Despite signs that inflation has likely peaked in certain areas of the world, the idea that the global monetary tightening cycle might soon come to an end is misplaced. With CPI levels set to remain at uncomfortable levels for the foreseeable future, inflation mitigation remains key for investors.

Global inflation

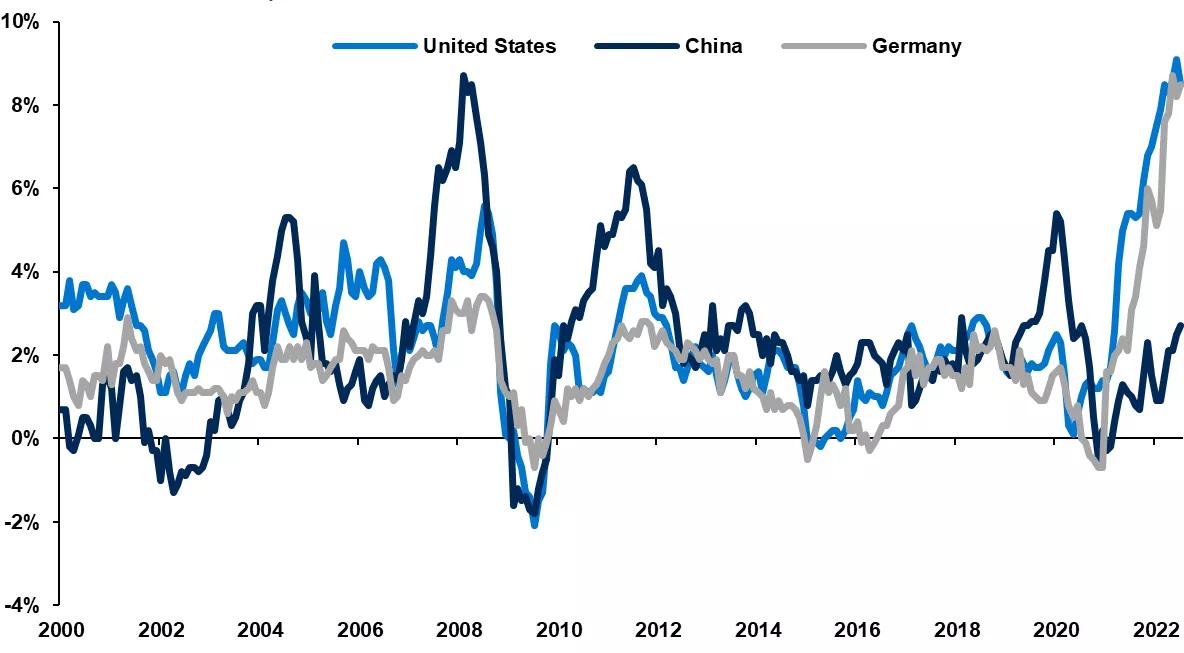

Annual headline CPI, 2000-present

Bloomberg, Principal Global Investors. Data as of August 11, 2022.

Softer than expected inflation data in the United States and China has prompted hopes that the global monetary tightening cycle may soon end. This view, however, is hopelessly optimistic.

U.S. headline CPI eased from 9.1% to 8.5% in July, helped by the recent softening in energy prices. Peak inflation may be behind us, but CPI will remain uncomfortably high as sticky shelter and services inflation continue to put upward pressure on prices. It will be some time before the Fed feels sufficiently comfortable to pause rate hikes.

China's headline CPI rose from 2.5% to 2.7% in July, lower than expected but its highest level in two years. China's inflation issue is diminutive compared to the U.S. Even so, rising food prices imply that inflation may rise further over coming months, potentially pushing it above the People's Bank of China's 3% target, limiting the space for rate cuts.

Unlike the U.S., Germany's inflation peak is still ahead. Headline CPI rose from 8.2% to 8.5% in July and the relentless rise in natural gas prices will likely push inflation into double digits later this year. Against that backdrop, even the oncoming Eurozone recession cannot stop the European Central Bank from hiking rates further.

The U.S. outlook is still one of uncomfortably high inflation, China's inflation problem may be growing, while Europe's inflation problem is extraordinarily pressing. The need for inflation mitigation has not disappeared.

Wall Street Journal Custom Content is a unit of The Wall Street Journal advertising department. The Wall Street Journal news organization was not involved in the creation of this content.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor's investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the United States. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world.

Principal Global Investors leads global asset management at Principal.®

2350717