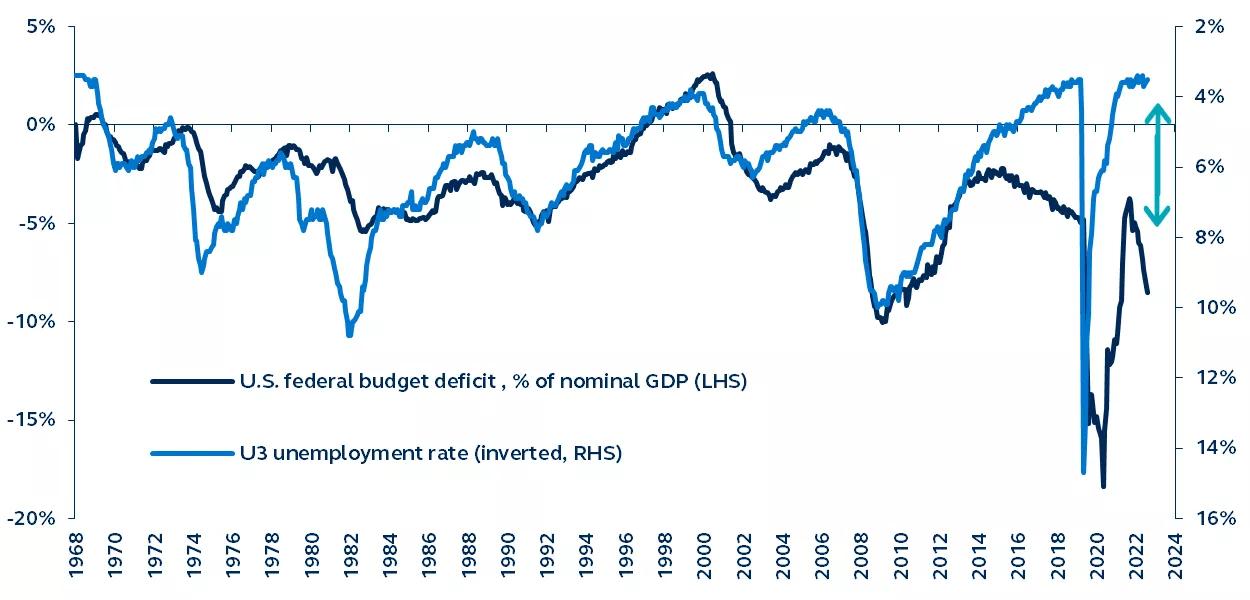

Another consequence of ever-higher fiscal deficits putting pressure on yields is the assessment of bond rating agencies. On August 1, Fitch Ratings downgraded U.S. Treasury debt from its highest rating of AAA to one increment lower, AA+, reflecting the expected high and growing general government debt burdens. Rationally, the structural and potentially unsustainable character of U.S. public debt requires higher yields to appeal to investors.

In addition to the challenges posed by Treasury bond issuance, the corporate and mortgage bond sectors (MBS) have contributed to the mounting pressures on the market. For corporates, the end of summer often brings about higher bond issuance, and this year’s issuance once again proved substantial. On the MBS front, the resolution of bank failures earlier this year led to transferred mortgages being securitized and offered to bond investors. These combined factors have further deepened the strain on an already saturated bond market.

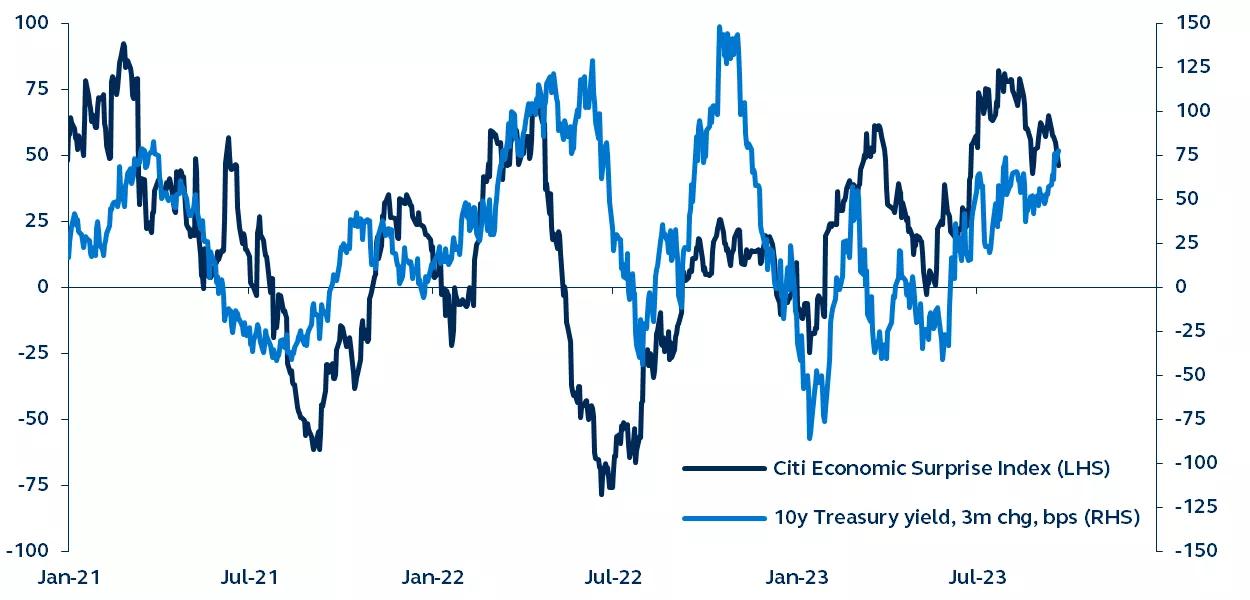

This year, persistent fiscal deficits requiring Treasury issuance, corporate bond issuance, and the sudden increase in mortgage issuance hit bond markets within a short timeframe. The non-Treasury issuance, though temporary, has created competition for Treasury securities, resulting in higher yields being necessary to attract investor demand. Although the market is unlikely going to absorb the additional issuance immediately, currently elevated Treasury yields should increasingly convince bond investors that this is a mounting buying opportunity.

Shifting Treasury demand

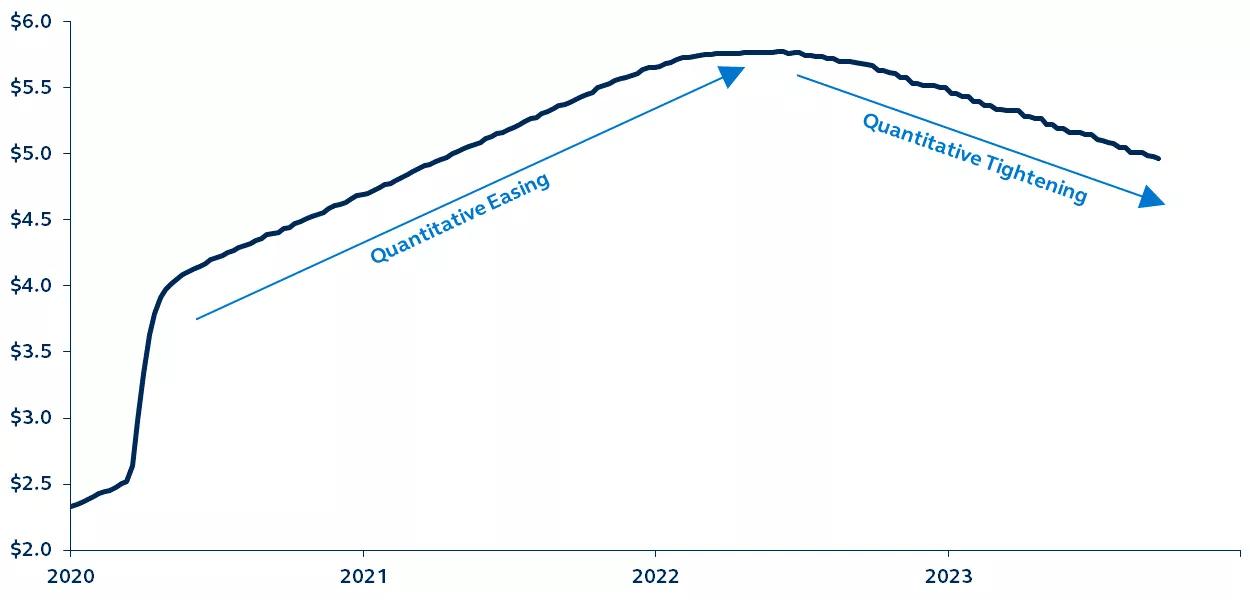

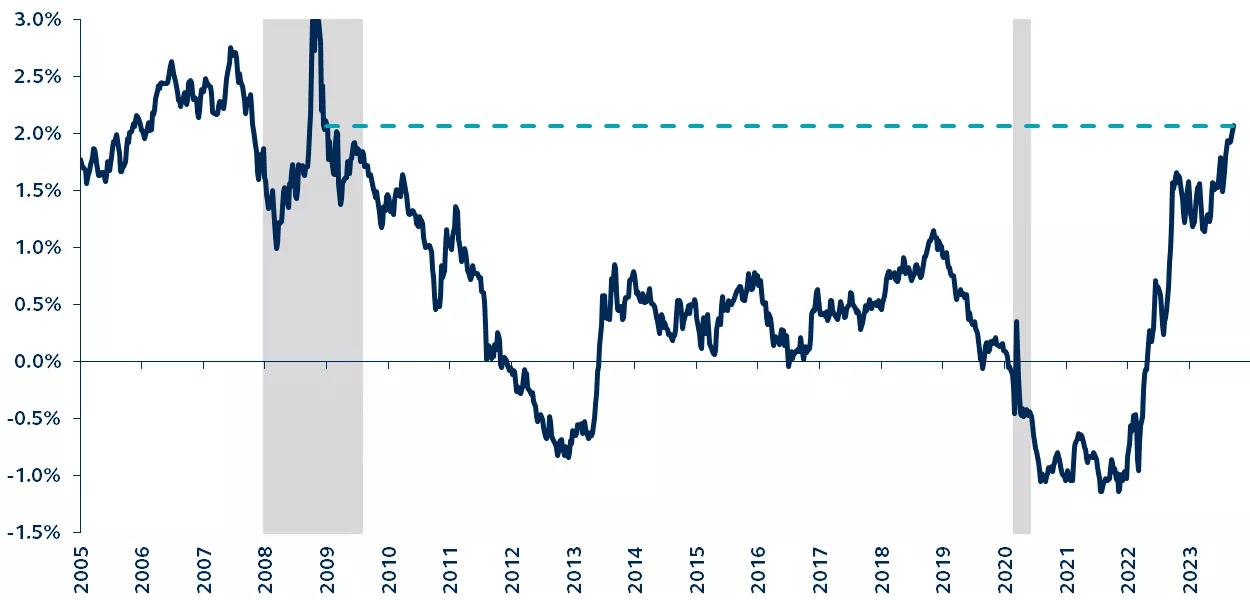

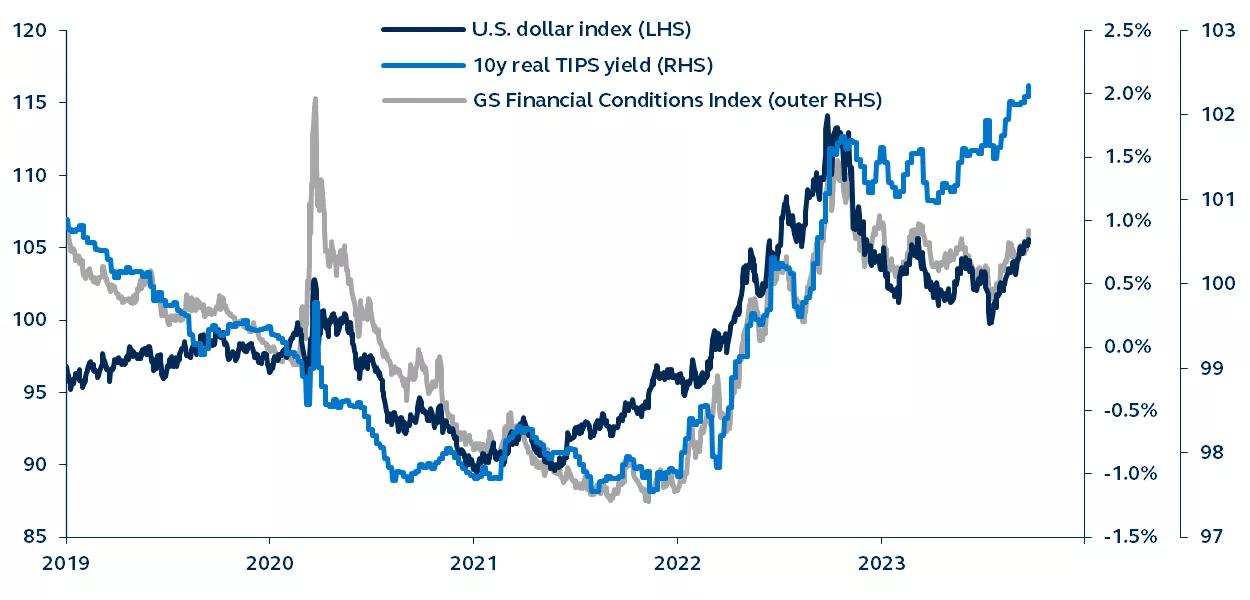

The Federal Reserve (Fed) spent much of the 2010s assimilating Treasury supply via its Quantitative Easing programs (QE), which saw the Fed purchase Treasurys to keep bond yields in-check, while acting as a price-insensitive buyer in markets. However, this practice has now gone into reverse, with the Fed now running off its Treasury holdings as they mature without replacement.

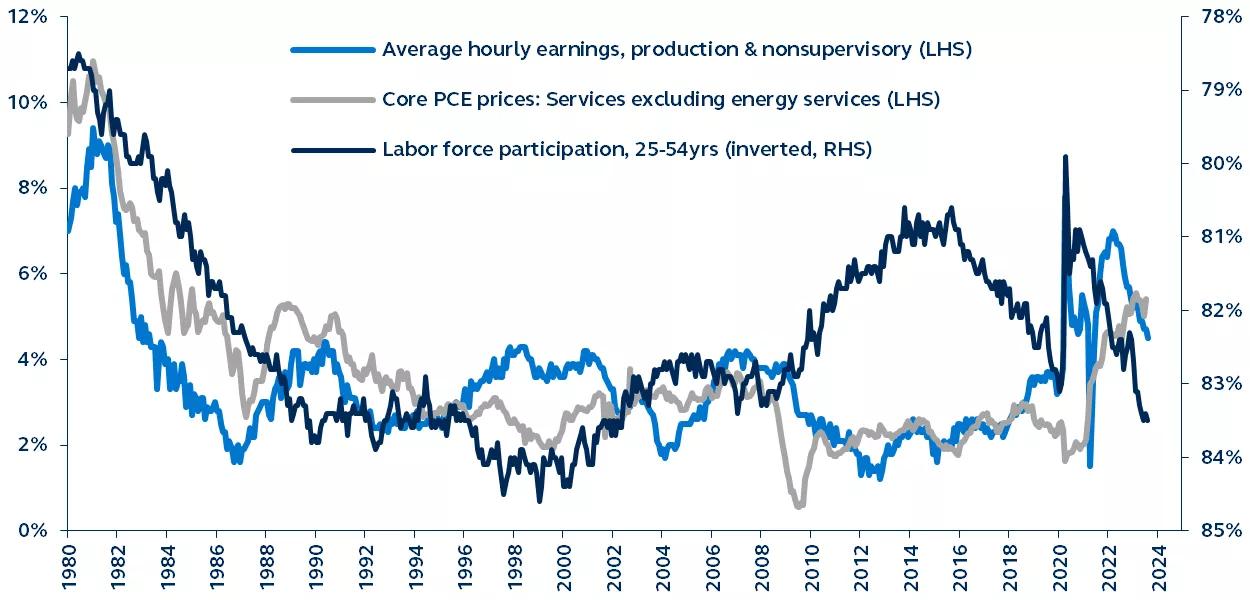

In contrast to the Fed, private investors in U.S. Treasurys are price sensitive. The yields required to attract them derives from their expectations around economic growth and inflation, both of which remain elevated and uncertain. With the Fed no longer suppressing Treasury yields, private investors are demanding even higher yields, and in the absence of Fed intervention, there’s greater need for market absorption.