Policy outlook

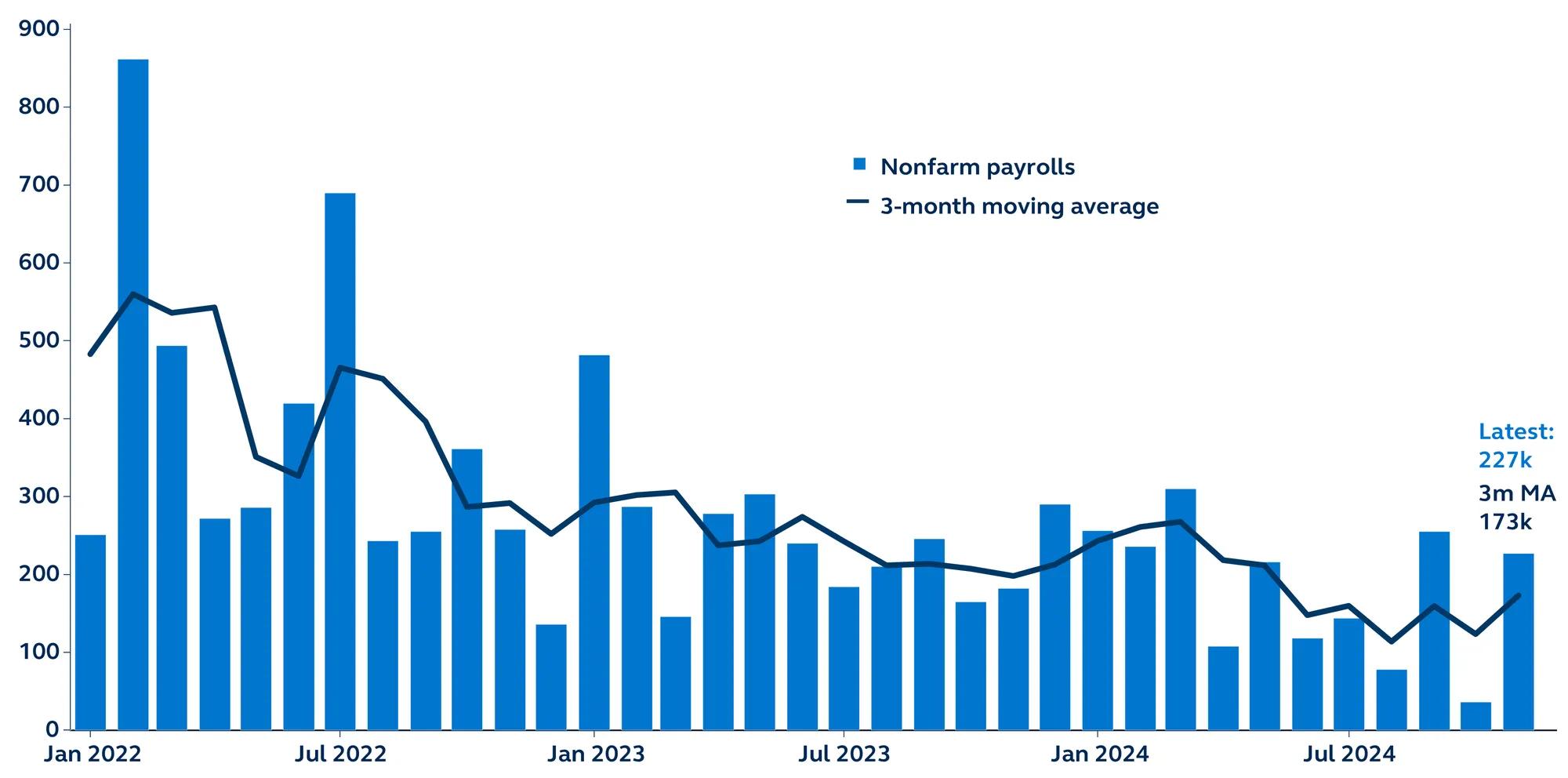

The absence of a large upside surprise snapback from October’s weather and strike weakened print reinforces the case for a Fed cut in December. Today’s data is also unlikely to incite any meaningful worries about the labor market. Nevertheless, labor demand is slowing, as evidenced by the rise in unemployment rate and duration of unemployment. These are among the cracks in the labor market that require Fed attention.

At the same time, with average earnings growth still stubborn, and the uncertain inflationary impact of the incoming Trump administration’s economic policies, the Fed must proceed down its rates path with significant caution and care. What started out as a Fed pivot to an ongoing easing cycle, may have evolved into a central bank swerve.