Investors may find value in a fixed income asset that typically benefits from a rising-rate environment.

Amid volatile markets, many investors are looking for stable sources of returns. Direct lending to middle market companies is one option that may suit sophisticated investors, including high-net- worth individuals and institutional investors. “The return profile is attractive, and the asset class has proven to be resilient during periods of economic uncertainty as well,” says Tim Warrick, managing director and alternative credit portfolio manager, at Principal Asset ManagementSM.

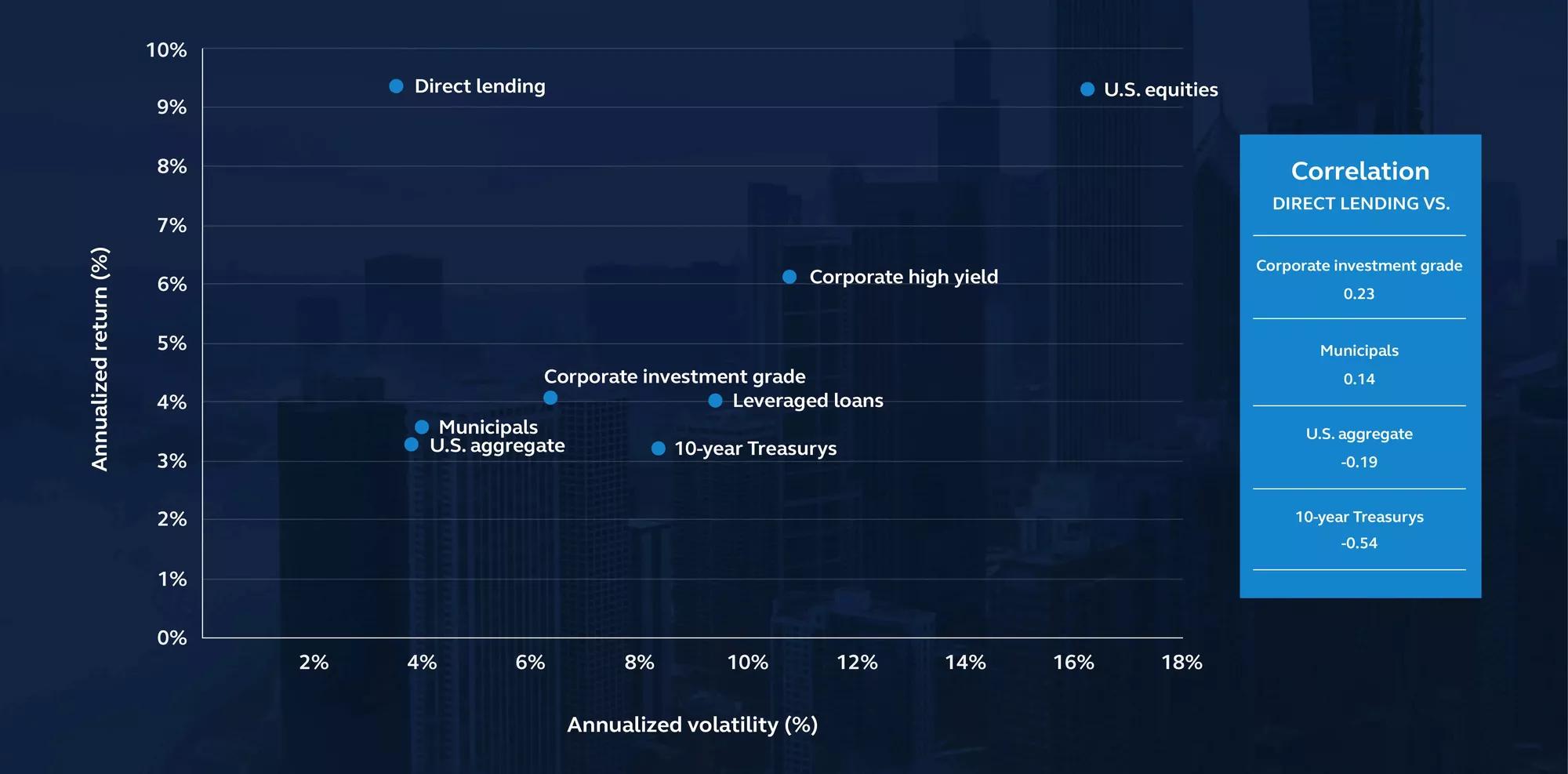

Warrick notes that direct loans to middle market companies have returned nearly 10% on an annualized basis since 2004, with substantially lower volatility than public market assets. The asset class performance, which is negatively correlated with Treasury performance, typically benefits from periods of rising rates. Though Principal Asset Management forecasts a recession on the horizon as the Federal Reserve continues to remove accommodation through higher policy rates, Warrick believes most companies in the middle market are effectively navigating the impact of historically high inflation and rising interest rates. Since these loans are typically floating rate, the ability of a company to service debt is key to ultimately obtaining the return benefit of higher interest rates. “Despite public market drawdowns and volatility, we’re still realizing very positive returns, with expectations for increased returns as coupons move higher,” he says.

Historical Asset Class Risk/Return

Annualized return and annualized volatility, 2004-2022*

*Since inception of Cliffwater Direct Lending index on September 30, 2004.

Source: Bloomberg, Principal Asset Management. Indexes represented include: direct lending—Cliffwater Direct Lending Index, U.S. equities—S&P 500, leveraged loans—S&P/LSTA Leverage Loan Index, U.S. aggregate—Bloomberg U.S. Aggregate Bond Index, municipals—Bloomberg U.S. Municipal Index, corporate investment grade—Bloomberg U.S. Corporate Bond Index, corporate high yield—Bloomberg U.S. Corporate High Yield Index, 10-year Treasurys—U.S. 10-year Treasurys. Risk measured as standard deviation of quarterly returns. As of June 30, 2022.