Exploring paths to income with private market debt

Matt Ciambriello, Director on our Global Wealth Alternatives team, highlights how private market debt may be a useful addition to traditional income-focused portfolios as a means to potentially improving yield, diversification, and portfolio resilience.

- Adding private market debt to a traditional income portfolio may improve yield, diversification, and portfolio resilience.

- Real estate debt allows investors to diversify their income sources by incorporating asset-backed, inflation-resistant income streams in their portfolios.

- Direct lending gives investors access to a high-yielding asset class with a favorable risk-adjusted performance record.

- Infrastructure is an economically resilient sector with low default rates and attractive risk-adjusted returns on inflation-protected core assets.

Private credit, including real estate debt, infrastructure debt, and direct lending, has become increasingly popular for income-oriented wealth clients. During the prolonged low-rate environment of 2007-2022, real estate and private credit emerged as real-yield-generating alternatives for income-starved investors. While traditional fixed income struggled to meet income needs, private credit and real estate debt consistently delivered attractive cash flows, establishing themselves as useful tools for income-focused portfolios.

Interest rates are now more in line with long-term historical averages, and still, investors continue to seek exposure to private markets, recognizing the benefits it can bring to their portfolios. While these income vehicles have limited liquidity and are sometimes viewed as having more risk than traditional public-market bond offerings due to less regulatory oversight, knowledgeable wealth managers can use these tools to potentially boost client income and portfolio diversification.

Breakdown of average annual returns by asset class: Q4 2014 through Q1 2025

| Asset class | Income return (CAGR) |

|---|---|

| Direct Lending | 10.37% |

| Private Infrastructure | 9.66%* |

| Private Debt Real Estate | 7.65% |

| U.S. Fixed Income | 3.01% |

*Note: Preqin’s Private Infrastructure index captures the aggregate performance of the asset class. The total return index does not provide a breakdown between income- and appreciation-driven return components. Sources: Direct lending: Cliffwater Direct Lending Index; Private infrastructure: Preqin Private Infrastructure indices, which include a mix of senior debt and core equity as a generally accepted proxy for high-yield debt given limited public data; Private Debt Real Estate: NCREIF/CREFC Debt Agg Total Return Index; U.S. Fixed Income: Barclays US Aggregate (TR) Index. Data from Q4 2014 through Q1 2025. Please see indices used in the disclosures at the end of the document. Indices are unmanaged and do not take into account fees, expenses, and transaction costs and it is not possible to invest in an index. CAGR - Compound annual growth rate.

Areas of focus

The range of income choices in the private markets is broad, but there are three areas of focus that could make sense for investors who want to take an income-oriented approach or complement growth strategies with diversifying asset classes. These include direct lending, private infrastructure financing, and real estate debt.

Every investment has unique characteristics that influence its overall risk profile and income potential, but there are several commonalities within these three sectors.

Direct Lending

What is it? Investors directly provide capital to companies via loans. Non-bank lenders make loans to a business, usually smaller or mid-sized companies, without it being arranged, underwritten, or syndicated by an investment bank. Loans are typically used to finance leveraged buyouts, M&A transactions, growth investments, minority or management buyouts, and refinancings. Borrowers are drawn to direct lending because it can provide more flexible capital, and private equity sponsors (that own many middle market companies) benefit from the greater certainty of capital access for their growth strategies, as well as the lower fees and structuring expenses when compared to issuing public debt.

Income and risk profile:

- Direct lending borrowers tend to be smaller organizations with fewer resources. Most loans in this space are considered below investment grade. This additional risk typically results in higher yields.

- Loan defaults have historically been relatively low and there are many tools managers can use to limit default risk. As a result, the risk/return profile for direct lending compares favorably to other income-oriented sectors.

- Placement in the capital structure is important when evaluating risk, as are the loan covenants. Most middle market loans are senior in the capital structure and secured by a borrower’s assets. Also, strong loan covenants may allow lenders to negotiate with borrowers early if there are performance concerns.

- Typical expected yield for the lower to core middle market is from 10.25%-12.25% vs. upper middle market and public broadly syndicated of 8.75%-9.75% and 7.50%-8.50% respectively.1

Private Infrastructure Debt

What is it? Investors provide capital to finance the construction, maintenance, or operation of essential infrastructure assets. These may include projects related to renewable energy, thermal power, natural gas and pipelines, water treatment facilities, data centers, airports, seaports, and toll roads, among others. Infrastructure debt is sometimes considered a subset of private credit, but these loans are unique in that their borrowers own assets that are critical to regional economies and are typically supported by long-term fixed contracts with utilities, governments or large corporations. While capital intensive, infrastructure assets generally produce stable cash flows with high barriers to entry and regulatory protections.

Income and risk profile:

- Infrastructure loans are backed by the assets they fund and any income those assets generate, such as utility payments for power supply, hyperscaler payments for data storage, or user fees for assets like toll roads or seaports.

- Infrastructure assets are expected to last for many decades, so they carry a lot of long-term intrinsic value.

- Historically, infrastructure debt has empirically shown high resiliency given its underlying economic essentiality, with Moody’s data reporting a 2.4% default rate compared to 9.6% vs. corporates over a 20-year period, and higher recovery rates in default of 99.1% vs. 94.1% (over the same period), including very low impact during the GFC, 2016 oil price shocks, and the 2020 COVID pandemic.

- High-yield infrastructure debt maintains the sector’s attractive defensive qualities when targeting subordinated positions to “core” assets and/or senior secured positions to “core-plus” assets. These infrastructure financing opportunities in today’s market generally offer investors income yields of 8-11% (plus fees/original issue discount) at LTV levels of 60% or less, strong covenant protection, and 3-7 year maturities.2

Private Real Estate Debt

What is it? Investors provide capital to property owners or developers via loans (like mortgages, mezzanine debt, and bridge loans). Investable sectors typically include multifamily, single-family rentals, industrial, and retail. Yields may be higher than public market equivalents as lenders are being compensated for development risk, leasing risk, or renovation risk―sometimes referred to as an illiquidity premium.

Income and risk profile:

- These loans are typically backed by the property being financed, so performance depends on the property’s cash flow and market valuation.

- Placement in the capital stack is a key determiner of risk. Typically, senior debt has the first claim on collateral, while mezzanine and bridge debt follow behind. The further away from first loss position in the capital stack you go, the higher the return potential.

- Expertise is needed to ensure that the income of a given loan accurately compensates the investor for the risk assumed.

Using private market income opportunities in a portfolio

For a typical wealth investor, exposure to a broad portfolio of loans within each of these core segments is both prudent and desirable. Because of recent technology and regulatory developments, these portfolios can now be accessed through a variety of structures, and wealth managers can target alternatives that deliver the income and diversification benefits suitable to individual clients.

Diversifying within a single segment, such as infrastructure, helps ensure you have exposure to a range of loan types, and can limit the impact of any credit or market risks. Investors can go a step further and diversify across different private market income segments. Doing so provides a unique advantage, because private real estate and direct lending are not highly correlated, either with the public markets or with each other. Given these low correlations, a combined exposure to private assets can more significantly enhance risk-adjusted returns for investors seeking greater portfolio optimization.

| Direct lending | Private infrastructure | Private debt real estate | U.S. fixed income | |

|---|---|---|---|---|

| Direct lending | 1.00 | 0.55 | 0.07 | -0.03 |

| Private infrastructure | 0.55 | 1.00 | 0.01 | -0.18 |

| Private debt real estate | 0.07 | 0.01 | 1.00 | 0.24 |

| U.S. fixed income | -0.03 | -0.18 | 0.24 | 1.00 |

Source: Bloomberg, Cliffwater, Preqin, NCREIF, Barclays, Principal Asset Management. Quarterly returns 4Q 2014 to 1Q 2025. Indices used: Preqin Private Infrastructure (TR), Cliffwater Direct Lending Index; NCREIF/CREFC Debt Agg Total Return; Barclays US Aggregate (Total Return). No investment strategy, such as asset allocation or diversification, can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future index returns. It is not possible to invest directly in an index.

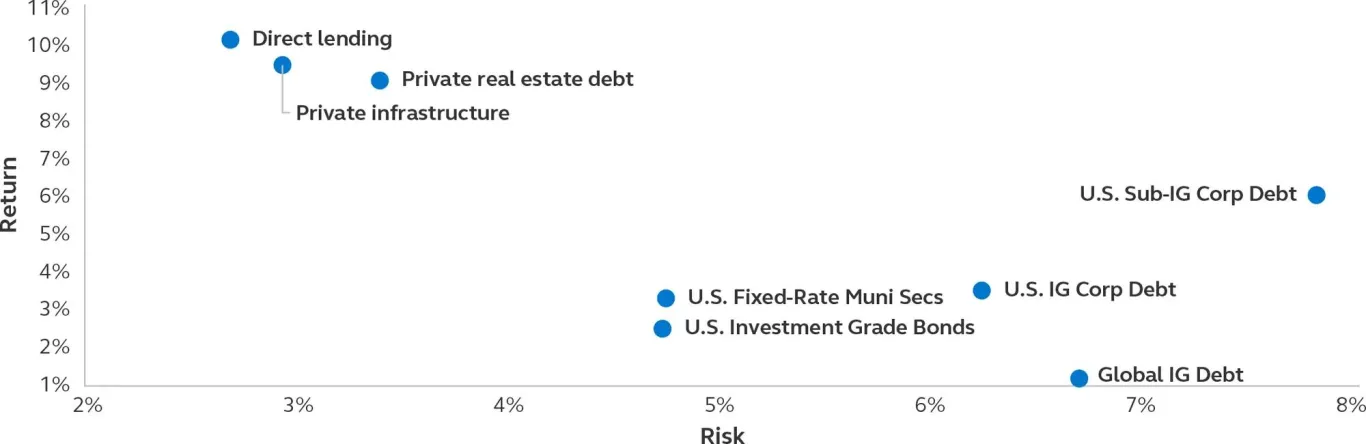

Comparison of annualized risk vs. return

April 2010 - March 2025

Notes: The chart above shows the annualized return and risk (as measured by the annualized standard deviation of quarterly returns) of each of the labeled asset classes. Source: Cliffwater Direct Lending Index, Preqin Indices, Bloomberg, ICE BofA Indices, Observation period is 01/04/2010 to 03/31/2025. Please see indices used in the disclosures at the end of the document. Indices are unmanaged and do not take into account fees, expenses, and transaction costs and it is not possible to invest in an index.

Adding private market income to a client’s portfolio

A recent proliferation of new product types and platforms has made higher-income alternatives more accessible to income-oriented wealth clients, and advisors should be prepared to introduce these alternatives to their clients. Even in today’s more normal interest-rate environment, an allocation to real estate debt and private credit vehicles offers the potential for:

- Enhanced income generation - private credit and real estate debt have historically offered higher yields than comparable public fixed-income securities.

- Stable income streams - coupons and distributions are often tied to spread premiums and underlying asset cash flows rather than interest rate movements alone.

- Inflation protection - loan portfolios are typically supported by company cash flow generation, properties or income streams that adjust with inflation, like rents, tolls or CPI-indexed contracts.

- Interest-rate risk protection - private real estate debt and private credit frequently (though not always) use floating-rate structures that reset upward in rising-rate environments. Note they may also go down in a declining rate environment.

- Risk management - private credit and real estate debt have historically low correlation with traditional stocks and bonds, which can reduce portfolio volatility.

- Access to underserved but growing market segments – these include segments such as digital infrastructure or renewable energy projects.

These advantages and the potential return premium the private market asset classes may deliver come with a certain amount of risk. Private debt can be complex and evaluating structure and credit risk effectively is necessary to identify and properly manage the underlying portfolio exposures. It is essential to work with a manager that has a proven process and resources to take advantage of the inefficiencies of these markets, while having a clear focus on capital preservation.

Part of the premium offered by the private market asset classes is an illiquidity premium. Though there are some semi-liquid alternatives, many of the private real estate debt and private credit product solutions require that investors commit their funds for multiple years, sometimes up to a decade. For the average investor, a 10% to 20% allocation may be a good target. The exact allocation will depend on investor objectives and preferences, but adding private debt to a portfolio has proven to not only improve income generation and investment performance, but to also create a more durable and steady return profile.

| Type of investor | Allocation to private real estate debt and private credit |

|---|---|

| Conservative risk, or high liquidity needs | 0%-10% |

| Moderate risk, or average liquidity needs | 10%-20% |

| Aggressive risk, or minimal liquidity needs | 20%-30% |

Inflation, interest rates, and other economic cycles and conditions are difficult to predict and there Is no guarantee that any inflation mitigation/protection strategy will be successful. Some private market investments may provide a few layers of protection against inflation and volatility; however, the performance of some assets is linked closely with economic expansion. For example, the revenue airports, certain kinds of toll roads, and ports generate, for example, depends on volume and usage, which can vary depending on economic conditions or trade activity. Floating rate structures naturally mitigate interest rate risk due to their adjustable nature, the degree of protection and suitability depends on factors like the specific loan terms, the presence of caps, floors, or collars, and overall market condition.

Three questions to ask your clients about private market debt income-focused investments:

- Is your income allocation diversified to include cash-flow backed lending and asset-backed lending?

- What daily liquidity do you believe is reasonable for your portfolio?

- Do you understand the interest rate risk of your overall portfolio and specifically your income generating portfolio?

Download client infographic (PDF)

If you have questions on how private market debt can fit into your clients’ investment approach, ask an expert on our team.

Access additional tools to help navigate real estate and private markets.

Taking action

Adding real estate debt, direct lending and infrastructure debt to a public income portfolio may improve yield, diversification, and portfolio resilience. However, investors should carefully assess liquidity needs and risk tolerance with changes to their asset allocation.

Manager selection is also an important consideration. Successfully navigating the large and diverse private debt markets requires experience across a range of product and loan types. Superior underwriting capabilities are a necessity, as is an ability to work with borrowers proactively. One key differentiator to look for in your investment provider is whether they invest their own money alongside investors. Another key consideration is if the manager has maintained a consistent focus on its core strategies or potentially has experienced style drift. It is also essential to understand a manager’s ability or consistently originate attractive and diverse loan opportunities.

It’s also wise to investigate the manager’s track record of managing through challenging economic environments or market disruptions. In addition, it’s beneficial to understand a manager’s capabilities with respect to restructuring transactions, as may sometimes be needed. Knowing the actions they may have taken during events like the great financial crisis of 2008 can help you identify managers that will fit your clients’ risk tolerances.

1 Source: Principal Asset Management as of 30 June 2025. Expected gross yield is before management fees, loan costs, and other expenses. These estimates are based on business plans, expectations and market conditions that Principal Alternative Credit has observed on the U.S. direct lending market generally. There is no guarantee that an investor will achieve these yields or returns on any similar investments in the future.

2 Source: Principal Asset Management as of 30 June 2025. These estimates are based on market conditions that the Principal Infrastructure Debt Team has observed. There is no guarantee that an investor will achieve these yields or returns on any similar investments in the future.

For Public Distribution in the United States. For Institutional, Professional, Qualified, and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk considerations

Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Investing involves risk, including possible loss of principal. Potential investors should be aware of the risks inherent to owning and investing in real estate, including: value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk all of which can lead to a decline in the value of the real estate, a decline in the income produced by the real estate, and declines in the value or total loss in value of investments in real estate. . Investments in private debt, including leveraged loans, middle market loans, and mezzanine debt, second liens, are subject to various risk factors, including credit risk, liquidity risk and interest rate risk. Private market investments, unlike publicly traded stocks, involve various risks due to illiquidity, lack of transparency, and higher minimum investment requirements. These risks include liquidity risk, market risk, capital risk, and regulatory risk. Additionally, private market investments often involve higher fees and expenses and may have longer investment horizons. Private credit securities may be illiquid, present significant risks, and may be sold or redeemed at more or less than the original amount invested. Such securities are considered to have speculative characteristics similar to high yield securities, and issuers of such securities are more vulnerable to changes in economic conditions than issuers of higher-grade securities. Infrastructure investments are long-dated, illiquid investments that are subject to operational and regulatory risks. Infrastructure companies are subject to risk factors including high interest costs, regulation costs, economic slowdown, and energy conservation policies. Asset allocation and diversification do not ensure a profit or protect against a loss. The risk management techniques discussed seek to mitigate or reduce risk but cannot remove it.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account.

Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided. All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Indices used: Cliffwater Direct Lending Index seeks to measure the unlevered, gross of fees performance of US middle market corporate loans; Preqin Private Infrastructure indices are time-weighted return indices that track the quarterly performance of global private market infrastructure funds, providing insights into the returns of invested capital in this asset class; Preqin Real Estate Debt index analyzes and benchmarks the performance of closed-end private real estate debt funds; NCREIF/CREFC Debt Agg Total Return Index is a fund-level aggregate that provides comprehensive data and performance insights into open-end debt funds that primarily invest in private U.S. commercial real estate debt, particularly emphasizing private commercial and multifamily real estate debt; Barclays US Aggregate (TR) Index is a broad-based flagship benchmark that measures the investment grade, US dollar denominated, fixed-rate taxable bond market. Bloomberg U.S. Corporate High Yield Index measures the performance of the U.S. dollar-denominated, high-yield, fixed-rate corporate bond market; Bloomberg U.S. Corporate IG Index measures the investment grade, fixed-rate, taxable corporate bond market; Bloomberg U.S. Municipal Bond Index is a flagship measure of the US municipal tax-exempt investment grade bond market; Bloomberg U.S Treasury 10-Year Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury with 7-9.9999 years to maturity.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorised and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- United Arab Emirates by Principal Investor Management (DIFC) Limited, an entity registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as an Authorised Firm, in its capacity as distributor / promoter of the products and services of Principal Asset Management. This document is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- Hong Kong SAR by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission. This document may only be distributed, circulated or issued to persons who are Professional Investors under the Securities and Futures Ordinance and any rules made under that Ordinance or as otherwise permitted by that Ordinance.

- Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Global Investors, LLC (PGI) is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA), a commodity pool operator (CPO) and is a member of the National Futures Association (NFA). PGI advises qualified eligible persons (QEPs) under CFTC Regulation 4.7.

© 2025 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

MM14621 | 07/2025 | 4693835-072026