The first month of summer came in hotter than expected. Data released in June showed that annual headline CPI inflation—previously thought to be cooling—had touched a new 40-year high. In response, the United States Federal Reserve (Fed) raised its benchmark interest rate by 75 basis points (bps)—25 bps more than initially forecast and the largest increase since 1994. Eyeing the rest of 2022, further substantial rate hikes are possible as the Fed remains focused on stabilizing prices, however, in the process, a recession may become unavoidable. With broad equities and fixed income both facing difficult months and quarters ahead, investors need to actively seek out the opportunities that can still perform well in this tough investment environment.

Inflation sticking around longer than expected

It had been widely assumed that inflation had peaked in March. Later, in early May, Fed Chair Powell’s assertions that a 0.75% increase to the federal funds rate would not be a serious consideration at the next meeting of the Federal Open Market Committee (FOMC) led many investors to assume the Fed policy rates would follow only a modest tightening path. Some optimists even went so far as to predict a Fed policy pause in September.

Then the data came out. Rather than slowing in May, the consumer price index showed that annual headline inflation rose from 8.3% to 8.6%, the highest level since 1981.

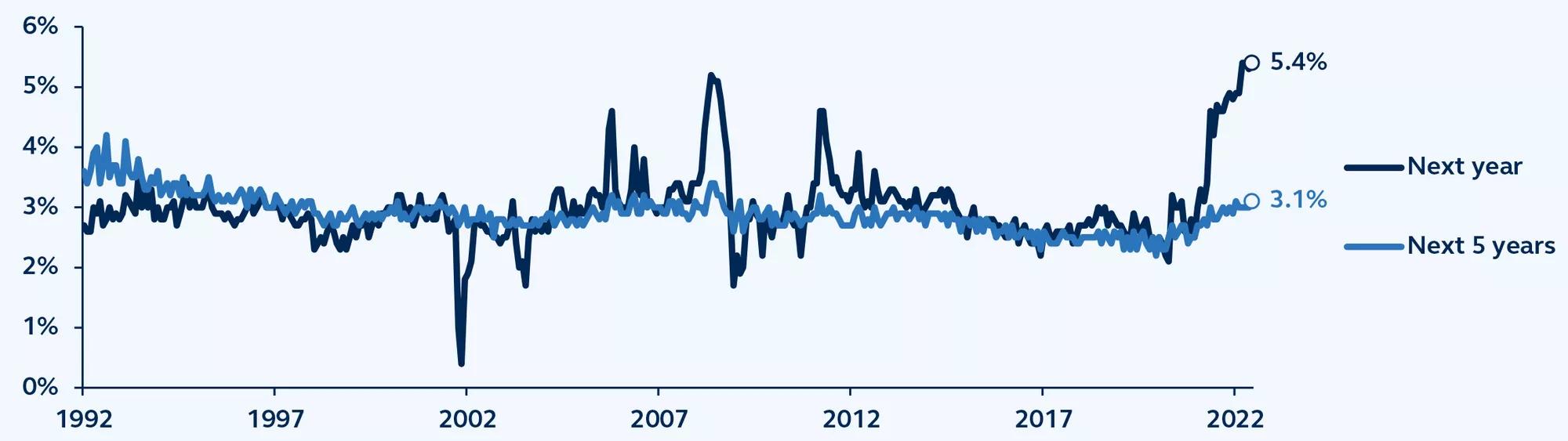

Perhaps more significantly, the flash reading of the University of Michigan Index of Consumer Sentiment, released right before the FOMC meeting, showed inflation expectations for the next 5 to 10 years rose from 3.0% in May to 3.3% in June, as consumers faced higher prices for gas and groceries.1 These two upside inflation surprises were enough to convince the Fed to break its recent forward guidance, demonstrate its data dependence, and introduce the first 75 bps increase since 1994.

Inflation expectations

University of Michigan Surveys of Consumers, 1992 – present

University of Michigan, St. Louis Fed, Principal Global Investors. Data as of June 27, 2022.

More tightening may be coming

The inflation challenge facing the Fed today is more nuanced than what it was just 12 months ago. Driven by surging energy and food inflation, and lingering COVID supply chain driven disruptions, both inflation expectations and wage pressures are rising. Without swift and decisive actions from the Fed (such as 75 bps rate hikes…), the situation could move beyond their control. Therefore, with Chair Powell emphasizing their "unconditional" commitment to price stability just a week after the June FOMC at the House Financial Services Committee, investors should prepare for significantly more tightening.

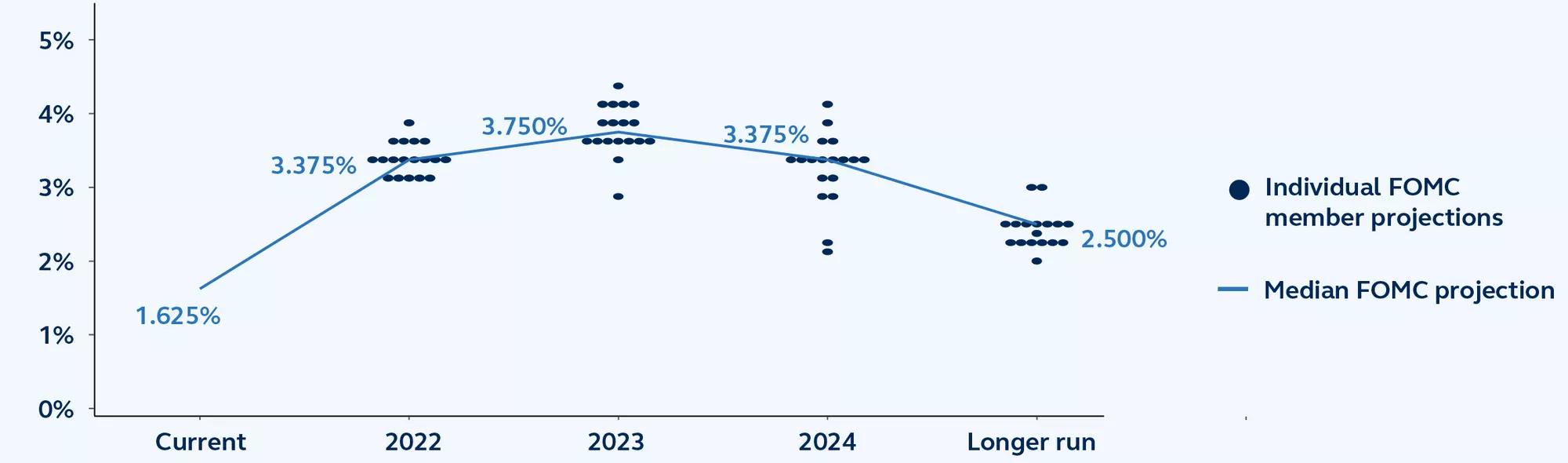

With the June move, the federal funds rate now stands between 1.5% and 1.75%. The median entry on the FOMC dot plot—used to chart committee members’ data forecasts—sees rates ending the year at 3.4%. This represents a 250 bps upward revision from the FOMC’s March forecast of 1.9% and brings policy rates sharply into restrictive territory. For the rest of 2022, investors should expect that the federal funds rate will likely rise an additional 175 bps to reach 3.5% by year-end. This accelerated tightening may imply fewer hikes are required next year, so the federal funds rate may rise only a further 75 bps in 2023, potentially peaking at 4.25%. Later in 2023, as economic data slows meaningfully, it is reasonable to think that rate cuts could once again be on the table.

Federal Open Market Committee dot projections

Federal funds rate midpoint, June 2022

Federal Reserve, Clearnomics, Principal Global Investors. Data as of June 15, 2022.

Immaculate disinflation may be wishful thinking

The Fed's Summary of Economic Projections in March had forecast that the unemployment rate would remain broadly unchanged at 3.6% through to 2024. The new Summary of Economic Projections introduced an important upward revision to this forecast. They now see the unemployment rate rising gradually from 3.6% to 4.1% by the end of 2024.

In other words, the Fed is projecting a 0.5% rise in the unemployment rate over the next two years. This marks a shift from what it has called “immaculate disinflation,” a scenario in which inflation could meaningfully come down without an accompanying rise in unemployment.

Why is the pickup in unemployment relevant? According to the Sahm Rule, created by former Fed economist Claudia Sahm, a recession occurs when unemployment climbs by at least 0.5% in a short time-frame. So, while the Fed hasn’t outright stated that it expects a recession in the near term, their own numbers tell a different story.

If—and when—a recession could start

Despite Chair Powell’s continued assertions that a soft landing is possible, the odds that the Fed will be able to tighten policy rates without the U.S. economy entering into a recession are not in the Fed’s favor. During the last 11 tightening cycles, the Fed has only skirted recession three times (1965, 1984 and 1994). But in each of those cycles, inflation was lower and the federal funds rate was meaningfully higher to begin with, so the Fed’s tightening measures did not have to be as dramatic as they do to achieve their goals today.

Despite sharp monetary tightening over the next 12 months, inflation will likely decline very slowly, to only around 6.5% by the end of 2022 and then to 3% by end of 2023. The consequences of the Fed's aggressive hiking impact on the U.S. economy may be more significant, precipitating recession—likely by mid 2023—if not sooner.

Where investors can turn

In this challenging climate, it is crucial for investors to focus on stability and high quality, particularly in the following asset classes:

- U.S. mid-cap stocks: U.S. mid-caps are more attractive than either large- or small-caps. Not only are large cap valuations markedly more expensive, but their exposure to the relatively weaker global economy also suggests continued underperformance. By contrast, although small-cap valuations are as equally attractive as mid-cap, they will likely struggle amid rising interest rates and may continue to be challenged by the limited pricing power in this inflationary environment.

- Securitized debt: Fixed-income positioning should be more defensive and tilted toward higher quality— greater exposure to U.S. Treasurys is warranted. As the U.S. economy moves towards recession next year, the Fed will likely shift from rate hikes to rate cuts, putting downward pressure on U.S. Treasury yields. High yield will likely be challenged as recession concerns grow and remains particularly vulnerable to an oncoming drop in liquidity as the Fed reduces its balance sheet. In contrast, securitized debt products tend to provide better stability during periods of high volatility and risk, without exposure to corporate credit.

- Infrastructure: Alternatives are poised to outperform amid the pressures on stocks and bonds. Infrastructure investments offer an opportunity for diversification, inflation mitigation, and exposure to the structural decarbonization trend. They also potentially provide attractive real yield and predictable cash flows.

- Commodities: As structural supply shortages continue, commodities are another alternative asset class poised to extend positive performance.

The possibility for near-term volatility may be daunting. But the key is to remain positioned, so investors are poised for potential gains when the recovery starts.

The ongoing war in Ukraine has driven up the costs of energy, food, and other key commodities, while recent factory closures in China—part of that country’s strict response to a fresh COVID-19 outbreak—have exacerbated supply pressures that might otherwise have eased by this point in the pandemic.

Although Powell advised that markets should not expect 75 bps hikes to be “common,” as they represent an “unusually large” move, he also signaled that the July FOMC meeting could see a 50 or 75 bps hike if inflation expectations continue to drift higher.

1 The flash reading of the University of Michigan indicator was on June 10. The official release, on June 24, and after the FOMC meeting, was revised down to 3.1%.

Risk considerations

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. Equity markets are subject to many factors, including economic conditions, government regulations, market sentiment, local and international political events, and environmental and technological issues that may impact return and volatility. Infrastructure issuers may be subject to regulation by various governmental authorities and may also be affected by governmental regulation of rates charged to customers, operational or other mishaps, tariffs, and changes in tax laws, regulatory policies, and accounting standards. Inflation and other economic cycles and conditions are difficult to predict and there Is no guarantee that any inflation mitigation/protection strategy will be successful.

Important Information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence)for errors or omissions in the information or data provided.

This material may contain 'forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is intended for use in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (EU) Limited, Sobo Works, Windmill Lane, Dublin D02 K156, Ireland. Principal Global Investors (EU) Limited is regulated by the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID). The contents of the document have been approved by the relevant entity. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (EU) Limited (“PGI EU”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGI EU, PGIE or PGI EU may delegate management authority to affiliates that are not authorized and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland.

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority ("FCA").

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organization.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS License No. 225385), which is regulated by the Australian Securities and Investments Commission. This document is intended for sophisticated institutional investors only.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- Hong Kong SAR (China) by Principal Global Investors (Hong Kong) Limited, which is regulated by the Securities and Futures Commission and is directed exclusively at professional investors as defined by the Securities and Futures Ordinance.

- Other APAC Countries, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

- Nothing in this document is, and shall not be considered as, an offer of financial products or services in Brazil. This presentation has been prepared for informational purposes only and is intended only for the designated recipients hereof. Principal Global Investors is not a Brazilian financial institution and is not licensed to and does not operate as a financial institution in Brazil.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

© 2022 Principal Financial Services, Inc. Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world. Principal Global Investors leads global asset management at Principal®.

MM12979 | 2262209