The recent failure of three U.S. banks has unnerved the preferred and capital securities market. However, with spreads near their highest in the last decade, coupled with new regulatory support that helps limit the risk of banking crisis contagion, now could be an attractive entry point to the asset class.

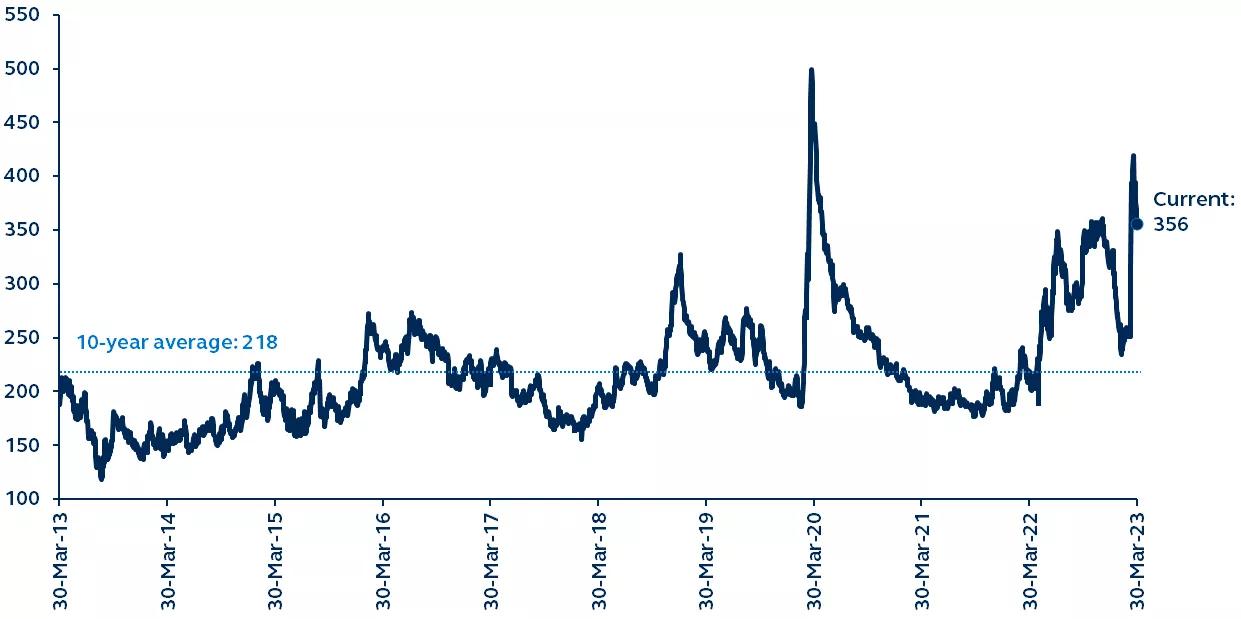

Investment grade $1,000 par spreads

ICE BofA ML U.S. Investment Grade Institutional Capital Securities Index spread-to-worst vs. gov’t, last ten years

Source: Bloomberg, Principal Asset Management. Data as of March 30, 2023.

The recent banking crisis created significant turmoil in several markets, including preferred and capital securities—hybrid securities that have features of both stocks and bonds and sit between the two in the capital structure. Yet, with the crisis seemingly now contained, the extra risk attached to the hybrid assets is likely overdone, creating a compelling investment case:

- The three U.S. banks that collapsed were unique to the broader banking sector—and the risks have been further reduced by recent federal regulatory support and a new Federal Reserve lending program.

- The decision by Swiss regulators to wipe out Credit Suisse Additional Tier 1 (AT1) bondholders ahead of equity holders in the UBS merger initially had the market perplexed, triggering significant selling of the AT1 and contingent capital (CoCo) market. However, European regulators have since confirmed that, for banks outside Switzerland, AT1 bonds only take losses after equity holders, thereby removing a key source of investor concern.

- Following the banking crisis, yields are near their highest levels in more than 10 years, and spreads to yields on risk- free Treasurys are historically wide.

Investors may want to consider taking advantage of this market dislocation, as these assets now offer a yield advantage over core bonds and, with regulators and policymakers intent on containing banking sector risks, have a more attractive risk profile than high yield.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Potential investors should be aware that Investment grade corporate bonds carry credit risks, default risk, liquidity risks, currency risks, operational risks, legal risks, counterparty risk and valuation risks. Risks of preferred securities differ from risks inherent in other investments. In particular, in a bankruptcy preferred securities are senior to common stock but subordinate to other corporate debt. Contingent capital securities (CoCos) may have substantially greater risk than other securities in times of financial stress. An issuer or regulators decision to write down, write off or convert a CoCo may result in complete loss on an investment.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal®.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2823406