The precarious debt ceiling stalemate in Washington, D.C. has increasingly drawn investor’s attention. To date, U.S. lawmakers have failed to agree to increase the debt limit, which has already begun distorting some markets. Since both sides know what is at stake, default is improbable. However, every day closer to the Treasury's June 1 deadline without a resolution will likely elevate volatility in markets, trim demand for U.S. risk assets, and even expedite recession.

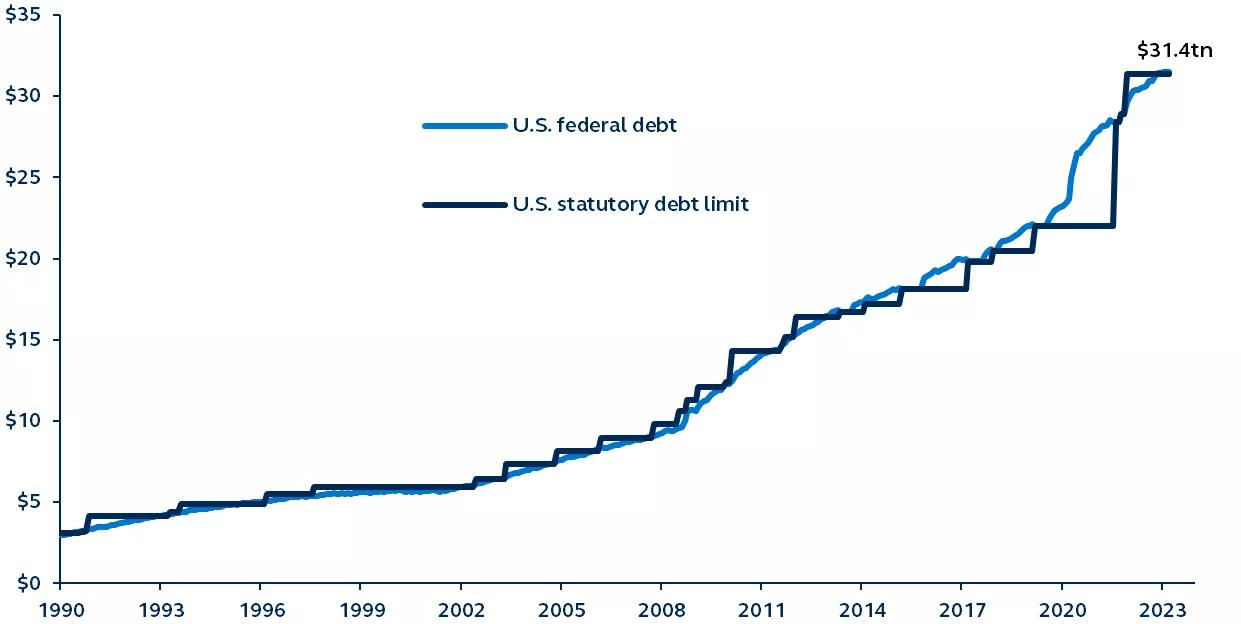

United States federal debt and statutory debt limit

$U.S. trillion, 1990–present

Source: Federal Reserve, U.S. Treasury, Bloomberg, Principal Asset Management. Data as of May 11, 2023.

U.S. Congressional lawmakers need to come to an agreement to either suspend or raise the debt ceiling. Failure to do so could result in the U.S. government defaulting on its debt (something it hangs its hat on never having allowed to happen).

Since January 2023, the U.S. Treasury has been enacting “extraordinary measures” to navigate the rapidly closing gap between the U.S. debt level and the $31.4 trillion debt ceiling—measures the Treasury has indicated will be exhausted by June 1. Significant party disagreement around the conditions tied to raising the debt ceiling has left Congress at a stalemate, amplifying investor tension as the deadline approaches.

While an outright default that would wreak havoc on global financial markets and increase borrowing costs for businesses and consumers is unthinkable, a U.S. debt rating downgrade, similar to 2011, cannot be dismissed. A government shutdown, of which there have been four since 1995, is even more conceivable. Regardless, even the uncertainty from the debt ceiling stalemate could trigger a sell-off in U.S. risk assets and potentially expedite recession.

This isn’t the first time the federal debt limit has been under the microscope, and optimism for resolution appears intact for now. However, investors should take note of the rising likelihood of near-term market volatility from this chronic procedural deficiency and dangerous legislative brinkmanship.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal®.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.