The emergence of CMBS in the early 1990s changed the market for commercial mortgages fundamentally—for lenders, borrowers, and investors. Lenders no longer had to keep the mortgages they issued on their books for the duration of the loan. Instead, they could sell the stream of interest and principal payments to investors, freeing up their capital for more lending or other business activities. Borrowers, meanwhile, benefited from improved loan availability and competitive rates.

Investors gained, too. In broad terms, they now had an efficient way to invest in commercial mortgages and an asset class capable of meeting a wide range of risk-return preferences. More specifically, CMBS offered and continues to offer some notable and favorable characteristics:

Yield enhancement

Reflected in their spread premium over corporate bonds, often a popular choice for the yield-seeking investor

Diversification benefits

Within the CMBS asset class—based on the diversity of property locations, property types, tenants, and borrowers represented in each pool of loans, and

Versus other asset classes—because, historically, CMBS has shown relatively low long-term correlations to other fixed income and equity alternatives because

CMBS represents an alternative asset class exposure—credit performance is ultimately determined by how well the underlying commercial real estate properties perform

Attractive risk-adjusted returns

Secured by commercial real estate, mitigated from value shocks through loan underwriting, and enhanced through the bond structure.

However, because of their securitized structure, CMBS can often be viewed as complex by investors, leading some to avoid the asset class completely—despite the opportunities they present. The purpose of this document is to help demystify CMBS; to explain, as simply as possible, how a CMBS bond is created, what role the ratings agencies play, how investors are compensated for their investment, and the provisions that exist within many bonds to help preserve those rewards.

What are CMBS?

Generally speaking, CMBS are fixed rate bonds that represent an investment in a portfolio of first mortgages on a diverse range of commercial properties. This type of CMBS is commonly referred to as “conduit” CMBS and is the focus of this document. A first mortgage is the primary lien against a property and takes precedence over all other mortgages. That means that if the property is sold or if the borrower defaults, the first mortgage is paid before any other mortgage lien on the property.

Are CMBS a fixed income or real estate investment?

They are a hybrid of both. While a CMBS investment involves the purchase of a bond... the bond is backed by commercial real estate mortgages.

What’s the typical mortgage in a CMBS pool?

The mortgages are obviously commercial mortgages i.e. mortgages that have been taken out to finance the purchase or refinance of income-producing commercial properties such as office buildings, retail centers, apartments, hotels, and warehouses. On average, the borrower is required to contribute 40-50% of the property’s value from their own funds (ie. borrower equity), with the balance (50-60%) covered by the mortgage. A “typical” CMBS mortgage has a 10-year loan term, a fixed interest rate, a substantial balloon payment due at loan maturity, and investor-friendly prepayment protections. These prepayment protections are explained later in this document.

What does it take to invest in CMBS?

Since CMBS is a hybrid of real estate and fixed income, investors in the asset class must have expertise in both areas. At its core, CMBS is real estate because the performance of the underlying properties is the primary driver of the credit performance of any given CMBS bond. This is why it is critical to understand the risk profile of each CMBS loan, based on location, property quality, borrower dynamics, loan structure, etc. However, that’s only one piece of the puzzle since investors must also have a strong understanding of the CMBS bond structure, in addition to all of the other considerations faced by a traditional bond investor.

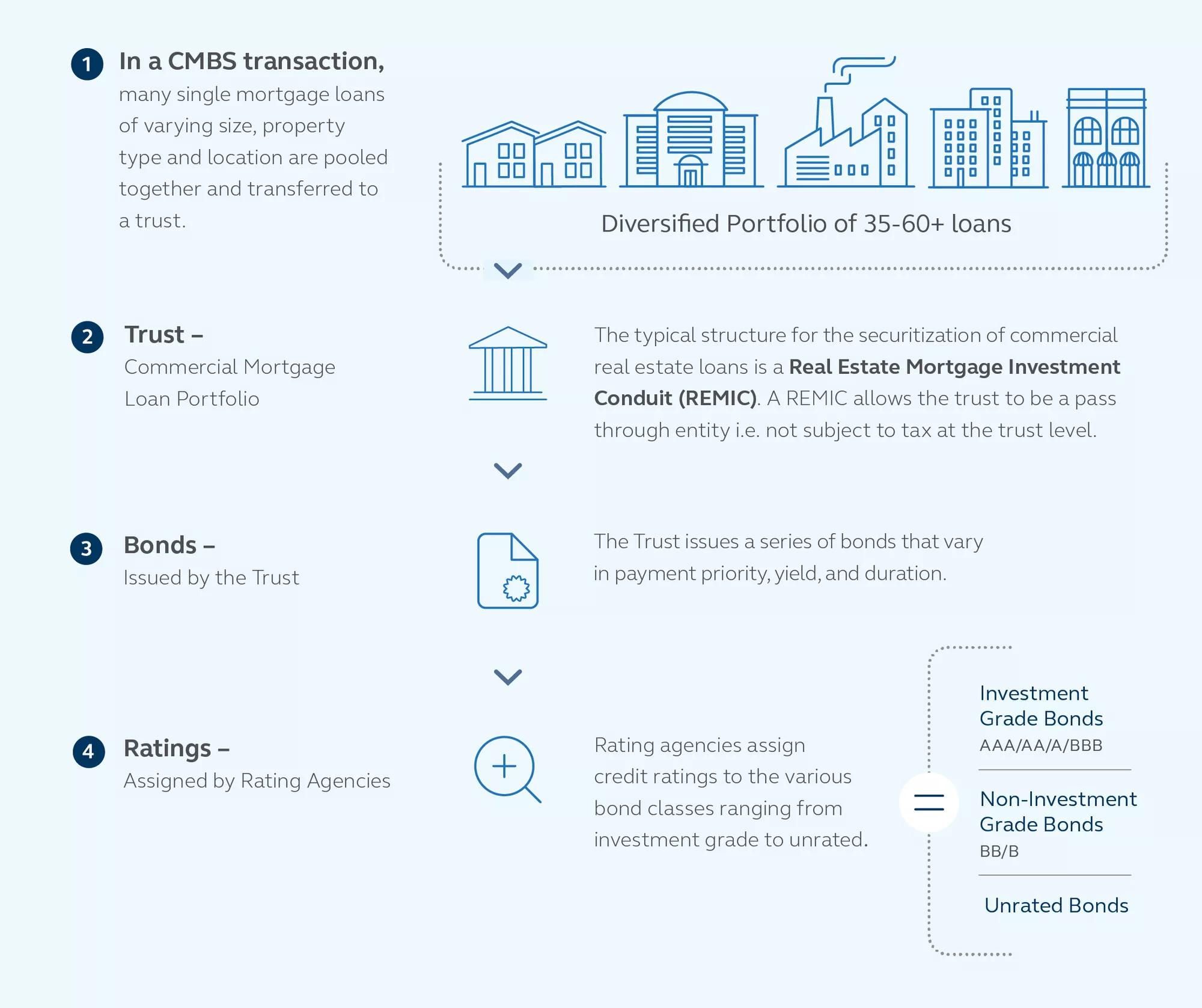

How is a CMBS bond created?

The best way to explain is with the following simplified diagram:

Securitization

The process of converting the commercial mortgage loan portfolio into bonds.

How does a CMBS bond compensate the investor?

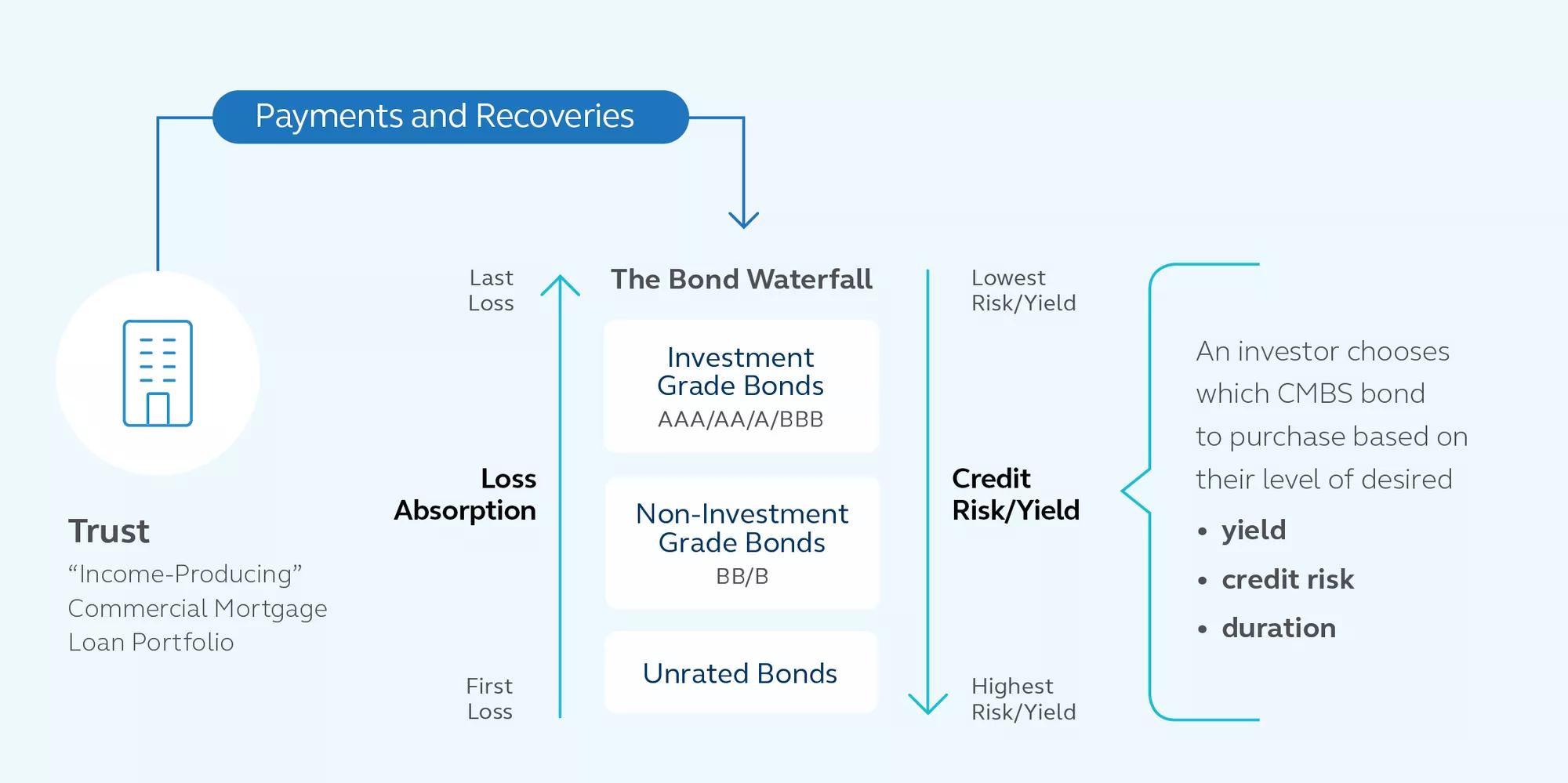

Each month the interest received from all of the pooled loans is paid to investors, starting with those investors holding the highest rated bonds, until all accrued interest on those bonds is paid. Then interest is paid to holders of the next highest rated bonds and so on. The same thing occurs with principal payments received. This sequential payment structure is generally referred to as the bond waterfall.

If there is a shortfall in loan payments from borrowers or if an underlying property is foreclosed upon and sold, but does not generate sufficient proceeds to pay off the loan balance, investors in the most subordinate outstanding bond class will incur losses first, with accumulated losses impacting more senior classes in reverse order of payment priority. In this way, lower rated bonds act as a shock absorber for higher rated bonds. This is called subordination or credit enhancement.

It is important to keep in mind that the example provided here is very simplified. As with any other asset class, a more detailed review could reveal other complexities, however understanding the basic structure is an important first step.

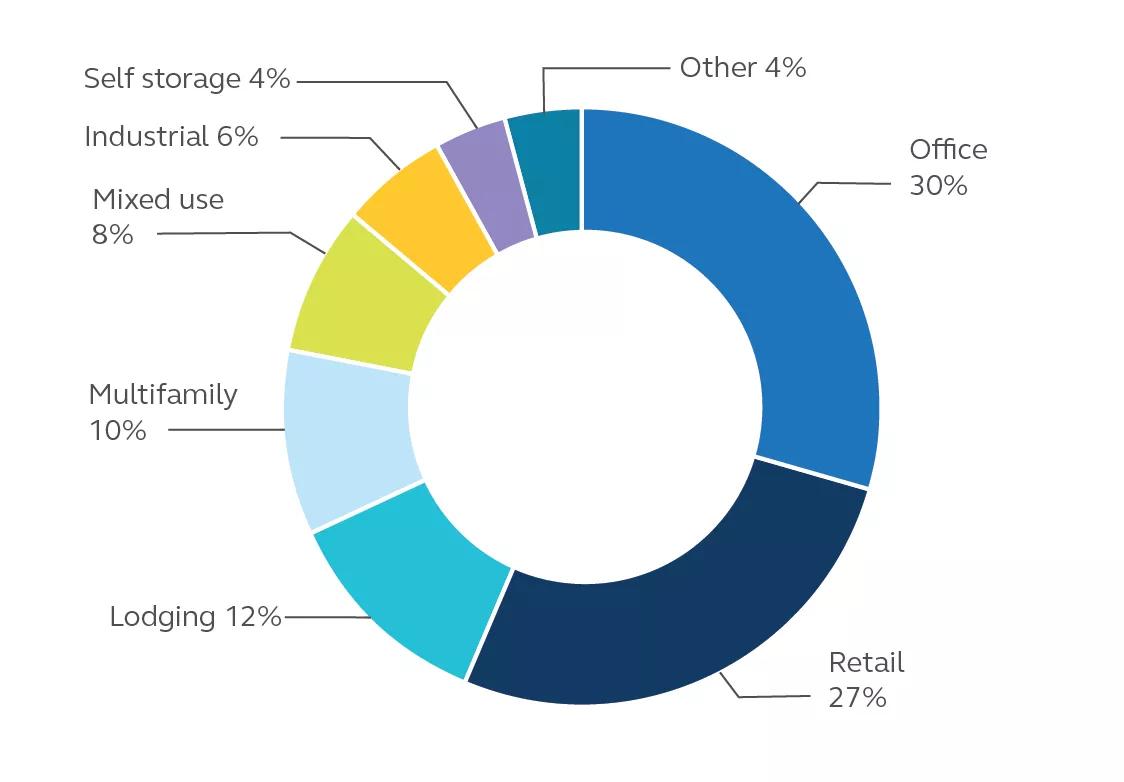

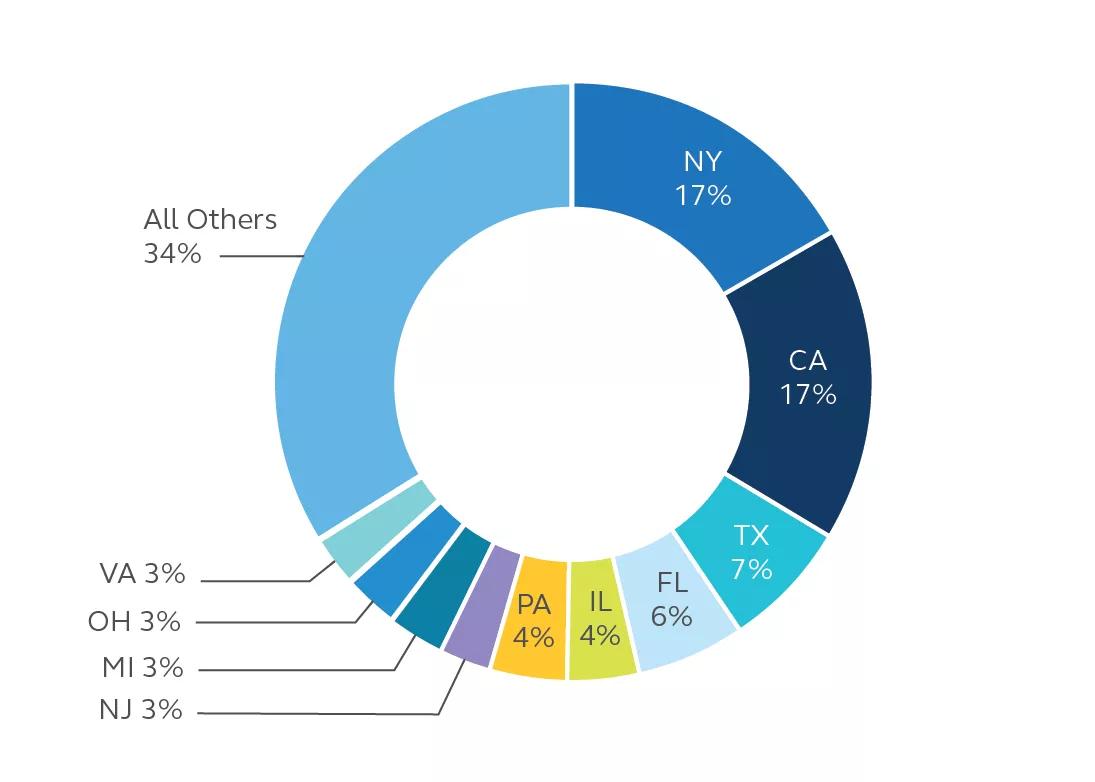

How diversified is the pool of mortgages that backs CMBS bonds?

Each conduit CMBS issuance is well-diversified by property type and geography as shown in the charts below. The typical mortgage pool consists of 35-60+ loans, with the largest 10-15 comprising a significant portion of the pool. In contrast to residential mortgage-backed securities (RMBS), where the loans are relatively homogenous, CMBS loans often have varied and unique credit characteristics. Successful investment in the asset class, therefore, requires granular analysis of the individual loans in the mortgage pool.

EXHIBIT 1: Property type diversification

Sources: Trepp LLC, Principal Real Estate.

As of 19 May 2023.

EXHIBIT 2: Geographic diversification rate

Sources: Trepp LLC, Principal Real Estate

As of 19 May 2023.

Can CMBS bond ratings change over time?

Yes they can. Rating agencies establish a rating for each bond class at the time the securitization is issued based upon their assessment of credit risk in the mortgage pool and the amount of subordination carried by each bond class. The original bond ratings assume the credit quality of the loan pool will not change significantly over time. However, as the economic landscape and commercial real estate markets change, the agencies monitor the mortgage pool’s performance and update ratings based on property performance, delinquency and potential loss events affecting the loans within the trust.

What types of investors buy CMBS bonds?

CMBS is an asset class that institutional investors traditionally look to for yield enhancement and diversification to complement a broader portfolio.

- Insurance companies and asset managers are particularly active in investment grade CMBS bonds, given their relative value versus other fixed income alternatives.

- Banks and money market managers tend to focus on the shorter duration, higher quality portion of the CMBS universe.

- Hedge funds and private equity firms are the primary investors in below-investment grade CMBS bonds.

- Specialized investors, referred to as “b-piece buyers,” purchase varying portions of the lowest-rated classes of each issuance at new issue.

Are CMBS bonds more illiquid than other fixed income investments?

No, not in general... but this is a common misperception of the asset class. In reality, CMBS bonds trade in an active market with ongoing new issuance and secondary trading supported by dealers at major banks and more specialized regional brokers. Increased regulation has reduced the amount of capital available for broker/dealers to hold bonds on their balance sheets, which has reduced liquidity across the entire fixed income landscape. Because of this, broker/dealers have moved away from “market making” (being willing to buy bonds from investors wanting to sell) towards “market facilitating,” i.e. seeking to efficiently connect buyers and sellers. While liquidity ebbs and flows with market conditions, CMBS offers investors the ability to actively trade, similar to the corporate bond market.

What happens when a loan within the mortgage pool is repaid early? How does it impact an investor’s return?

It should have little or no impact to most bonds, because CMBS are generally “call protected” as opposed to the residential market where most loans are freely pre-payable. What that means is that an underlying CMBS loan generally cannot be prepaid (repaid early) without investors receiving some form of compensating payment to help maintain their expected yield.

Call protection in CMBS is achieved through either defeasance or some form of prepayment penalty.

- Defeasance involves the substitution of government securities for the mortgage collateral. A borrower wishing to obtain a release of its property from the trust may purchase and pledge to the trust a collection of government securities that are specifically selected to generate sufficient cash to make all monthly payments due on the loan through and including any balloon payment due at maturity.

- Prepayment Penalties consist of the payment of a sum of money designed to compensate investors for the loss of yield (often referred to as “yield maintenance.”) Yield maintenance is a present value calculation that enables investors to reinvest the loan payoff proceeds at then current treasury yields through the original loan maturity and maintain the same yield as if the loan had not paid off early.

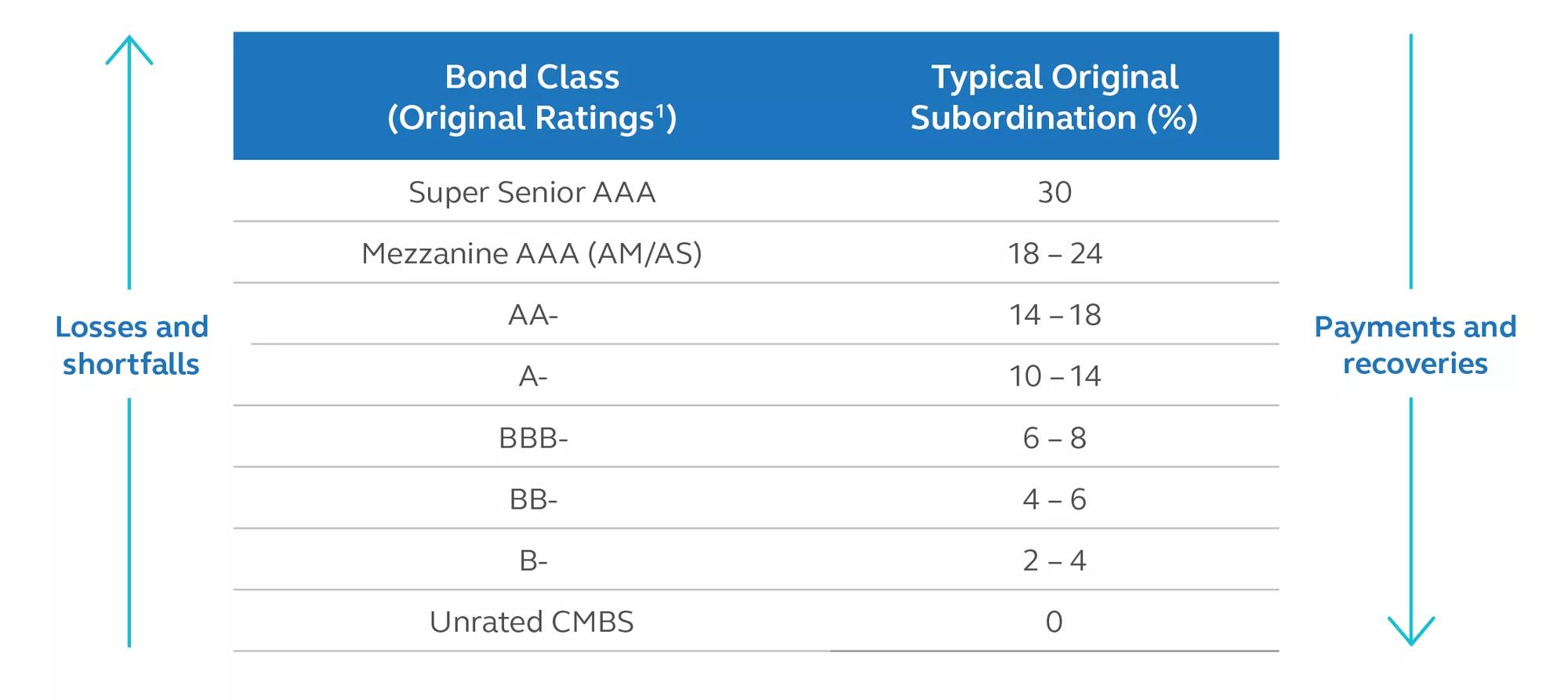

What extra hedge does subordination provide investors against losses in the trust?

As already noted, if there is a loss or a shortfall in loan payments within the mortgage pool, investors in the most subordinate bond class will incur a loss first, with any accumulated losses impacting more senior classes in reverse order. However, each bond senior to the unrated class is buffered from losses by varying levels of subordination (a form of credit enhancement). So, for example, a bond with 30% subordination would be hedged from cumulative losses within the mortgage pool of up to 30% of the original mortgage balance before incurring its first dollar of loss.

The following table is an example of the subordination levels that might apply to varying bonds within a CMBS structure.

EXHIBIT 3: CMBS Structural examples

$0.7-$1.0+Billion pool of commercial mortgages

1 Original ratings.

For illustrative purposes only.

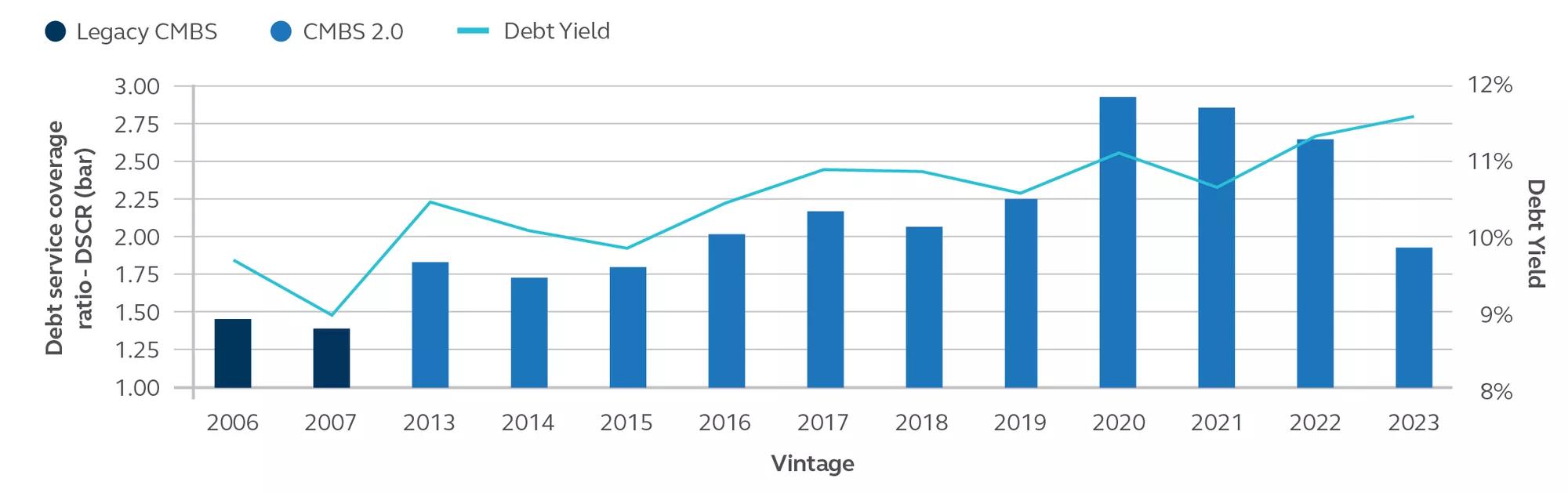

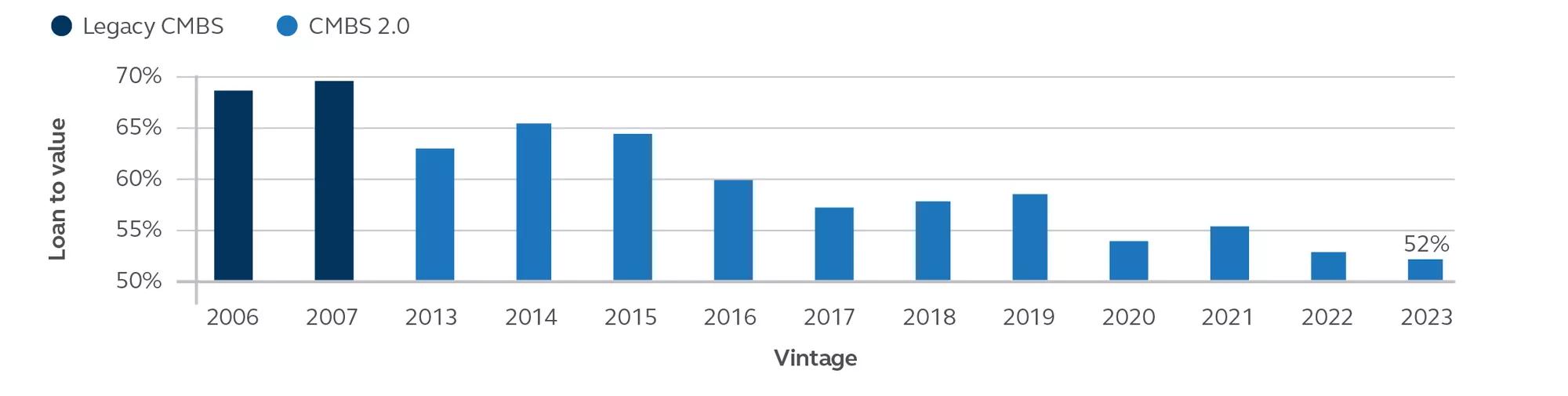

CMBS 2.0 and Legacy CMBS: What’s the difference?

Legacy CMBS are bonds issued prior to 2009, while CMBS 2.0 are bonds issued after 2009. The basic structure of CMBS 2.0 is very similar to legacy CMBS, but several important improvements have been made to the general credit profile since the global financial crisis.

- Focused on real cash flow: Mortgage underwriting is now more reflective of the cash flow currently being generated by the underlying properties. There is very little “pro-forma” underwriting—an aggressive practice prevalent in legacy mortgages, which based current cash flow underwriting on often overly optimistic projections.

- More conservative underwriting: Underwriting metrics are more conservative providing a larger equity cushion (i.e. lower loan-to-value ratio) and higher debt service coverage ratios (see charts below). DSCR’s have begun to normalize with rising rates, but LTV’s and debt yields (Net Operating Income (NOI)/Loan Amount) have become increasingly conservative in response.

- Higher levels of subordination: Rating agencies now require higher levels of subordination for each bond class (tranche) in the structure. For example, CMBS 2.0 AAA rated bonds now carry approximately 20% subordination, whereas subordination on comparable legacy AAA bonds was around 12%, a 67% increase in structural credit enhancement.1

1 Source: Citi Research, Principal Real Estate. As of 31 March 2023

EXHIBIT 4: Improved underwriting metrics

CMBS 2.0: better able to service debt

Source: Citi Research, Principal Real Estate. As of 31 March 2023.

CMBS 2.0: lower LTV than Legacy CMBS

Source: Citi Research, Principal Real Estate. As of 31 March 2023.

What is risk retention and what does it mean for CMBS?

Risk retention is a regulatory requirement under Dodd-Frank aimed at creating better alignment between CMBS issuers and investors in response to the global financial crisis. For CMBS in particular, the risk retention requirement can be satisfied by the issuer, loan originator(s), b-piece buyer, or a combination thereof. Generally speaking, the risk retention holder is prohibited from directly hedging or leveraging the position and is required to be a long term holder of the investment. This regulation was implemented at the end of 2016.

Are there different types of CMBS?

Yes, conduit CMBS has been the focus of this piece but the asset class has evolved over time to include other sub-sectors which offer investors a more diverse set of opportunities that can be accessed to meet a wide variety of investment needs.

CONDUIT

Diversified pools of mortgages on office, retail, industrial, hotel, and apartment properties. Fixed rate.

SINGLE ASSET / SINGLE BORROWER (SASB)

Mortgage collateral is secured by a single “trophy” property or a portfolio of assets owned by the same borrower. Fixed and floating rate.

AGENCY

CMBS and pass through securities issued primarily by Freddie Mac or Fannie Mae, backed by mortgages on apartments. Fixed and floating rate.

CRE CLO

Pools of mortgages typically secured by transitional properties in need of shorter term “bridge” financing. Floating rate.

CMBX

Credit default swap contracts that provide conduit CMBS exposure to an underlying index. Derivative instrument.

Asset allocation and diversification do not ensure a profit or protection against loss.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in Other Permitted Jurisdictions as defined by local laws and regulations.

Risk Considerations

Investment involves risk including possible loss of principal. Past performance is no guarantee of future results. Fixed-income investment options that invest in mortgage securities, such as commercial mortgage- backed securities, are subject to increased risk due to real estate exposure. Commercial Mortgage Backed Securities carry greater risk compared to other securities in times of market stress.

Important Information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided. All figures shown in this document are in U.S. dollars unless otherwise noted. Investing involves risk, including possible loss of principal.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to, or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is intent for use in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe - Europe by Principal Global Investors (EU) Limited, Sobo Works, Windmill Lane, Dublin D02 K156, Ireland. Principal Global Investors (EU) Limited is regulated by the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID). The contents of the document have been approved by the relevant entity. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (EU) Limited (“PGI EU”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGI EU, PGIE or PGI EU may delegate management authority to affiliates that are not authorized and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland.

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorised and regulated by the Financial Conduct Authority (“FCA”).

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg.No.199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission. This document is intended for sophisticated institutional investors only.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission and is directed exclusively at professional investors as defined by the Securities and Futures Ordinance.

- Other APAC Countries, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Global Investors, LLC (PGI) is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA), a commodity pool operator (CPO) and is a member of the National Futures Association (NFA). PGI advises qualified eligible persons (QEPs) under CFTC Regulation 4.7.

Principal Funds are distributed by Principal Funds Distributor, Inc.

© 2023 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal Real Estate is a is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

MM10146-03 | 06/2023 | 2937008 - 062024