Using real estate and private markets to help strengthen client portfolios

Matt Ciambriello, Director on our Global Wealth Alternatives team, provides a quick overview of private market investments and the potential benefits they can bring to clients’ portfolios.

- Portfolios that incorporate alternative investments—including real estate and private markets—can meaningfully enhance a traditional 60-40 asset allocation model.

- There are several types of real estate and private market offerings, each with unique use cases and risk/return profiles.

- Advisors need to consider client goals and liquidity needs when exploring the addition of real estate and private assets to portfolios.

Investment portfolios for individual investors have traditionally focused on public equities and fixed income, often structured into a 60-40 asset allocation split to balance risk and reward potential. Increasingly, however, real estate and private markets offerings are viewed as viable additions to portfolios for high-net-worth clients.

Historically, these asset classes have been characterized as primarily suitable for institutional investors, but recent efforts to democratize access to them have spurred growing interest from accredited individuals and wealthy families. Not only do private markets offer access to compelling market or economic trends, recent studies suggest that they can also enhance diversification—and therefore risk management—because of low correlations with public equity performance.

Real estate and private markets

There are several categories of real estate and private market strategies (sometimes grouped under the heading alternative investments). Each category has unique qualities, but as a group, alternative investments can potentially deliver enhanced results, relative to unit of risk, compared with their public market counterparts.

The most common private markets strategies in use today include:

Real estate: This diverse sector includes physical properties or real estate-related securities distributed across all four quadrants of investing—public equity and debt as well as private equity and debt. It is popular in wealth portfolios as it has historically provided consistent income at moderate risk.

- Residential

- Commercial

- REITs

- Real estate debt

Moderate risk, income generation

$1.8T

Private credit: Also known as private debt, private credit involves lending to companies outside traditional banking channels, often with the expectation of an enhanced yield.

- Direct lending

- Investment-grade private credit

- Distressed debt

Higher yields than comparable public debt instruments, with a wide range of risk

$1.6T

Infrastructure: Infrastructure strategies finance essential public goods such as transportation, utilities, and digital infrastructure (e.g., data centers) through equity or debt structures. These assets typically provide long-term, stable cash flows.

Equity and debt across:

- Energy

- Power

- Digital

- Transportation

- Social infrastructure

Moderate risk, stable cash flows

$1.6T

Private equity: Private equity provides capital to private businesses with the aim of improving operations and, possibly, exiting via a sale or public offering.

- Buyouts

- Growth capital

- Venture capital

High risk, high potential return

$11.5T

Hedge funds: As pooled investment funds, hedge funds use various strategies, such as long/short equity, arbitrage, and macroeconomic bets, with the goal of generating returns uncorrelated to traditional markets. Hedge funds often use derivatives strategies to enhance performance, which may have the additional risk of synthetic leverage.

- Long/short

- Event-driven

- Macro

Varies widely, active management

$4.7T

Advantages compared to a traditional 60-40 portfolio

Private markets strategies have grown significantly, in part because they offer advantages to private wealth clients and others that have traditionally relied on a standard 60-40 portfolio. The 60-40 asset allocation model provides clients with access to sources of return in both public equity and fixed income markets, while managing risk via diversification. Yet private market and real estate investments have also historically offered a growing range of dynamic investment opportunities with attractive returns relative to risk levels taken.

Private markets often provide early access to innovations and disruptive technologies, such as artificial intelligence (AI) or alternative energy. In addition, private markets are typically less efficient than public markets, presenting mispricing opportunities that can add significant value.

Private markets are playing an increasingly critical role in portfolio risk management as well. One perceived benefit of the traditional 60-40 portfolio has been the defense it can provide against volatility because of the historically low correlations between equities and fixed income investments. In recent years, however, this diversification benefit has not been consistently reliable.

A 2023 analysis published by the CFA Institute1, for example, highlighted that the diversification benefits of the 60-40 portfolio have been greatly reduced in inflationary or stagflationary environments. It noted that inflationary trends led to major losses for both stocks and bonds in 2022, wiping out the diversification benefit of the 60-40 portfolio.

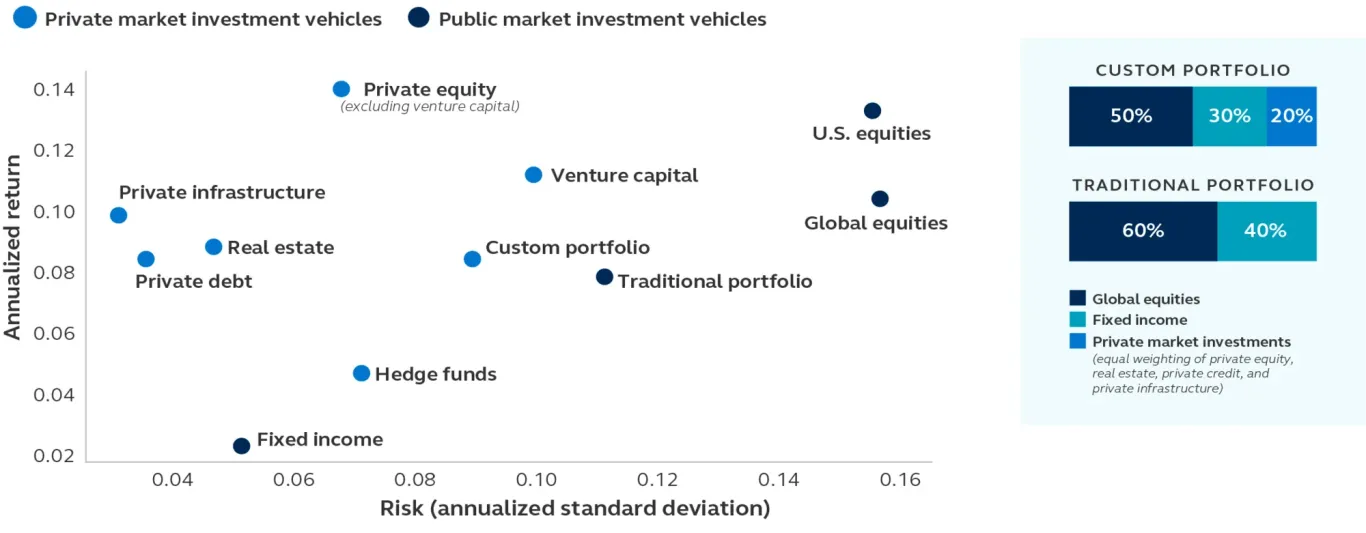

Comparison of risk and return for private market investments vs. public and traditional investments (2013-2024)

Source: Preqin, Bloomberg, Principal Asset Management, 30 September 2024. Please see indices used in the disclosures at the end of the document. Indices are unmanaged and do not take into account fees, expenses, and transaction costs and it is not possible to invest in an index.

Private markets strategies are idiosyncratic in that performance is driven more by the unique circumstances of the investment than by larger market or economic trends. As a result, correlations are typically lower than those between public markets, providing more opportunities for effective diversification. In addition, real assets such as real estate can benefit from inflationary trends due to income streams that are linked to inflation.

Due to this combination of traits, real estate and private markets exposures have historically added meaningful value to a standard wealth portfolio. As indicated in the chart below, over the 10 years through 30 September 2024, most real estate and private market options have produced results relative to their risk level that far exceed the traditional 60-40 portfolio alone. Even modest allocations to these diversifying sectors have been beneficial.

Introducing private markets and real estate to clients

Real estate and private market strategies can help clients achieve their financial ambitions, but they do not function quite the same as public market strategies. If you would like to introduce these asset classes to your clients, it is important to discuss potential impacts with them and to set clear expectations.

At a high level, you will need to clarify the goals of any real estate or private markets exposure, including desired income and capital appreciation results alongside risk mitigation. More specifically, your client’s liquidity needs will be critical in determining both the type of private markets exposure they can consider and the percentage of their assets that can be allocated to them.

Private market strategies may have lock-up periods, redemption policies, or other terms that need to be aligned with a client’s liquidity needs. This is particularly important for clients that are used to the instant liquidity available from public asset classes. For these clients, a documented liquidity plan can be a useful tool for selecting the right exposures.

Finally, real estate and private market exposures can help you offer your clients tax efficient opportunities. Using them in a client portfolio may not dramatically increase or decrease tax liability. However, private sectors are subject to different taxation laws than public securities, which could benefit some clients’ portfolio outcomes net of tax.

Download client infographic (PDF)

If you have questions on how real estate and private markets allocations can fit into your clients’ investment approach, ask an expert on our team.

Access additional tools to help navigate real estate and private markets.

Taking action

Once you and your client develop a consensus, involve your asset manager partner. A good partner has a deep understanding of the private markets they invest in and can articulate how to achieve income growth, inflation hedging, or any other client priorities using these types of investments. They will also have a clear view of the risks and liquidity constraints involved.

Alternative investments offer compelling opportunities to enhance traditional portfolios, providing diversification, income stability, and inflation resilience. As investors seek to navigate evolving market conditions, strategically integrating private markets and real estate can potentially lead to attractive long-term outcomes.

1 Source: CFA Institute, The 60/40 Portfolio Needs an Alts Infusion, December 2023.

For Public Distribution in the United States. For Institutional, Professional, Qualified, and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk considerations

Investing involves risk, including possible loss of principal. Past Performance does not guarantee future return. Real estate investment options are subject to risks associated with credit, liquidity, interest rate fluctuation, adverse general and local economic conditions, and decreases in real estate values and occupancy rates. There are risks associated with private equity that are not applicable to typical investments in the public equity market, are generally illiquid and carry the potential for significant losses. Typically, private credit investments are in restricted securities that are not traded in public markets, can range in credit quality and are subject to substantial holding periods. Infrastructure investments are long-dated, illiquid investments that are subject to operational and regulatory risks. Hedge funds may not be suitable for all investors and often engage in speculative investment practices which increase investment risk; are highly illiquid; are not required to provide periodic prices or valuation and often employ complex tax structures. Investment risk may be magnified with alternative investment strategies due to their use of arbitrage, leverage, and derivatives. Asset allocation and diversification do not ensure a profit or protect against a loss. The risk management techniques discussed seek to mitigate or reduce risk but cannot remove it.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account.

Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided. All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Bloomberg All Hedge Fund Index - represents the average performance of hedge funds, as defined by the Bloomberg Hedge Fund Classifications; Fixed income: Bloomberg US Agg Index - is a broad-based flagship benchmark that measures the investment grade, US dollar denominated, fixed-rate taxable bond market; Private Equity excl. VC: Preqin Private Equity excl. VC Index - is used to measure the returns of private equity investments, excluding the specific risk and return characteristics associated with venture capital; Venture capital: Preqin Venture Capital Index - is a benchmark that tracks the performance of venture capital funds globally; Private Debt: Preqin Private Debt Index - is a time-weighted return index that tracks the performance of private debt funds globally; Real Estate: Preqin Real Estate Index - is a benchmark that tracks the performance of private real estate investments; Infrastructure: Preqin Infrastructure Index - is a benchmark that tracks the performance of private infrastructure investments, specifically the returns on invested capital for funds tracked by Preqin; U.S. equities: S&P 500 Total Return Index - Widely regarded as the benchmark gauge of the U.S. equities market, this index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with over 80% coverage of U.S. equities, it also serves as a proxy for the total market.; Global equities: MSCI World Total Return Index - is a global stock market index that tracks the performance of large and mid-cap companies across 23 developed countries.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorised and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- United Arab Emirates by Principal Investor Management (DIFC) Limited, an entity registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as an Authorised Firm, in its capacity as distributor / promoter of the products and services of Principal Asset Management. This document is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- Hong Kong SAR by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission. This document may only be distributed, circulated or issued to persons who are Professional Investors under the Securities and Futures Ordinance and any rules made under that Ordinance or as otherwise permitted by that Ordinance.

- Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Global Investors, LLC (PGI) is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA), a commodity pool operator (CPO) and is a member of the National Futures Association (NFA). PGI advises qualified eligible persons (QEPs) under CFTC Regulation 4.7.

© 2025 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

MM14478-01 | 07/2025 | 4633967-052026