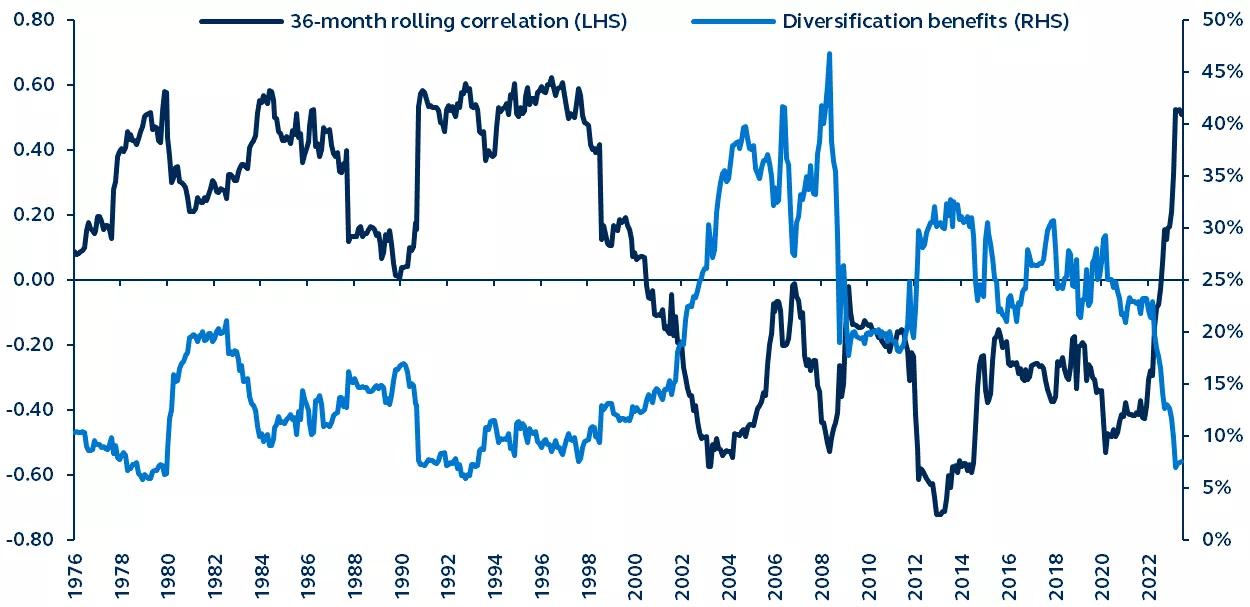

With rising stock/bond correlations reducing diversification benefits, the 60/40 portfolio suffered a historically bad run in 2022. However, an analysis of inflation and growth dynamics suggests that the elevated correlations are likely temporary, and that, combined with higher fixed income yields in the period ahead, the 60/40 portfolio will soon regain its appeal to investors seeking reasonably stable, risk-adjusted returns.

Stock/bond correlation and diversification benefits

1976–present

Note: Correlations are between S&P 500 and Bloomberg UST Index. Diversification benefits defined as volatility reduction of 60/40 portfolio.

Source: Bloomberg, Principal Asset Allocation. Data as of June 30, 2023.

The 60/40 portfolio's abysmal performance in 2022 raised the chorus of "the death of the 60/40," with concerns that the portfolios' stability benefits and asset allocation alpha potential had been significantly and fundamentally reduced. However, the forecasts for U.S. inflation in the period ahead likely imply that the demise of the 60/40 has been exaggerated, and the higher stock/bond correlations of 2022 appear to have been more of a speed bump than a permanent shift in trajectory.

Over the last five decades, the diversification benefit, or the volatility reduction of a 60/40 portfolio, has helped a 60/40 deliver 9.4% annual returns, only marginally below the S&P 500's 10.9% return and with much lower volatility. However, the economic environment of 2020-2022, with its large swings in inflation and rates, resulted in a breakdown of the diversification benefit. Rising correlations led to stocks and bonds falling together, driving 60/40 performance to a near-historic low.

Looking ahead, the drivers of inflation's rapid increase over the last two years are unlikely to repeat, and thanks to higher interest rates, investors are getting much higher compensation for taking interest rate risk compared to 2021-2022. In fact, recent falling stock/bond correlations combined with the highest bond yields since the Global Financial Crisis have restored the 60/40 portfolio construct back to its historical reputation as an appealing option for investors seeking risk-adjusted returns.

For a deeper dive into the past, present and future state of the 60/40 portfolio, read Is the 60/40 portfolio dead?

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. Asset allocation and diversification do not ensure a profit or protect against a loss. Inflation and other economic cycles and conditions are difficult to predict and there Is no guarantee that any inflation mitigation/protection strategy will be successful.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3042925