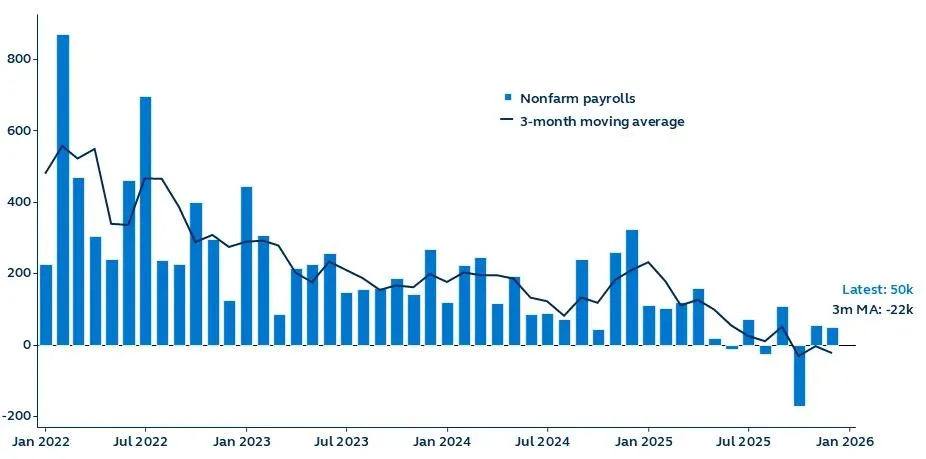

The December jobs report showed a weaker-than-expected 50,000 gain in payrolls. There were also material revisions to prior months, bringing three-month average job growth into negative territory, underscoring how momentum has softened even as the headline remains positive in December. Yet, with the unemployment rate also surprisingly declining to 4.4%, the narrative remains intact: employment continues to cool, yet it is not collapsing.

Thousands, January 2022–present.

Source: Clearnomics, Bureau of Labor Statistics, Bloomberg, Principal Asset Management. Data as of January 9, 2026.

- Total non-farm payrolls increased by 50,000 in November, below expectations of 70,000. Worryingly, both the November and October reports were revised lower, pushing the three-month average job gain into negative territory, contracting by an average of 22,000 per month over the period. Private payrolls were also very weak, gaining only 37,000 in the month versus expectations of 75,000. All of these point to an ongoing deceleration in labor demand, although, coupled with diminished labor supply, it suggests that the overall labor market picture is not as weak as the headline data may indicate.

- Overall job growth in December was driven by a few industries, particularly amid strong hiring in leisure & hospitality, healthcare & social assistance, and state and local government. The narrow breadth of job growth has been evident for some time, with the bulk of new employment gains occurring within the healthcare and government industries, albeit to a decelerating degree. Meanwhile, the strength in leisure & hospitality was a reversal of last month’s temporary weakness, and may indicate that households were still prioritizing experiences and travel over the fall and holiday seasons.

- On the other hand, leading job declines were the retail trade and construction industries. While colder-than-usual weather early in the month potentially weighed on construction hiring activity, the weakness in retail trade arose despite a relatively late start to the holiday season this year, which should have pushed more hiring into December. Meanwhile, manufacturing jobs declined for an eighth consecutive month, pointing to ongoing malaise brought by tariff policies.

- The unemployment rate surprisingly declined to 4.4%, from a downwardly revised 4.5% in November. This was in part driven by a reversal of technical idiosyncratic factors, such as a spike in temporary layoffs and labor force reentrants. Both are likely data distortions brought about by the government shutdown. In addition, the number of job losses also declined, consistent with still low initial jobless claims data. Together with average hourly earnings remaining firm, growing 3.8% over the past year, it suggests that the labor market is not collapsing. Nevertheless, with the number of long-term unemployed remaining elevated, and the average duration of unemployment spiking to above 11 weeks, difficulties in finding a new job persist.

- The labor force participation rate inched lower, reflecting downside structural pressures on labor supply from immigration policy and demographics. This decreases the level of new job creation needed to keep the unemployment rate steady.

The prospect of a January Fed rate cut has all but vanished following the unexpected drop in the unemployment rate. For now, it remains difficult to argue that the labor market is collapsing and in urgent need of monetary support. Indeed, as both labor demand and labor supply contract, this maintains the labor market’s precarious, yet stable, “low-hire, low-fire” environment.

However, the picture remains far from clear: payroll growth undershot expectations, and downward revisions to prior months have pushed the three-month moving average into negative territory. While a tighter labor supply may explain part of the dynamic, sustained job losses hardly inspire confidence. The U.S. economy likely requires additional support from the Fed, just not immediately.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

5112355