a direct pass through of inflation, making their revenue streams very attractive in today’s market. Certain user-pay assets, such as toll roads, have a similar sensitivity, whereby their prices are automatically adjusted for inflation.

Real assets can also provide opportunities to access attractive investment themes beyond inflation mitigation. One of these themes is the possibility that the global economy is entering into a new commodities supercycle— an extended period of strong demand for commodities that’s distinct from the business cycle.

These periods create strong demand for commodities and natural resources, ranging from industrial metals to energy, since these are necessary inputs to economic growth. While supply can grow, it often takes time to come online, thus driving prices higher in the meantime. Today, rapid growth in areas such as renewable energy, data centers, and consumer technology, alongside a robust economy and government stimulus, are driving the demand for commodities.

Many commodities also have natural supply limits, at least in the medium term. So-called rare earth metals, for instance, are necessary for a wide range of technology devices including batteries, cellphones, and electric vehicles. While they’re not actually that rare, extracting and processing is difficult, geographically concentrated, and takes time to ramp up. Today, China is still the main supplier of rare earth metals, although there are efforts to boost production in the U.S. and elsewhere. This limited market supply means that strong demand could continue to drive up prices.

Inflation sensitivity and market risk

Standard deviation vs. inflation sensitivity (correlation)

FactSet, Bureau of Labor Statistics, Principal Global Investors. *See disclosures for risk calculation information. Data as of March 31, 2022

Whether there is a new commodities supercycle or not, the post-pandemic recovery and the war in Ukraine have already crimped the supply of energy, grains, timber, and other natural resources in the near-term. Many commodities have remained in deep backwardation since mid-year 2021—usually a signal of supply shortage concerns. These concerns look legitimate in today’s environment as demand has strongly outpaced supply due to limited capital expenditure from major commodities producers. Additionally, given the unpredictability of geopolitical events, investors should prepare to be whipsawed in this environment. Diverting supply chains, or even substituting from alternative countries, is wrought with difficulties and delays. Therefore, even pockets of commodity shortages will likely result in prolonged price pressures.

The upshot is that commodity prices could remain elevated for the next year or so, until the next economic downturn naturally reduces demand. Thus, including commodities and natural resources in a portfolio may help to offset the inflationary pressures faced by other asset classes.

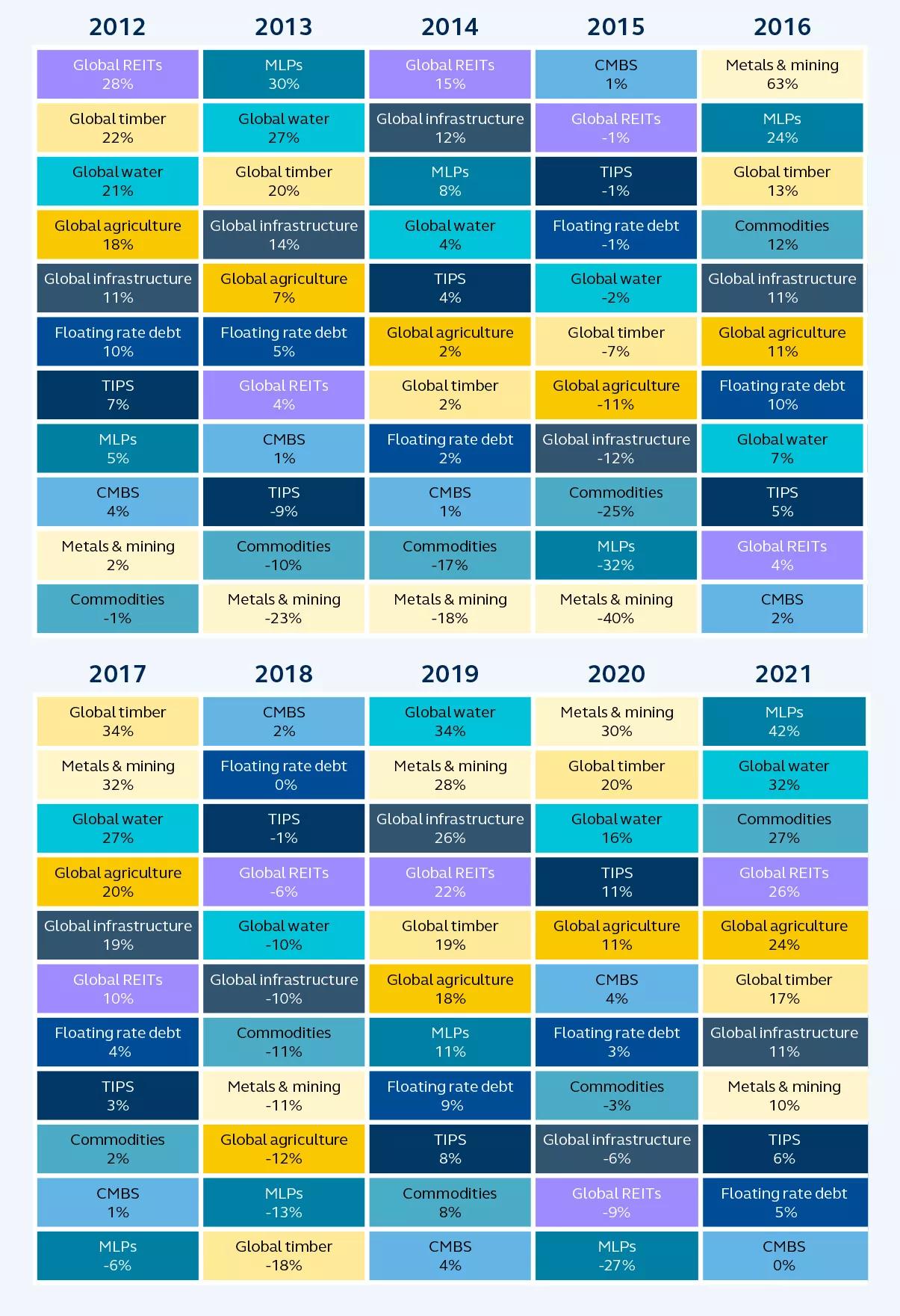

Calendar year asset class returns

2012 – 2021

Morningstar, Principal Global Investors. Percentages represent calendar year index returns. Past performance does not guarantee future results. For indices, see disclosures section. Data as of December 31, 2021.

Navigating the perfect storm with real assets

With the Fed so desperately behind the inflation curve, policymakers have finally recognized the urgent need to tighten policy. But, having left it so late, an aggressive hiking cycle is now required to bring inflation back to target, risking a sharp economic downturn in the process. Recession risk for 2022 is still muted given the strength of the consumer and corporate balance sheets, but risks are rising for 2023 and beyond.

Today’s perfect storm of historically high inflation, rapidly rising interest rates, and market uncertainty, has left many standard portfolio allocations unprepared for the market environment. Additionally, capturing the upside of many structural long-term trends now often requires solutions beyond the traditional asset classes.

The standard commentary for investors during challenged market environments is to diversify portfolios, ensuring that they are appropriately allocated for their goals. In today's market, allocation to real assets can help address those challenges. Not only are real assets a natural inflation hedge, but they can also provide potentially attractive real yield with low correlations to traditional asset classes. Along with their inherent exposure to many of today’s long-term investment themes, real assets may help to boost risk-adjusted returns in a way that is tailored to the evolving market environment.

1 As of market close, May 11, 2022.

* Standard deviation “risk” is calculated on a weighted basis over time with data as of March 31, 2022: 36-month rolling 50%, 12- month 25%, and 3-month 25%. The inflation sensitivity is calculated using 24-month rolling correlation to CPI-U non-seasonally adjusted as of March 31, 2022. Actual risk and actual correlations observed are used by the team for modeling.

Risk considerations

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. Asset allocation and diversification do not ensure a profit or protect against a loss. Investments in natural resource industries can be affected by disease, embargoes, international/political/economic developments, variations in the commodities markets/weather and other factors. Investing in derivatives entails specific risks regarding liquidity, leverage and credit that may reduce returns and/or increase volatility.

Important Information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

Bloomberg U.S. Treasury Inflation Protected Securities TR Index (TIPS); Bloomberg Commodity TR Index (Commodities); FTSE EPRA/NAREIT Developed TR Index (Global REITs); S&P/LSTA Leveraged Loan TR Index (Floating rate); S&P Global infrastructure Index (Global infrastructure); S&P Global Timber and Forestry TR Index (Global timber); S&P Global Water Index (Global water); S&P Global Natural Resources Index (Global nat res); B of A 0-3 YR US Fixed Rate CMBS Index (CMBS).

This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This material is intended for use in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (EU) Limited, Sobo Works, Windmill Lane, Dublin D02 K156, Ireland. Principal Global Investors (EU) Limited is regulated by the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID). The contents of the document have been approved by the relevant entity. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (EU) Limited (“PGI EU”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGI EU, PGIE or PGI EU may delegate management authority to affiliates that are not authorized and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland.

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority ("FCA").

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organization.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS License No. 225385), which is regulated by the Australian Securities and Investments Commission. This document is intended for sophisticated institutional investors only.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- Hong Kong SAR (China) by Principal Global Investors (Hong Kong) Limited, which is regulated by the Securities and Futures Commission and is directed exclusively at professional investors as defined by the Securities and Futures Ordinance.

- Other APAC Countries, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

- Nothing in this document is, and shall not be considered as, an offer of financial products or services in Brazil. This presentation has been prepared for informational purposes only and is intended only for the designated recipients hereof. Principal Global Investors is not a Brazilian financial institution and is not licensed to and does not operate as a financial institution in Brazil.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

© 2022 Principal Financial Services, Inc. Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world. Principal Global Investors leads global asset management at Principal®.

MM12906 | 2188164