An introduction to real estate and private markets in wealth portfolios

Matt Ciambriello, Director on our Global Wealth Alternatives team, explains why real estate and private markets matter in portfolio construction today and the importance of taking a thoughtful, goals-based approach when incorporating them.

- Alternative investments are no longer reserved for institutional investors—they’re becoming essential tools in modern wealth management.

- In recent years, public equities and bonds alone have struggled to deliver the income, diversification, and resilience that many wealthy investors seek.

- By following key best practices, advisors can help clients incorporate real estate and private market strategies that enhance income, growth, and diversification.

In today’s evolving financial landscape, real estate and private market investments are reshaping the way wealth managers help clients achieve their long-term financial goals. Once the domain of institutional investors, these asset classes are now increasingly accessible to high-net-worth individuals through a wave of regulatory reforms and technological innovation.

This shift presents new opportunities—but also new responsibilities—for advisors. Recent market trends have indicated that exposure to private markets gives investors a meaningful edge in successfully meeting risk/reward targets. But selecting the right investments and an appropriate asset allocation range is essential for success.

The democratization of real estate and private markets

Historically, private market investments, including private equity, private credit, and direct real estate, were mostly reserved for institutions with deep pockets and access to specialists. High minimum investment thresholds, long lock-up periods, and regulatory restrictions kept these opportunities out of reach for nearly everyone else.

Regulations have changed in recent years, however, making private investments more accessible to individual investors. New rules contained in the JOBS Act of 2012, for example, spurred the creation of platforms and vehicles that package these opportunities in user-friendly formats, often at more accessible minimums. These new avenues include online marketplaces that connect investors to private deals, as well as feeder funds that package a range of private investments with specific risk/return profiles.

Common private market access points

The mass affluent have greater access to semi-liquid funds and feeder funds, while some fund of funds and private markets platforms tend to be only accessible to institutional investors.

| Access point | Description | Advantages |

|---|---|---|

| Semi-liquid funds (e.g., Private REITs, interval funds) | Pools money from multiple investors to invest directly in private options; liquidity is restricted | Screened access to private investment options, typically at lower minimums, with at least some liquidity |

| Feeder funds | Pools money from multiple investors; then invests in a large institutional fund with high minimum investments | Ability to access top-tier private investment talent at a far lower minimum |

| Fund of funds | Pools money from multiple investors; invests that money across several institutional strategies | Expands on the benefits of a feeder fund by investing in a diversified range of private managers |

| Private markets platforms | A web-based portal that provides access to a variety of investment opportunities with a range of minimums, fees, and liquidity characteristics | Offers a range of options, at a lower minimum. Platforms also offer client service, reporting and education tools in a user-friendly interface |

High-net-worth individuals have responded enthusiastically to these new opportunities. A 2025 survey by private market investment platform Yieldstreet indicated that nearly half of all accredited investors surveyed intend to raise their exposure to private markets in the next five years.1

Private market investments are becoming a practical addition to a well-diversified wealth portfolio, offering potentially attractive advantages over traditional public market investments – especially in the current economic climate.

Filling gaps in the 60-40 portfolio

The traditional 60% equity – 40% fixed income portfolio is a long-standing allocation benchmark for advisors who focus on public markets. But in recent years, public equities and bonds have struggled to deliver the income, diversification, and resilience that many wealthy investors seek.

Recent research indicates that public markets have become increasingly correlated, reducing their effectiveness as diversification tools. According to the Bank for International Settlements (BIS), the correlation between U.S. equity and government bond returns turned positive in mid-2021 as a result of monetary policy responses to inflation, and has remained so since.2

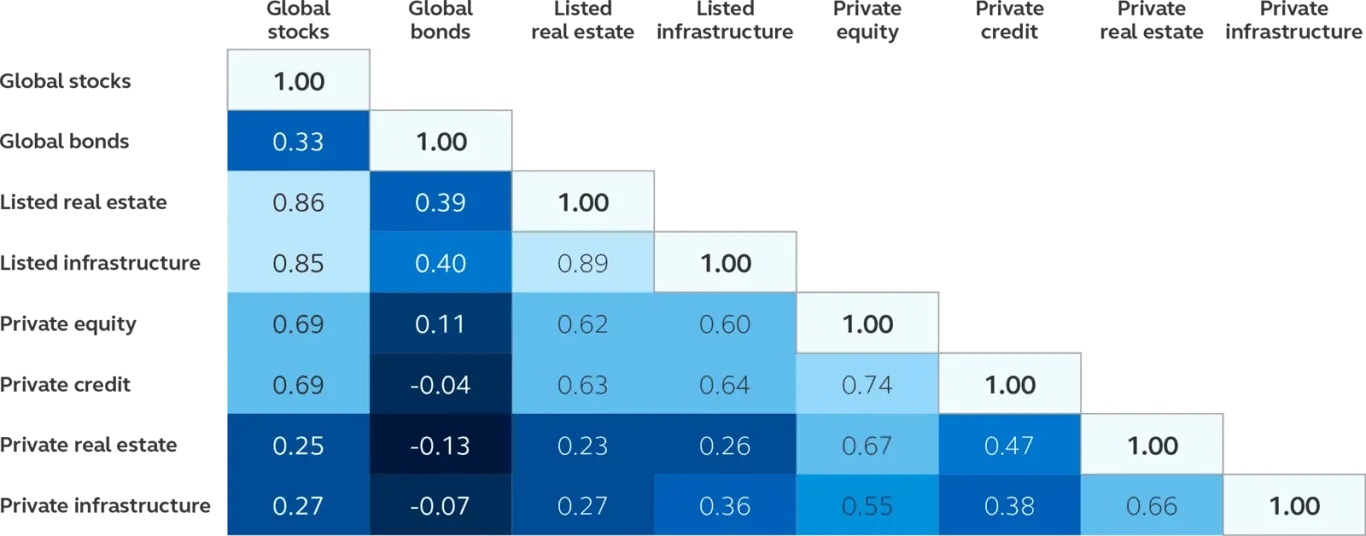

Private market exposure offers diversification, Correlation analysis

Source: Bloomberg S&P 500 Total Return Index, NFI-ODCE (Gross, Value Weighted) Index. Data from Q3 2006 to Q3 2024. Please see indices used in the important information section. Indices are unmanaged and do not take into account fees, expenses, and transaction costs and it is not possible to invest in an index.

This weakening of the diversification value of the 60-40 portfolio comes at a time when return opportunities in the public markets have become more limited. In a market where bond prices have been falling, the number of publicly traded U.S. companies is dwindling, and innovation is in high demand, private markets offer more opportunities to enhance income or gain early exposure to evolving market trends.

In all, real estate and private market offerings have provided investors with an attractive combination of income, growth, and diversification. For example, compare private real estate equity to the S&P 500. Over the past 25 years, the S&P 500 returned a total of 7.65% per year though December 31, 2024. Roughly 1.8% to 2% of that return came from income, and the results were delivered at 16.5% annual volatility.

Over that same horizon, the NCREIF NFI-ODCE index (a standard benchmark for Core institutional private equity real estate) delivered 7.08% per year with roughly 5.4% of that coming from income, all while maintaining only 6.72% in annual volatility. In addition, the correlation between these indices over that same horizon amounted to only 0.014%, arguably none.

Strategic integration: Best practices for wealth managers

Despite the growing availability and potential benefits of real estate and private market investments, their effective use requires strategic planning and due diligence. Wealth managers must consider each client’s liquidity needs, risk tolerance, and long-term goals when incorporating alternatives into a portfolio.

ASSET ALLOCATION. As a general guideline, most experts suggest that private market investments should make up no more than 15%–30% of a high-net-worth client’s overall portfolio, depending on their financial profile and time horizon. But liquidity needs are a core consideration whenever using real estate and private markets. Investors with more liquidity constraints should consider focusing on more liquid types of private products. The more private holdings in the portfolio, the greater the need to assess liquidity impacts and create a detailed liquidity plan.

| Investor type | Suggested allocation | Best practices |

|---|---|---|

| Affluent | 5-10% | Focus on diverse products that are liquid or semi-liquid |

| High-net-worth | 10–25% | Introduce more illiquid projducts that fit the client’s risk/return profile and potentially longer timeframe |

| Ultra-high-net-worth/institutional | 20–50% | Greater use of illiquid investments; develop detailed liquidity plan |

PRODUCT TYPES. Real estate and private markets offer categories of investments designed to meet a wide range of investor goals. All of these categories offer diversification potential when added to a traditional 60-40 portfolio but are geared toward achieving different types of outcomes for investors.

| Sector | Diversification strength | Income | Growth | Liquidity |

|---|---|---|---|---|

| Residential Real Estate (e.g., multifamily, Single-family rental) | Moderate | High | Moderate | Low |

| Commercial Real Estate (e.g., office, retail, industrial) | Varies | Moderate | Moderate | Low |

| Private Credit (e.g., direct lending, mezzanine) | High | Very high | Low-moderate | Low |

| Infrastructure (e.g., energy, data, transport) | High | High | Moderate | Low |

| Real Estate Turnarounds (e.g., value-add or distressed) | Moderate | Low-moderate | High | Low |

| Private Equity (e.g., buyouts, growth, Venture capital) | Varies | Low | Very high | Very low |

CLIENT COMMUNICATION. It’s important to discuss real estate and private markets options with your clients at length before allocating assets to these sectors. Unfamiliar clients will need a thorough understanding of the unique nature of these products and the way they can affect return, risk, and liquidity.

In many cases, real estate and private markets exposure offers income or return opportunities that are hard to match in the public markets. But the nature of the risks involved, and the tools to manage that risk, are different as well. It will be important to familiarize yourself with the risks and risk-mitigation strategies of each offering you direct clients toward.

For example, data centers are infrastructure projects that provide large technology businesses with the equipment needed to store and process data. They typically offer investors income and the potential for meaningful growth. However, data centers are dependent on factors like electricity costs or the failure of a key tenant. Many infrastructure financing deals try to manage these risks by imposing multi-year pricing agreements, performing due diligence on tenant credit worthiness, or by securing long-term leases with a diversified mix of tenant types.

Liquidity is also a particularly important topic. Private market strategies may have lock-up periods, redemption policies, or other terms that limit a client’s access to their liquid funds. These restrictions need to be aligned carefully with a client’s liquidity needs.

Finally, advisors will need to expand their skill at identifying real estate and private markets managers whose strategies align with client goals.

Download client infographic (PDF)

If you want to discuss these products in more detail and see how they can fit into your clients’ investment approach, ask an expert on our team.

Access additional tools to help navigate real estate and private markets.

Taking action

Real estate and private markets are no longer niche asset classes reserved for pension funds and endowments—they’re becoming essential tools in modern wealth management. As these opportunities continue to democratize, prepare to educate clients and build portfolios that responsibly incorporate these investments.

1 Yieldstreet Next Wave 2025 Private Markets Report.

2 BIS “The correlation of equity and bond returns”, December 2023.

For Public Distribution in the United States. For Institutional, Professional, Qualified, and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk considerations

Investing involves risk, including possible loss of principal. Past Performance does not guarantee future return. Real estate investment options are subject to risks associated with credit, liquidity, interest rate fluctuation, adverse general and local economic conditions, and decreases in real estate values and occupancy rates. There are risks associated with private equity that are not applicable to typical investments in the public equity market, are generally illiquid and carry the potential for significant losses. Typically, private credit investments are in restricted securities that are not traded in public markets, can range in credit quality and are subject to substantial holding periods. Infrastructure investments are long-dated, illiquid investments that are subject to operational and regulatory risks. Hedge funds may not be suitable for all investors and often engage in speculative investment practices which increase investment risk; are highly illiquid; are not required to provide periodic prices or valuation and often employ complex tax structures. Investment risk may be magnified with alternative investment strategies due to their use of arbitrage, leverage, and derivatives. Asset allocation and diversification do not ensure a profit or protect against a loss. The risk management techniques discussed seek to mitigate or reduce risk but cannot remove it. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. Data Center properties are only attractive to a unique type of tenant. A limited tenant base increases the risk of vacancy. Additionally, a property designed to be a data center may be difficult to re-let to another type of tenant or convert to another use. Thus, if operating a data center were to become unprofitable, the liquidation value of properties may be substantially less than would be the case if the properties were readily adaptable to other uses.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account.

Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided. All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Index descriptions: Global stocks represented by MSCI World TR, Global Bonds represented by Bloomberg Global-Aggregate Total Return Index Value Unhedged USD, Listed Real Estate represented by FTSE EPRA NAREIT Developed Index Net TRI USD, Listed Infrastructure represented by FTSE Global Core Infrastructure 50/50 Total Return Index in USD, Private Equity represented by Private Equity (Preqin, TR), Private Credit represented by Cliffwater Direct Lending Index, Private Real Estate represented by Real Estate (Preqin, TR), Private Infrastructure represented by Infrastructure (Preqin, TR).

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorised and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- United Arab Emirates by Principal Investor Management (DIFC) Limited, an entity registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as an Authorised Firm, in its capacity as distributor / promoter of the products and services of Principal Asset Management. This document is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- Hong Kong SAR by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission. This document may only be distributed, circulated or issued to persons who are Professional Investors under the Securities and Futures Ordinance and any rules made under that Ordinance or as otherwise permitted by that Ordinance.

- Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Global Investors, LLC (PGI) is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA), a commodity pool operator (CPO) and is a member of the National Futures Association (NFA). PGI advises qualified eligible persons (QEPs) under CFTC Regulation 4.7.

© 2025 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

MM14526 | 05/2025 | 4520120-052026