Investors expect that they’ve now seen the last rate hike in this hiking cycle, and for rate cuts to begin as soon as July. However, persistently strong economic data suggests that such a significant pivot in Federal Reserve sentiment is unlikely. For rate cuts to be in the cards, the Fed will need to see a desperately struggling economy or a financial crisis—not a particularly favorable backdrop for investors.

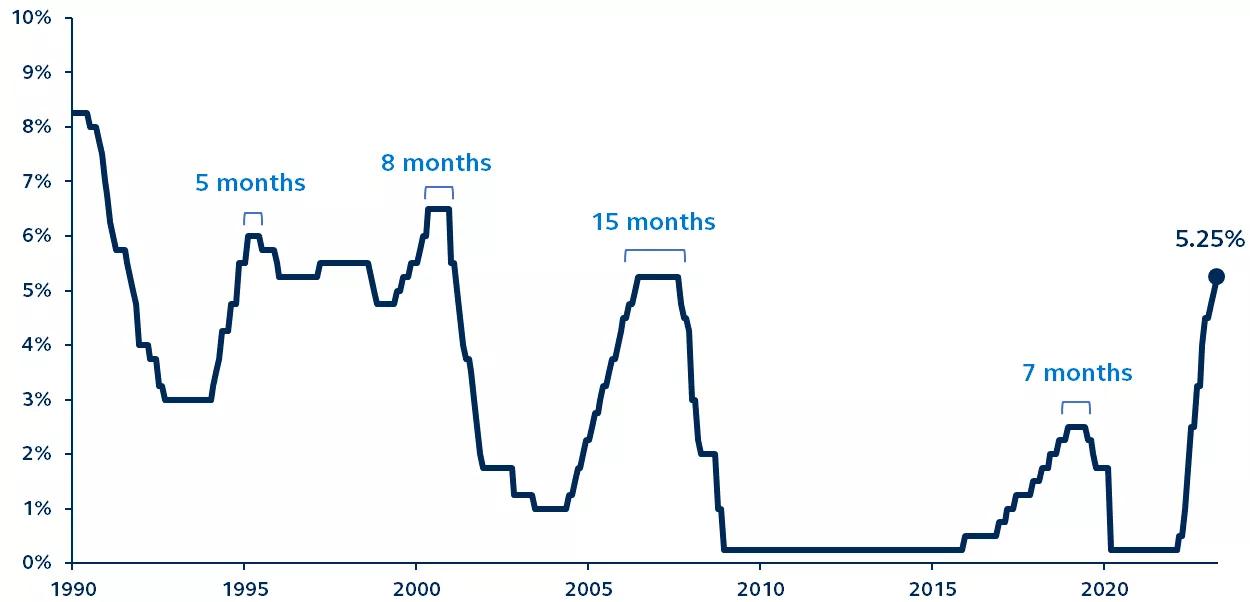

Federal Reserve policy rate

Upper bound, 1990-present

Source: Bloomberg, Principal Asset Management. Data as of May 5, 2023.

Following this week’s rate hike, markets are pricing that the Federal Reserve will stop its hiking cycle and have a near-term policy pivot. In fact, Fed fund futures are pricing in a 35% chance of a rate cut in July and are fully pricing in 75 basis points worth of cuts by year-end.

Such a rapid turnaround in policy would be highly unusual. Over the past four hiking cycles, the period between reaching peak Fed funds to lowering rates has ranged from 5 months in the 1994-1995 cycle to 15 months in the 2004-2006 cycle. The latest FOMC statement does not mention a potential easing scenario, suggesting that a significant change in economic conditions is necessary before a pivot is considered.

- A sharp rise in unemployment: The unemployment rate fell back to a multi-decade low of 3.4% in April. Inflation will stay sticky and elevated as long as the labor market remains tight.

- Acute financial strains: Despite three bank failures and the KRE regional bank index down over 40% since February, the Fed still considers the U.S. banking system sound. A further sharp escalation of banking strains would likely be necessary to change the Fed’s perspective.

The conditions necessary for the Fed to pivot and cut rates are dismal, requiring a desperately struggling economy or a financial crisis. Investors: be careful what you wish for.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal®.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2888044