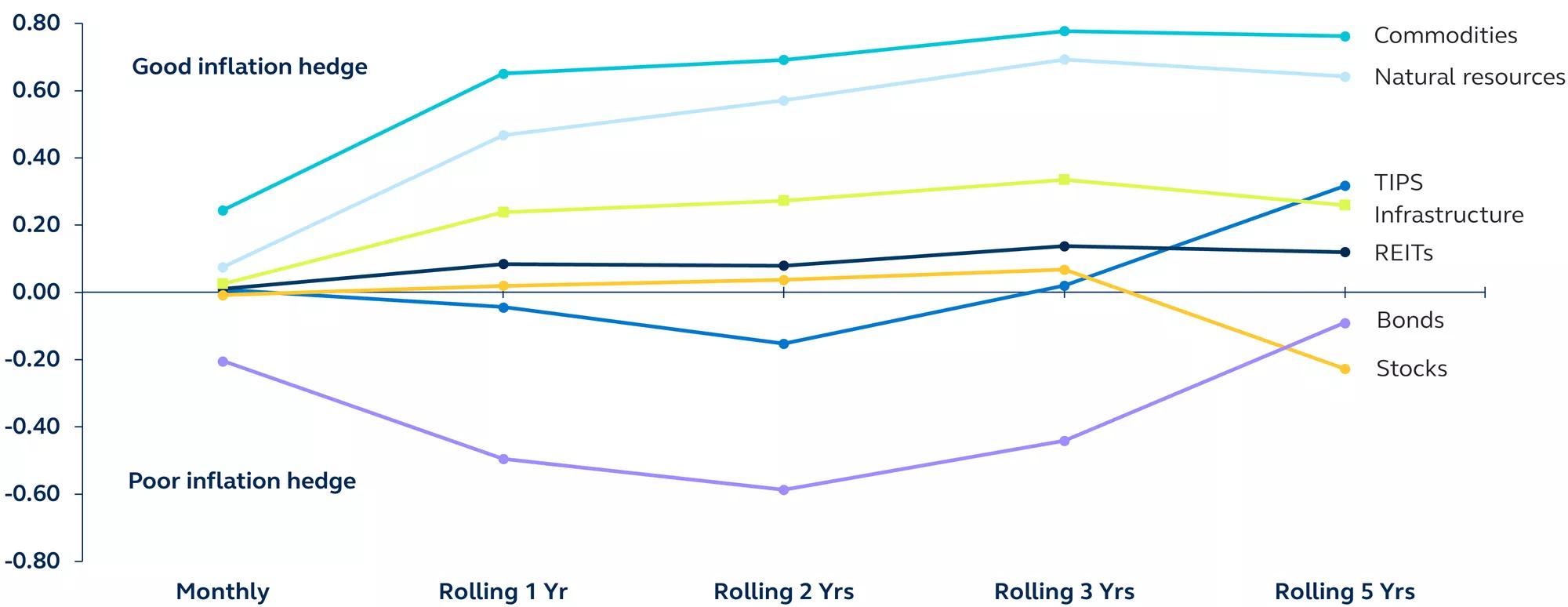

As inflation proves stickier than anticipated, the role of real assets in a diversified portfolio becomes increasingly important for inflation mitigation. Historical data and recent trends underscore that real assets not only shield against inflationary pressures but also offer the potential for attractive returns in a more inflation-prone economic environment.

Real and nominal assets correlation with CPI inflation

Correlation by time period, August 1997–December 2023

The disinflation narrative has stalled. Quarterly annualized U.S. core PCE inflation rose from 1.5% in Q4 to 4.4% in Q1, reinforcing the notion that a smooth return to a low inflation regime is unlikely. Understanding the tactical and strategic role that real assets play in a diversified portfolio is key to navigating this environment.

Historically, during higher inflationary periods, real assets, such as commodities and real estate, have offered risk mitigation against economic hardships. In the 1970s, a period not dissimilar to the current environment, while stocks and bonds were not able to keep pace with inflation, real assets delivered returns that surpassed the inflation rate.

2022 further exposed traditional equity and bond’s inflation vulnerabilities. As they declined almost in tandem, the 60/40 strategy reported its worst performance since 2008 and one of its worst in history. By contrast, real assets outperformed, with commodities easily delivering its best performance since the GFC.

While the current stickiness of inflation is at least partially due to the cyclical strength of the U.S. economy, several sizable secular macroeconomic trends, such as deglobalization and rising commodity costs, suggest that the economy may be shifting to a more inflationary paradigm. Fortunately, real assets have historically shown potential for helping mitigate the effects of inflation on portfolios and for delivering attractive returns – their tactical and strategic importance to portfolios today should not be overlooked.

Investing involves risk, including possible loss of principal. Past performance does not guarantee future return. Real assets include but not limited to precious metals, commodities, real estate, land, equipment, infrastructure, and natural resources. Each real asset is subject to its own unique investment risk and should be independently evaluated before investing. As an asset class, real assets are less developed, more illiquid, and less transparent compared to traditional asset classes. Asset allocation and diversification do not ensure a profit or protect against a loss. Any risk management process discussed includes an effort to monitor and manage risk which should not be confused with and does not imply low risk or the ability to control certain risk factors. Inflation and other economic cycles and conditions are difficult to predict and there Is no guarantee that any inflation mitigation/protection strategy will be successful.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3551926