Real estate in modern portfolios: A wealth advisor’s guide

Matt Ciambriello, Director on our Global Wealth Alternatives team, discusses the real estate asset class and how private wealth clients may potentially benefit by including it in their portfolios.

- Like institutional investors, private wealth clients can use the full spectrum of real estate investment alternatives to meet portfolio goals.

- The real estate investment market can be divided into four quadrants: private equity, private debt, public equity, and public debt.

- Each quadrant offers accessible investments with a wide range of risk/return profiles.

- Diversification, capital appreciation, and income generation are important potential benefits of including real estate in your portfolio.

While many high-net-worth investors have experience with residential property ownership and may own commercial real estate properties directly, the investment landscape offers a more diverse opportunity set of investment vehicles - private real estate funds that offer different return profiles across the risk spectrum (core, core-plus, value-add and opportunistic), publicly traded real estate investment trusts (known as REITs) and real estate debt including loans as well as public Commercial Mortgage-Backed Securities (CMBS). Additionally, there are specialized and alternative property types like data centers, cell towers, senior housing and single-family rentals that may be more difficult for many investors to access directly.

Commercial real estate (CRE) is already a core holding in the institutional space with many institutional investors allocating an average of approximately 10% of the portfolio to the asset class. They recognize its potential to deliver multiple portfolio benefits, including steady income generation, potential capital appreciation, inflation hedging characteristics, and portfolio diversification through its typically low correlation with traditional assets like stocks and bonds. We believe that wealth managers can take inspiration from institutional approaches to help individual clients consider real estate as part of their own portfolio strategy.

The best starting point for clients interested in exploring the asset class is to understand the four quadrants of the real estate sector.

What are the four quadrants of real estate investing?

There are four main areas that make up the the real estate market – private equity, private debt, public equity, and public debt. This breakdown is useful because each of these quadrants has unique characteristics that investment managers must account for when selecting options for clients.

Private equity

Investing in private equity real estate involves the acquisition and ownership of property or properties either directly or via an investment fund.

Private debt

Private debt real estate investments allow non-bank lenders, like funds, to provide capital to real estate developers or owners, usually in the form of loans secured by the property.

Public equity

Includes publicly traded companies, such as real estate investment trusts (REITs), that own and operate income-producing real estate, allowing investors to gain exposure to real estate without directly owning physical properties.

Public debt

The public debt market trades debt instruments, such as commercial mortgage-backed securities (CMBS), that are issued to finance real estate projects or infrastructure.

Overview of real estate equity vehicle types

Each of the quadrants has unique characteristics, but within real estate equity there are four common segments. Ranging from lower to higher risk, there are core, core-plus, value-added, and opportunistic strategies. These segments are defined by risk and return profile, as well as the strategy to drive results. Investors can select investment products that focus on specific strategies to tailor their return objectives.

| Key questions | Core | Core-plus | Value-add | Opportunistic |

|---|---|---|---|---|

| What is the strategy to drive results? | Buy and maintain an already performing asset | Enhance the asset through light renovation and lease-up | Rehabilitate or redevelop the asset and lease-up | Develop the asset from the ground up, redeveloping existing properties into a different use, or purchasing distressed properties in need of significant rehabilitation |

| What is the expected return profile? | 7-10% primarily driven by income returns | 9-13% driven by a combination of real income and capital appreciation | 13-15% Real income and greater capital appreciation | 15-20% primarily driven by capital appreciation |

| What is the risk of capital loss? | Lower | Low | Medium | Higher |

Source: Principal Real Estate, June 2025. Any forecasted returns, yields or other forward-looking performance shown in this material are not meant to predict the returns of any portfolio or strategy and do not guarantee future results. The forecasted returns are shown for Illustrative, informational purposes only and subject to change without notice. These forecasted returns do not reflect any deductions for investment management fees or expenses that would reduce the actual returns realized by investors and there is no guarantee that the forecasted returns will be realized or achieved or that any investment strategy will be successful. The information concerning the real estate market outlook is based on current market conditions and general assumptions which will fluctuate and may be superseded by subsequent market events or for other reasons.

Listed REITs can serve as a complement to private equity CRE portfolios for a variety of reasons. First, they are more liquid since they are traded on national stock exchanges allowing investors the opportunity to buy and sell the stocks every minute of every trading day. Second, while listed REIT returns are more volatile than private CRE equity over the near term, they are also leading indicators for the private CRE equity. As a result, adding an allocation of public real estate to a private portfolio can smooth returns at certain allocations. Third, they offer investors access to alternative CRE property types as nearly 70% of market capitalization is in sectors that we consider to be next generation like data centers. The property types owned by real estate are typically core in nature, but listed REITs may also offer value-add opportunities through acquisitions and redevelopment.

CRE debt is often overlooked, but it’s an important part of the CRE capital structure and offers compelling risk-adjusted returns in the current market. Like equity, debt may be structured as public or private.

Within private debt, there are various risk return profiles: (1) Senior debt that offers the lowest risk and lowest return, (2) Mezzanine debt that is subordinate to senior debt, but above the equity, and (3) Preferred equity that technically is equity but structured with fixed returns and senior to common equity. Longer term fixed rate loans can typically be encumbered by stabilized properties while bridge loans are usually floating rate and can be collateralized by a range of assets in different phases of the investment life cycle, including light transitional, transitional (more in depth business plans), or even stabilized assets where the seller is bridging to sell. Finally, construction loans fund ground-up development or major redevelopment.

Public debt most often comes in the form of Commercial Mortgage-Backed Securities (CMBS) - a type of bond backed by a single CRE loan or a pool of loans. The loans are then bundled together in a securitization and bonds (tranches) are issued with different levels of risk and return. The most senior tranche is typically rated AAA; it’s paid first and therefore has the lowest risk, but also the lowest yield. There are also mezzanine tranches (typically rated AA to BBB) with moderate risk and return while subordinate / junior tranches (typically rated BB, B, and unrated) that absorb losses first if loans default and therefore have higher risk, but higher yields. CMBS is more liquid than private CRE debt, but not as liquid as publicly listed REITs.

Investors can tailor their portfolios across the four quadrants based on their risk tolerance, yield requirements and liquidity preferences. Within the public quadrants, REITs and CMBS are often used and well understood in traditional portfolios, but private equity and private debt should not be overlooked. They offer similar long-term fundamentals as their public counterparts but are often less volatile albeit more illiquid. We think there is a home in portfolios for all four quadrants—it’s not an either-or proposition.

How do real estate investments impact portfolio construction?

Real estate investments have some key features that may enhance your clients’ portfolios. Chief among these is diversification. There are relatively low correlations between stocks and bonds and real estate, particularly for private real estate, as shown in the correlation data compiled by Principal Asset Management below comparing real estate indices with global stock and bonds over the past 10 years. This correlation profile suggests that including both public and private real estate in a portfolio may provide compelling diversification benefits when combined with traditional assets like stocks and bonds.

Correlation levels over the past 10-year period

| Global stock1 | Global investment grade2 | Global REITs3 | Investment grade CMBS4 | Private equity real estate5 | Private debt real estate6 | |

|---|---|---|---|---|---|---|

| Global stock | 1.00 | 0.47 | 0.82 | 0.43 | -0.34 | -0.03 |

| Global investment grade | 0.47 | 1.00 | 0.61 | 0.86 | -0.38 | 0.24 |

| Global REITs | 0.82 | 0.61 | 1.00 | 0.58 | -0.13 | 0.33 |

| Investment grade CMBS | 0.43 | 0.86 | 0.58 | 1.00 | -0.40 | 0.27 |

| Private equity real estate | -0.34 | -0.38 | -0.13 | -0.40 | 1.00 | 0.52 |

| Private debt real estate | -0.03 | 0.24 | 0.33 | 0.27 | 0.52 | 1.00 |

Source: Bloomberg, Preqin, NAREIT, NCREIF, Principal Asset Management. Quarterly returns 1Q 2014 to 4Q 2024. No investment strategy, such as asset allocation or diversification, can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future index returns. It is not possible to invest directly in an index.

1 MSCI World Total Return; 2 Bloomberg Global-Aggregate Total Return Index Value Unhedged USD; 3 FTSE EPRA NAREIT DEVELOPED Total Return Index USD; 4 BB/BC Inv Grade CMBS Index (Total Return Unhedged; 5 NFI ODCE Total Return Index, Gross USD; 6 NCREIF/CREFC Debt Agg Total Return Index. See index descriptions in the Disclosures below.

Historical performance during inflationary periods

| Asset class | Typical behavior during high inflation periods | Reason |

|---|---|---|

| Private real estate/REITs | Generally, will rise | Rental income and property values will generally increase with inflation |

| Equities | Varies | Earnings may grow but higher interest rates can compress valuations |

| Fixed income | Declines | Inflation erodes purchasing power of fixed payments |

| Cash | Declines | Value erodes quickly in real terms |

Source: Principal Asset Management, June 2025.

From a portfolio construction perspective, the four quadrants tend to react differently to prevailing market or economic trends. One example is their reaction to interest rates. Private market investments are generally less immediately affected by interest rate changes due to their long-term, illiquid nature and less frequent valuation adjustments given their long-term investment time horizons. Meanwhile public market investments react more quickly as interest rates influence market sentiment, valuations, and liquidity. In other words, public markets tend to be leading indicators in both downturns and recoveries.

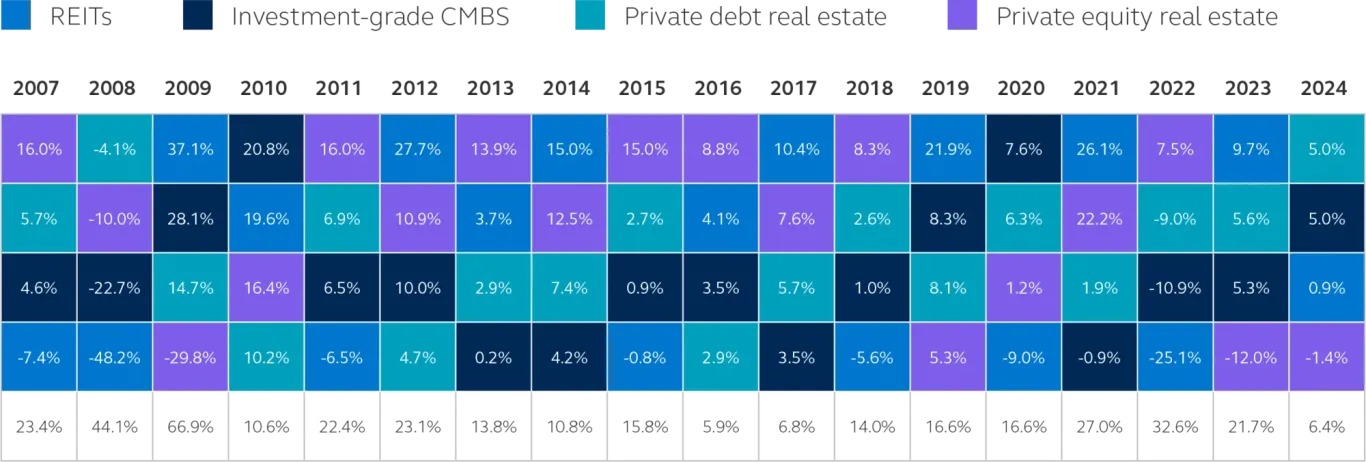

A review of the annual results for the four quadrants from 2007 to 2024 shows just how dispersed results can be. For this reason, the quadrants often function best when used together. A dynamic allocation approach may provide investors with the best possible outcomes by maximizing the opportunity set in any given market environment and through considering the asset allocation mix that is most suited to their objectives.

Average performance spread across quadrants since 2007: 21.03%

Performance gross total return

Percentages in last row show the difference between the highest performing sub-asset class and the lowest for the relvant year.

Source: Principal Asset Management, as of 31 December 2024. Indices: US REITs: U.S. REIT Linked Index; IG CMBS: Bloomberg US CMBS Investment Grade Index; Private RE Debt: Giliberto- Levy Index; Private RE Equity: ODCE value weighted index. Past performance is not indicative of future performance. Indices are unmanaged and do not take into account fees, expenses, and transaction costs and it is not possible to invest in an index.

Average annual income returns: Q4 2004 through Q4 2024

| Asset class | Average income return |

|---|---|

| U.S. private debt real estate7 | 7.51% |

| U.S. private equity real estate | 5.25% |

| U.S. public equity real estate (REITs) | 4.60% |

| U.S. public debt real estate (CMBS) | 4.46% |

| U.S. fixed income | 3.69% |

| Global equities | 3.11% |

| U.S. equities | 1.94% |

Source: Principal Asset Management as of 31 December 2024. Indices: Private debt real estate - NCREIF/CREFC Debt Agg Income; Private equity real estate - NPI Income return; U.S. public equity real estate - NAREIT (All REITS, Income return); U.S. public debt real estate - Bloomberg Investment Grade CMBS; U.S. fixed income - Bloomberg Barclays US Aggregate (Income); Global equities - MSCI ACWI Ex US Income Return; U.S. equities - S&P Inc Return Index. Past performance is not indicative of future performance. Indices are unmanaged and do not take into account fees, expenses, and transaction costs and it is not possible to invest in an index.

7 U.S. private debt real estate is from Q4 2013 through Q4 2024.

Download client infographic (PDF)

If you have questions on how leveraging the four quadrants framework will influence your clients’ investment approach, ask an expert on our team.

Access additional tools to help navigate real estate and private markets.

Discussing real estate with clients

Real estate investments often create tangible, meaningful impact that resonates with investors beyond pure financial returns. These investments can drive significant societal transformations – for example, developing affordable housing, building senior living facilities, or funding sustainable building improvements. This combination of social purpose and environmental stewardship, alongside potential financial returns, makes real estate particularly appealing to investors seeking to align their portfolios with their values.

As part of your discussions with clients, it can be beneficial to ask your investment provider to offer photos of funded projects, or case studies of projects that were financed by specific real estate investments. Sharing these resources with your clients can help them get a better picture the tangible advantages of real estate developments in society as well as in their portfolios.

Ultimately, you can leverage real estate investments in various ways to seek to benefit any client who wants to enhance income, diversification, and capital appreciation. Using the four quadrants framework can help you expose clients to the breadth of real estate opportunities and more efficiently identify options that suit their needs.

For Public Distribution in the United States. For Institutional, Professional, Qualified, and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk considerations

Investing involves risk, including possible loss of principal. Past Performance does not guarantee future return. Real estate investment options, such as real estate investment trusts (REITs) and commercial mortgage backed securities (CMBS), are subject to risks associated with credit, liquidity, interest rate fluctuation, adverse general and local economic conditions, and decreases in real estate values and occupancy rates. Direct investments in real estate are highly illiquid and subject to industry or economic cycles resulting in downturns in demand. Accordingly, there can be no assurance that investments in real estate will be able to be sold in a timely manner and/or on favorable terms. Private market investments, unlike publicly traded stocks, involve various risks due to illiquidity, lack of transparency, and higher minimum investment requirements. These risks include liquidity risk, market risk, capital risk, and regulatory risk. Additionally, private market investments often involve higher fees and expenses and may have longer investment horizons. Investment risk may be magnified with alternative investment strategies due to their use of arbitrage, leverage, and derivatives. Asset allocation and diversification do not ensure a profit or protect against a loss.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account.

Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided. All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Indices used: MSCI World - a global equity index that represents the performance of large and mid-cap stocks across developed market countries; Bloomberg Global-Aggregate Total Return Index Value Unhedged USD - a broad, multi-currency benchmark that tracks the performance of investment-grade, fixed-rate bonds across both developed and emerging markets, without currency hedging; FTSE EPRA NAREIT Developed Total Return Index USD - a globally recognized benchmark that tracks the performance of publicly traded real estate companies and REITs in developed markets; BB/BC Inv Grade CMBS Index (TR Unhedged) - tracks the performance of investment-grade Commercial Mortgage-Backed Securities (CMBS) within a specific rating range, typically those rated between BBB- and BBB+, and provides a total return (TR) calculation without any currency hedging (Unhedged); NFI ODCE Index - performance of open-end private real estate funds that invest in core properties; NCREIF/CREFC Debt Agg total return - a fund-level aggregate that tracks the performance of open-end funds providing credit and financing for commercial real estate. Giliberto Levy Index - tracks investment results produced by private-market debt investments in commercial real estate within the United States; The MSCI ACWI Ex US Income Return Index - tracks the performance of large and mid-cap stocks in developed and emerging markets outside the United States, with a focus on companies exhibiting higher dividend yields and quality characteristics; S&P 500 Index - tracks the performance of 500 of the largest publicly traded companies in the United States; Bloomberg Barclays U.S. Aggregate Bond Index - tracks the performance of a wide range of publicly offered, fixed-rate, taxable, dollar-denominated bonds, including U.S. Treasuries, government-related securities, corporate bonds, and mortgage-backed securities.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorised and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- United Arab Emirates by Principal Investor Management (DIFC) Limited, an entity registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as an Authorised Firm, in its capacity as distributor / promoter of the products and services of Principal Asset Management. This document is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- Hong Kong SAR by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission. This document may only be distributed, circulated or issued to persons who are Professional Investors under the Securities and Futures Ordinance and any rules made under that Ordinance or as otherwise permitted by that Ordinance.

- Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Global Investors, LLC (PGI) is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA), a commodity pool operator (CPO) and is a member of the National Futures Association (NFA). PGI advises qualified eligible persons (QEPs) under CFTC Regulation 4.7.

© 2025 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

MM14561 | 07/2025 | 4606734-072026