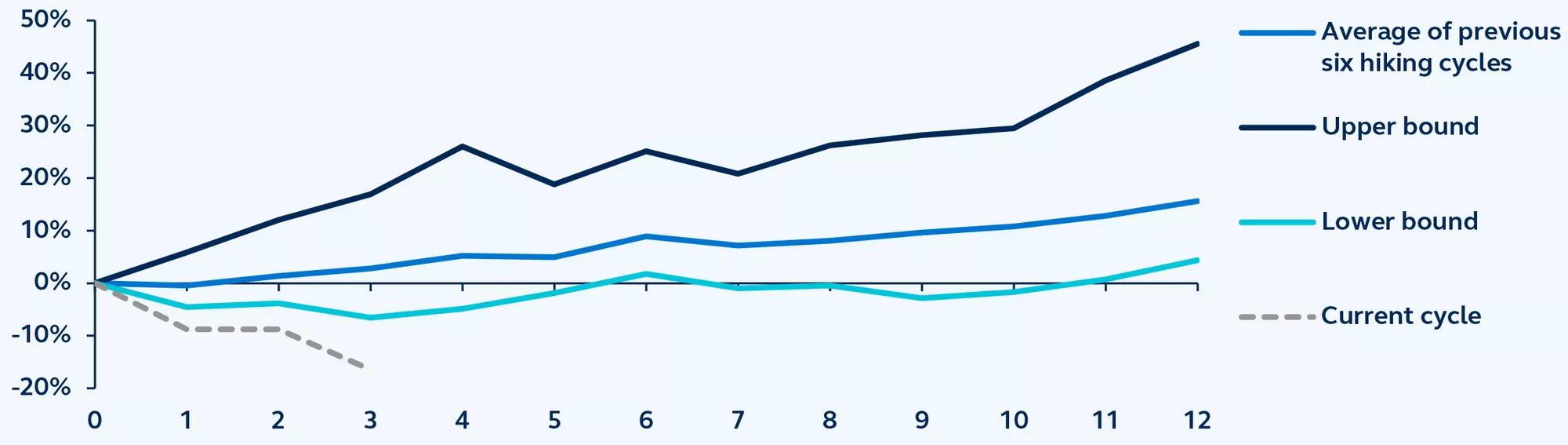

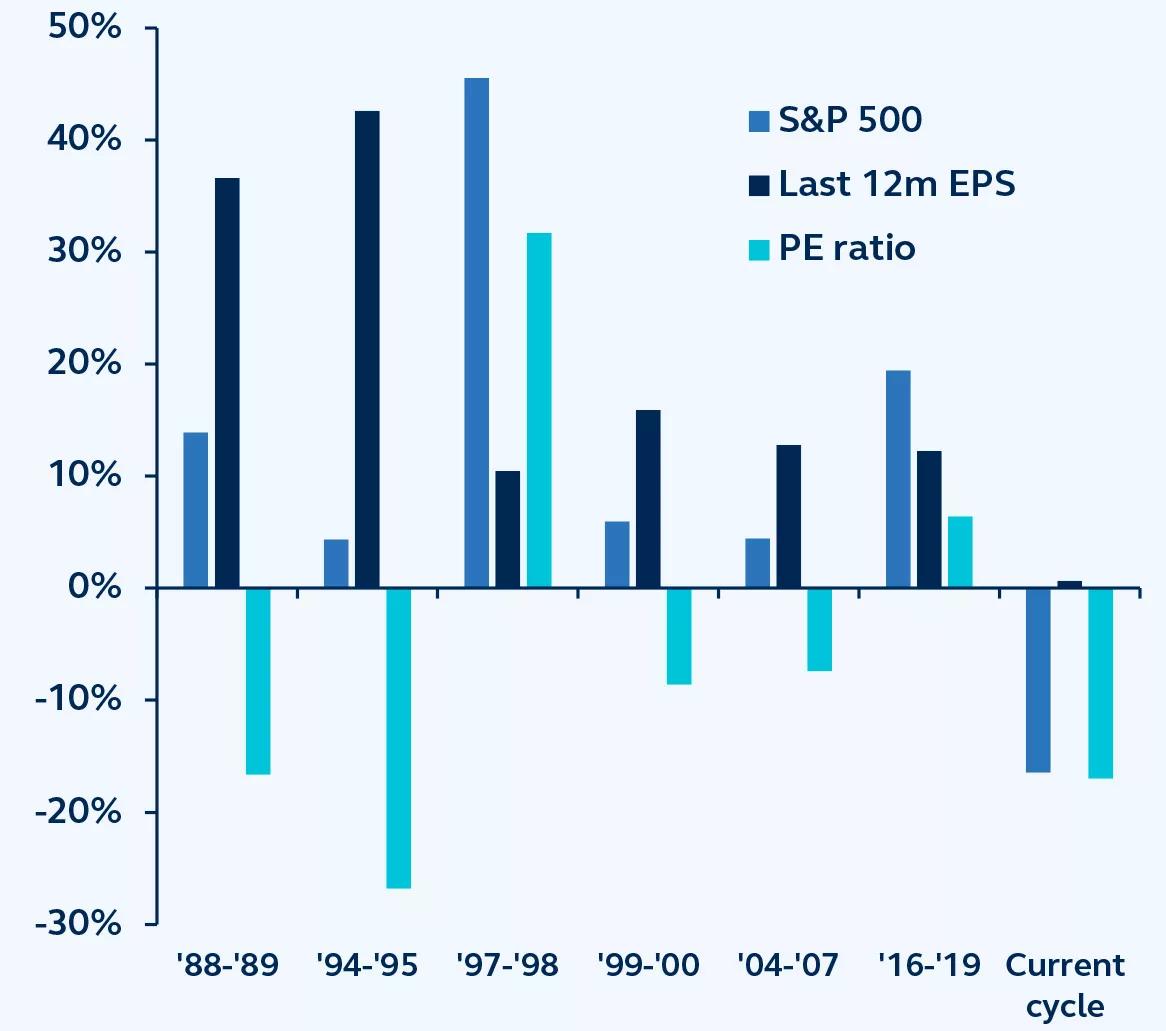

Whereas valuation compression weighing on equity returns was sizeable in the 1988–1989 and 1994–1995 cycles, earnings growth was more significant, ultimately carrying equity returns into positive territory. In contrast, earnings growth in the current cycle has been considerably more muted, failing to offset the drop in valuations and resulting in the very poor performance of U.S. equities.

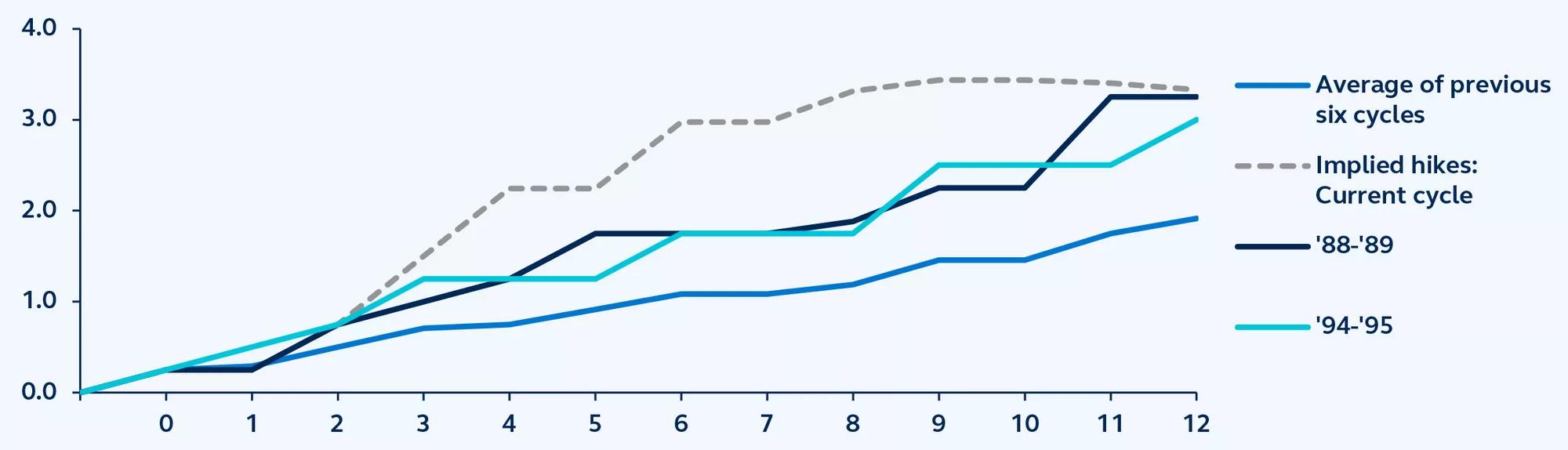

While earnings strength in a Fed hiking cycle may seem counter-intuitive, the current tightening cycle is the unusual one. The Fed has typically responded to higher inflation pressures as they emerge and, usually, inflation pressures have been driven by an over-heating economy. In those situations, earnings would have been strong as the Fed embarked on pulling back monetary accommodation. By contrast, in this cycle, the Fed waited until inflation had become entrenched and sticky before they responded, by which time price pressures were already starting to constrain household budgets, wage growth began pressuring corporate margins, and the economic slowdown had already kicked off.

The Fed’s delayed tightening response this year has meant that not only have market rate expectations soared, crushing equity valuations, but earnings growth was already slowing and therefore has been too soft to support equities higher.

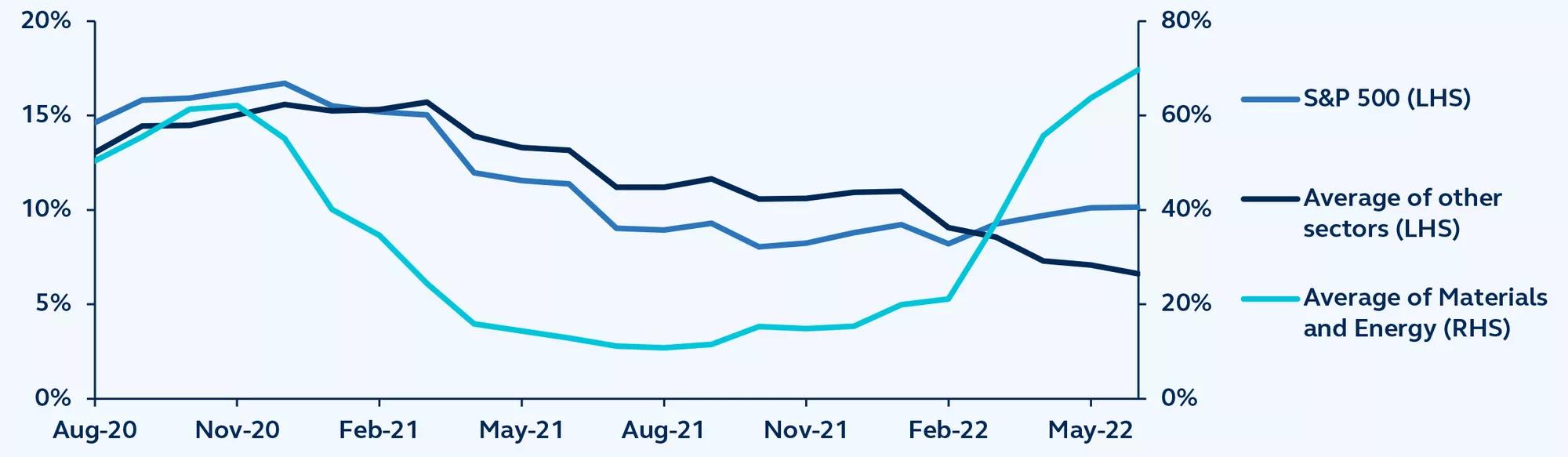

From here, although U.S. valuations have contracted significantly, given stubbornly high inflation and Fed commentary emphasizing that price stability is their priority, valuations could still fall slightly further. Certainly, on a historical basis, as U.S. equities have still been cheaper around 80% of the time, there is little pressure for multiple expansion.

Yet, with the bulk of valuation compression likely now behind markets, whether they can bounce back or drop further will largely depend on if earnings momentum can recover and deliver strong growth. Early indications are not encouraging.